Using Indicators For Forex Trading Analysis

[ad_1] Struggling to make smart choices in forex trading? Forex indicators are tools that help traders spot trends and signals. This guide will explain how these indicators work and how you can use them to improve your trades. Keep reading to boost your trading skills! Key Takeaways Best Forex indicators use past data to predict

[ad_1]

Struggling to make smart choices in forex trading? Forex indicators are tools that help traders spot trends and signals. This guide will explain how these indicators work and how you can use them to improve your trades.

Keep reading to boost your trading skills!

Key Takeaways

- Best Forex indicators use past data to predict trends and price changes. Common tools include RSI, MACD, Bollinger Bands, and Moving Averages.

- Combining 2-3 indicators MA with RSI or Fibonacci Retracement helps confirm signals and reduce mistakes. Too many tools can confuse traders.

- Indicators, like ATR help manage risks by showing market volatility. Adjust position sizes or stop-loss levels based on these insights.

- Tools like Stochastic Oscillator spot momentum shifts, while Ichimoku Cloud gives a complete view of trends and support/resistance levels.

- Using forex indicators improves trade accuracy by highlighting entry/exit points, managing risks, and reducing guesswork in decisions.

Using Indicators for Forex Trading Analysis

Indicators help traders analyze the forex market. They show patterns, trends, and possible price changes.

What are Forex indicators?

Forex indicators are tools for technical analysis. They use past market data to find trends and predict price changes. These indicators help traders identify entry and exit points in the forex market.

Common types include trend, momentum, and volatility indicators. Examples are Moving Average, RSI, MACD, and Bollinger Bands. Each serves a specific purpose like tracking trends or showing overbought conditions.

Importance of indicators in forex trading

Indicators guide traders in making smart decisions. They predict market trends using data like price and volume. For the forex trading style, indicators offer insight into currency pairs’ future movements.

Using tools like the MACD or RSI increases accuracy. They identify trends, reversals, and strong entry points. This reduces risks while maximizing profits. Reliable indicators help plan trades with confidence, improving overall results for beginners and experts alike.

Top Best Forex Indicators

Forex indicators simplify trading decisions. They help traders spot trends, check momentum, and plan trades better.

Moving Average (MA)

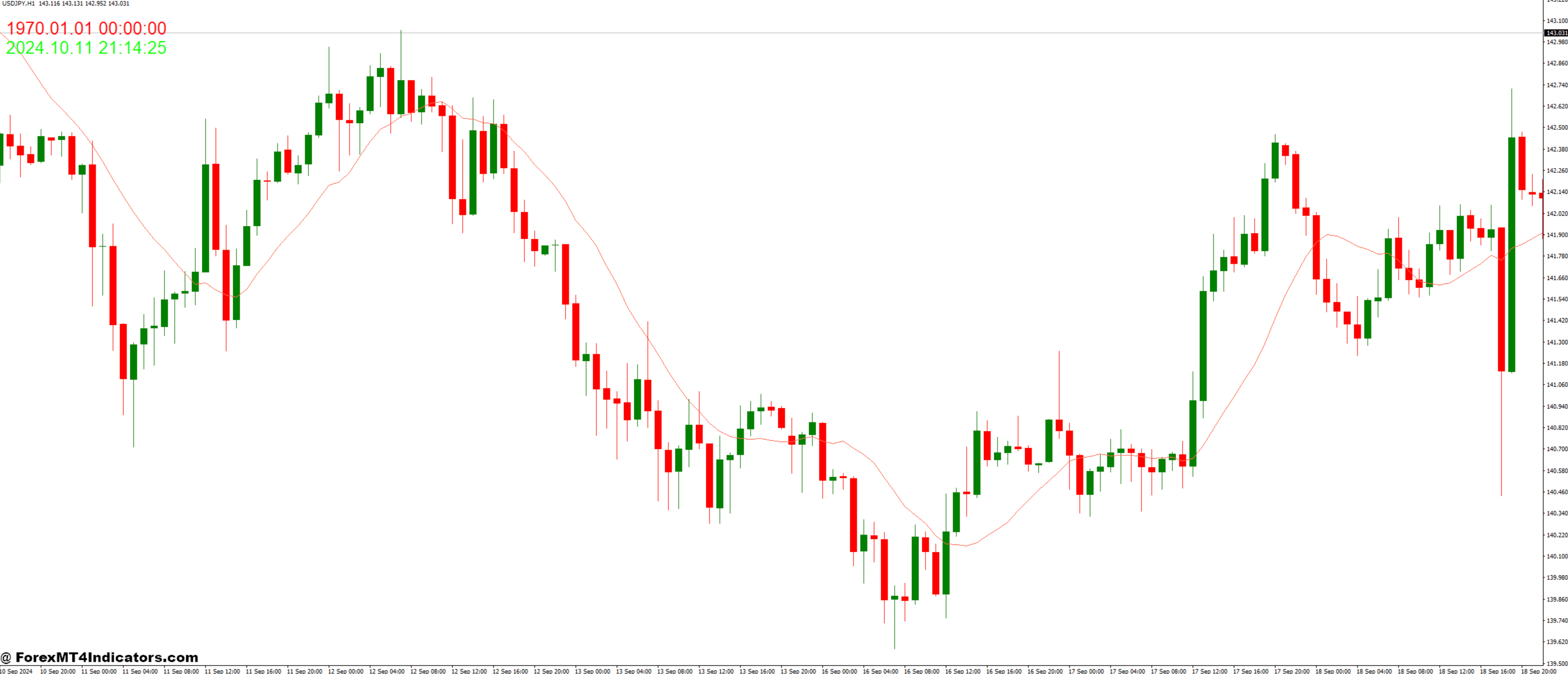

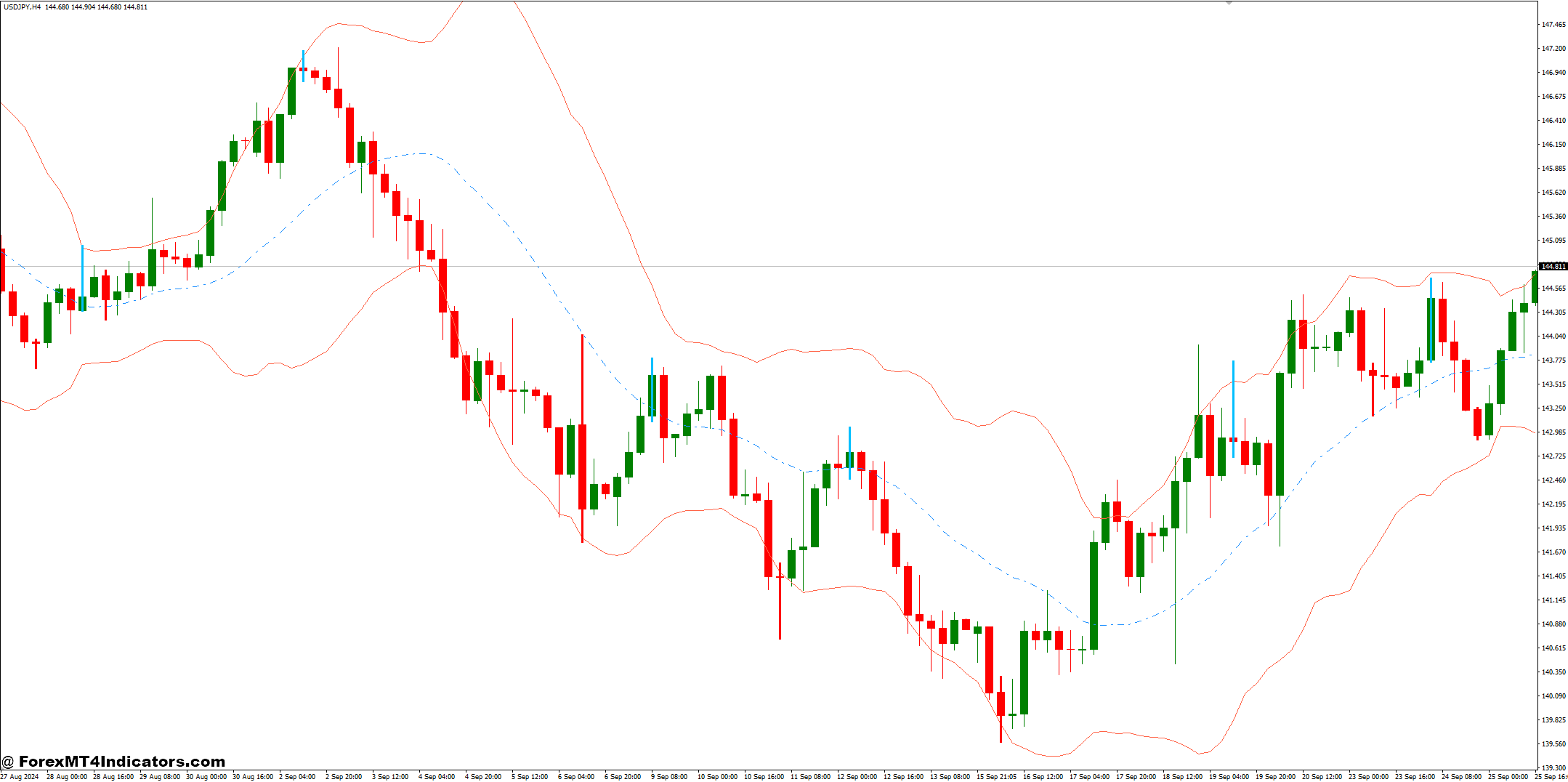

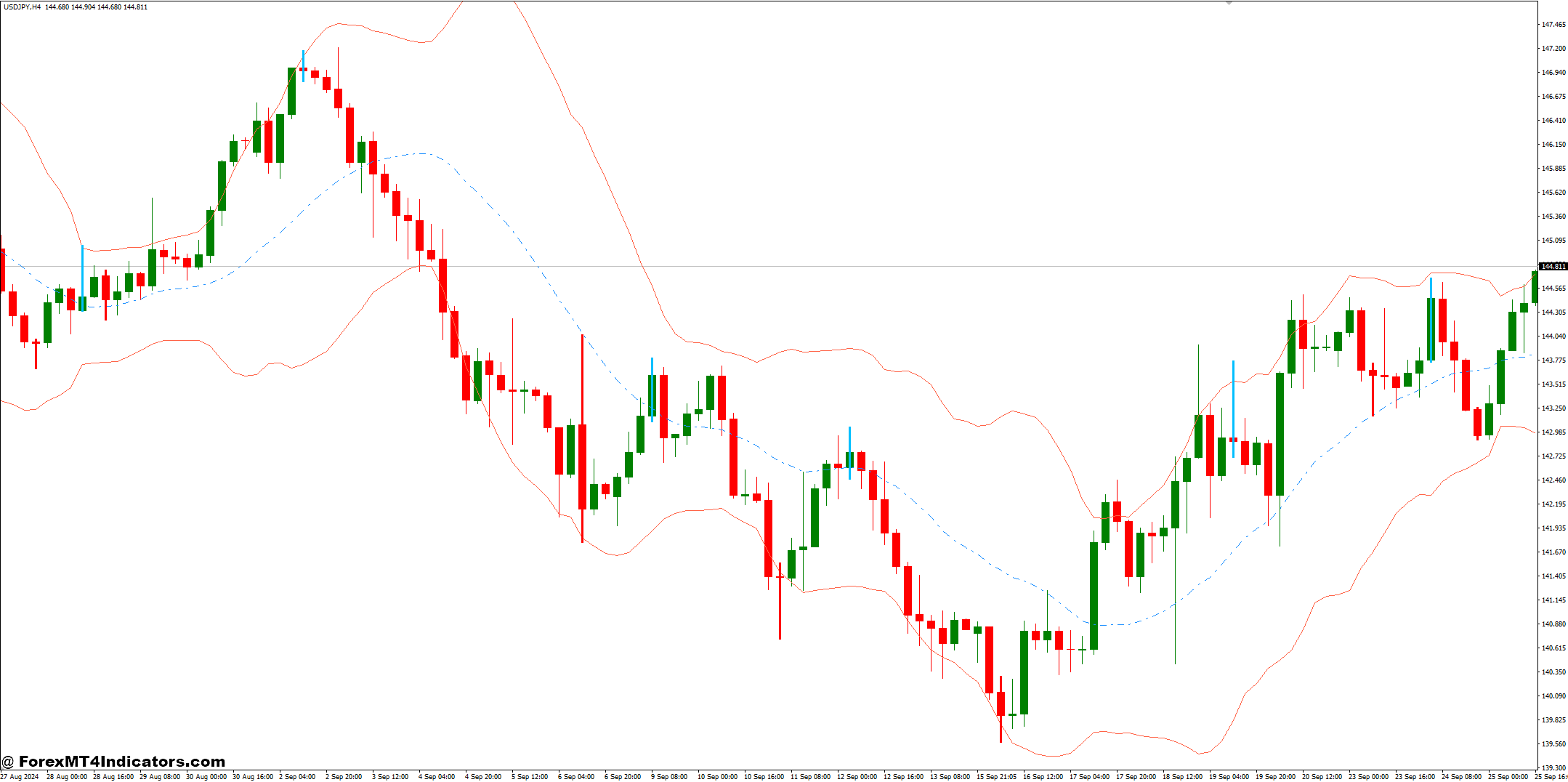

Moving Average (MA) tracks the average price over a set time. It helps spot trends by smoothing random market movements. For example, a 50-period MA above a 200-period MA signals an uptrend.

On July 23, 2024, EUR/JPY’s 50-period MA crossed below its 200-period MA—indicating a downtrend shift. Traders often use MAs with other forex indicators to confirm changes in trend direction or potential entry points.

Top 5 Best Moving Average Indicators

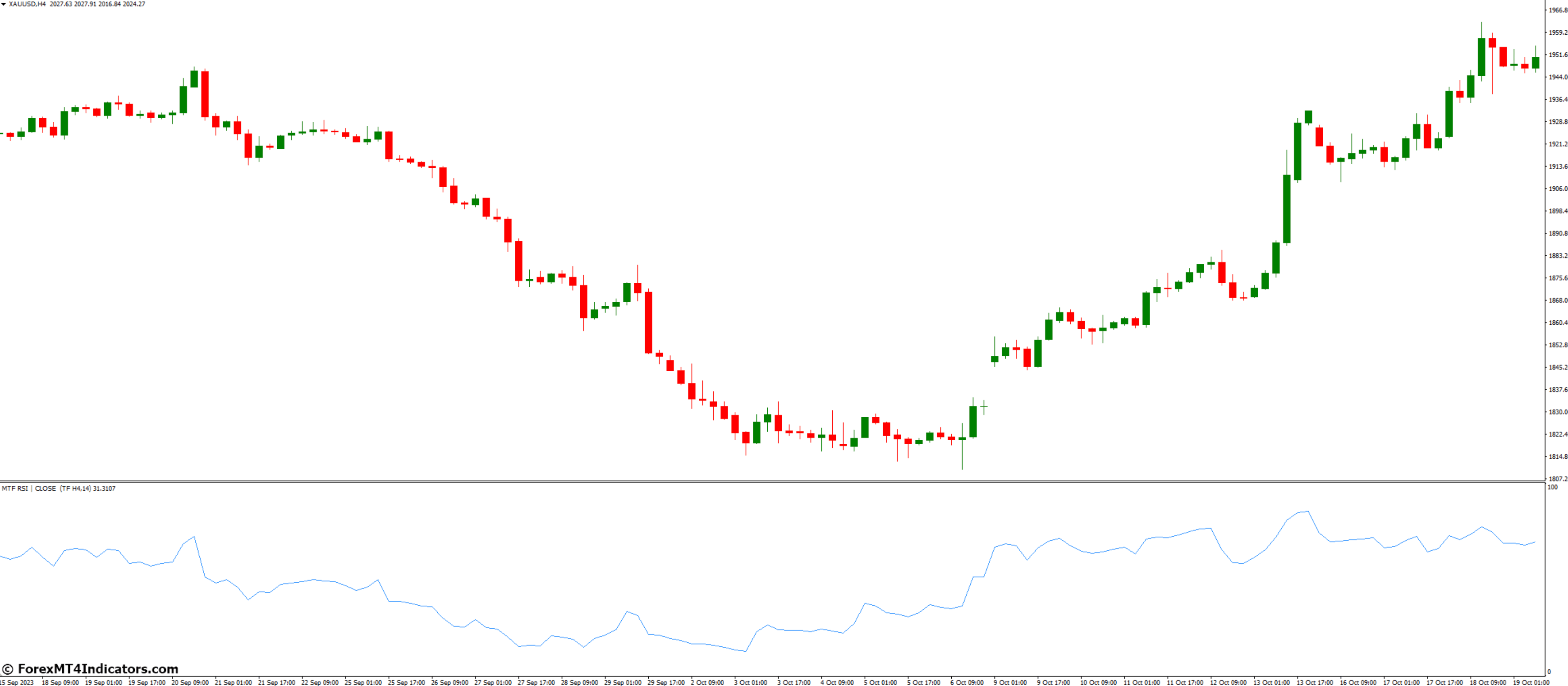

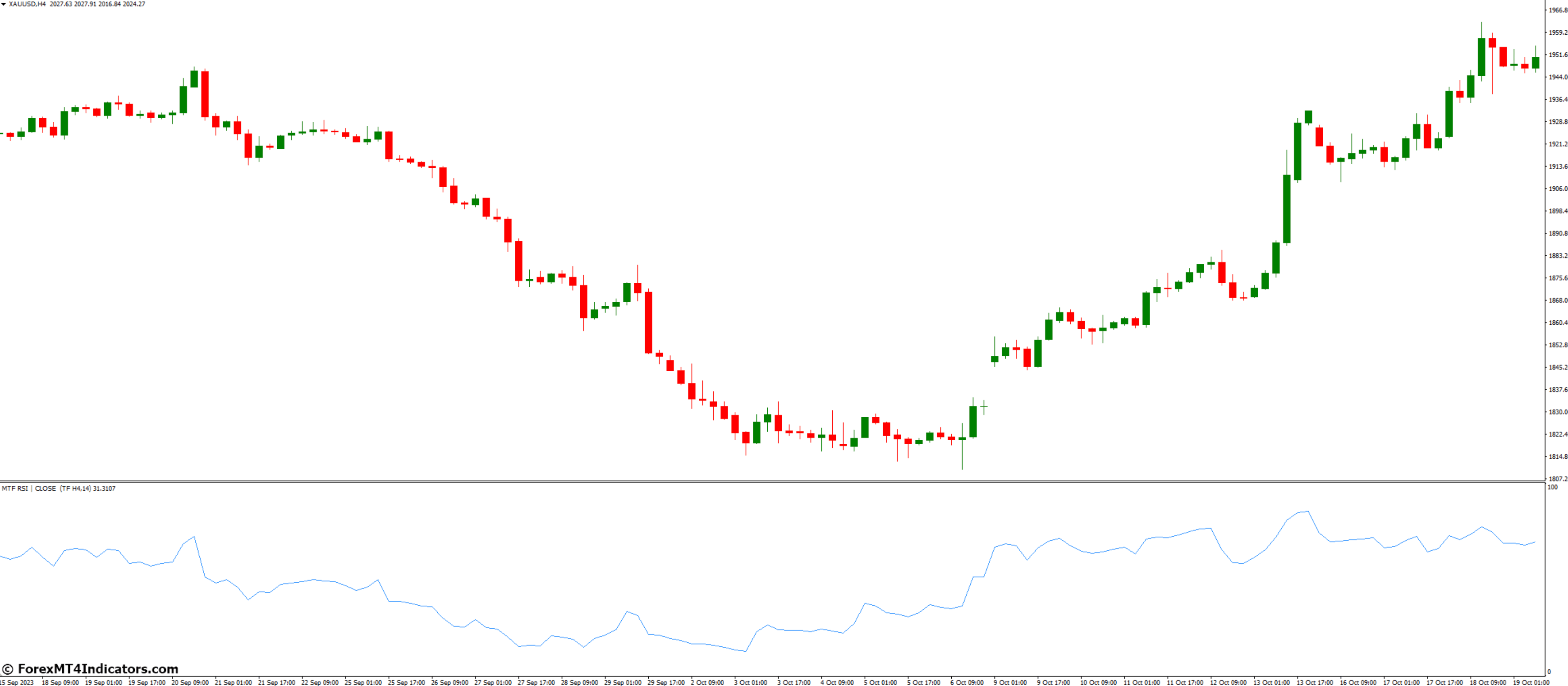

Relative Strength Index (RSI)

RSI measures price momentum on a scale of 0 to 100. It helps forex traders spot overbought or oversold conditions. A reading above 70 means the asset is overbought, and below 30 signals it is oversold.

Values near 100 point to strong upward trends, while scores close to 0 show downward pressure. Traders use RSI with other tools like support and resistance levels for better accuracy…

Next, explore MACD for deeper market insights.

Top 3 Best Relative Strength Index Indicators

- MTF Relative Strength Index Indicator for MetaTrader 4

- Non-Lag Relative Strength Index MT5 Indicator

- Relative Strength Index (RSI) MT4 Indicators

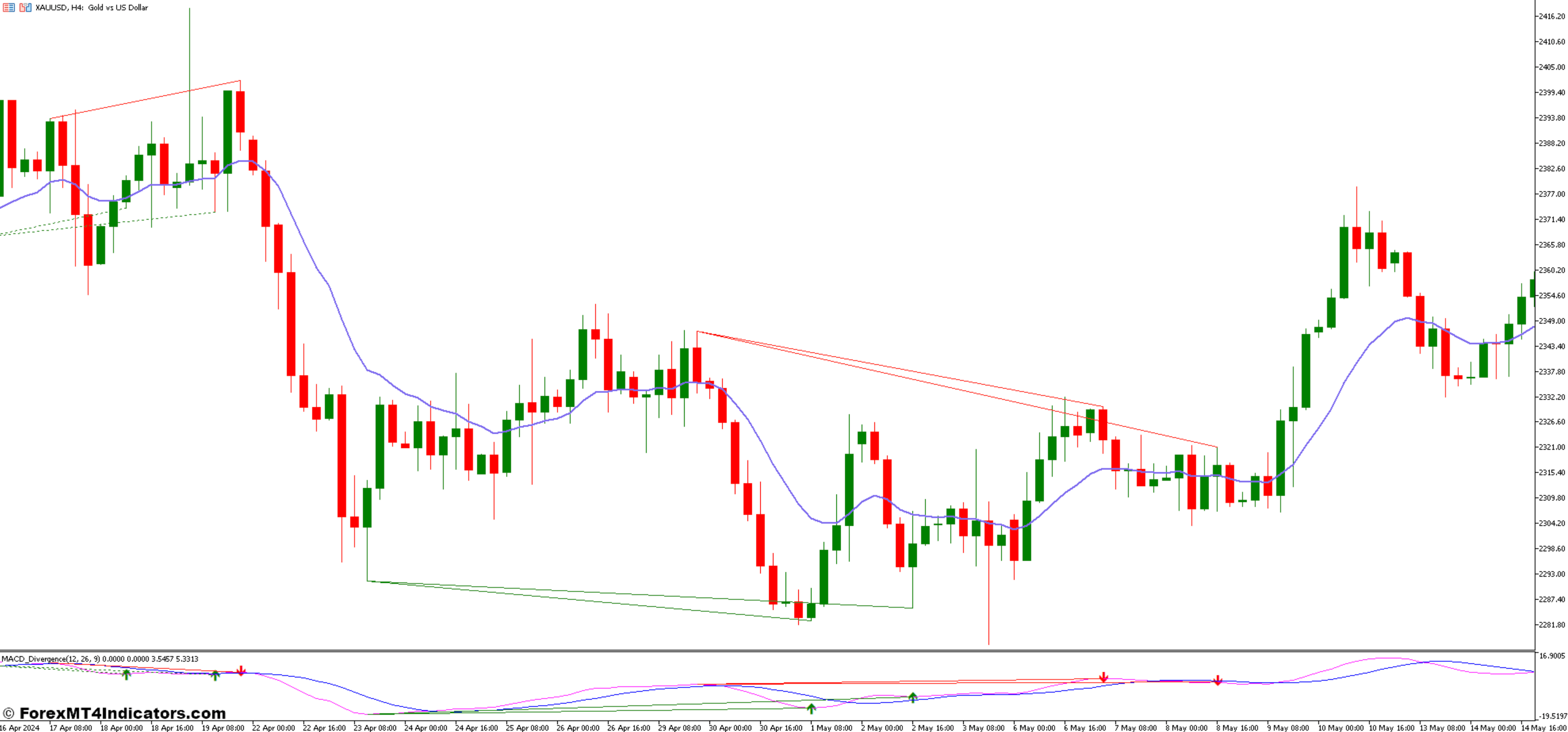

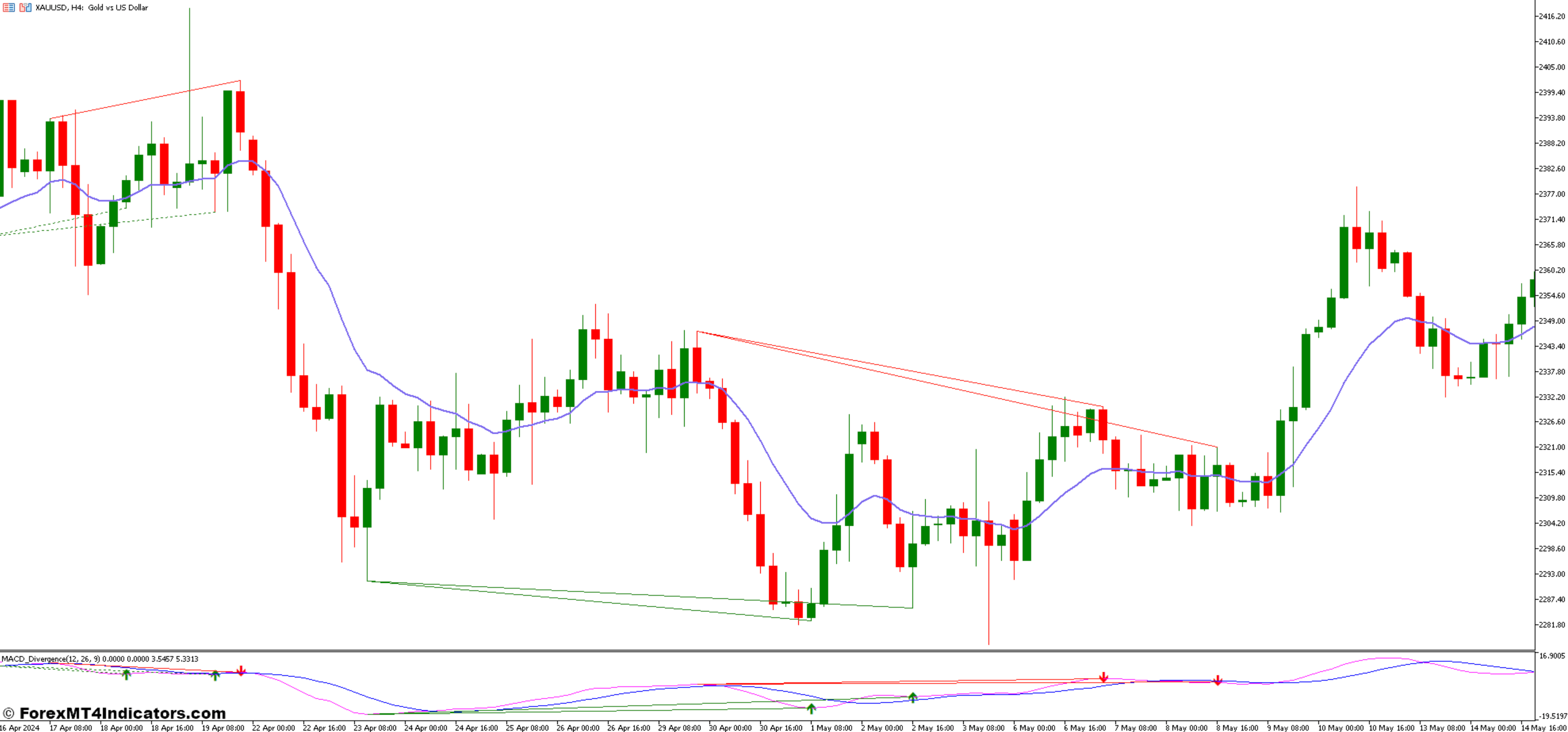

Moving Average Convergence Divergence (MACD)

MACD tracks momentum by comparing two moving averages. Its formula is simple: 12-period EMA minus 26-period EMA. Traders use it to spot trends and possible reversals in the foreign exchange market.

Convergence means the averages are coming closer, showing stronger momentum. Divergence shows they’re moving apart, signaling weaker momentum. The MACD indicator works best in trending markets and can help traders make better decisions like entry or exit points.

Bollinger Bands

Bollinger Bands use three lines—upper, middle, and lower bands—to measure price volatility. They show traders how much a forex pair’s price moves over time. A tightening of the bands often signals low volatility, while widening predicts high volatility or breakouts.

Prices reaching the upper band suggest potential profit-taking for buy trades. Hitting the lower band may signal profit-taking for sell orders. These bands adjust automatically based on standard deviation from the 20-day moving average, making them a dynamic tool for trading strategies like trend following and identifying reversals.

Top 3 Best Bollinger Bands Indicators

- TTM Scalper and Bollinger Bands Forex Trading Strategy

- Bollinger Bands MT5 Indicator

- Advanced Bollinger Bands MT4 Indicator

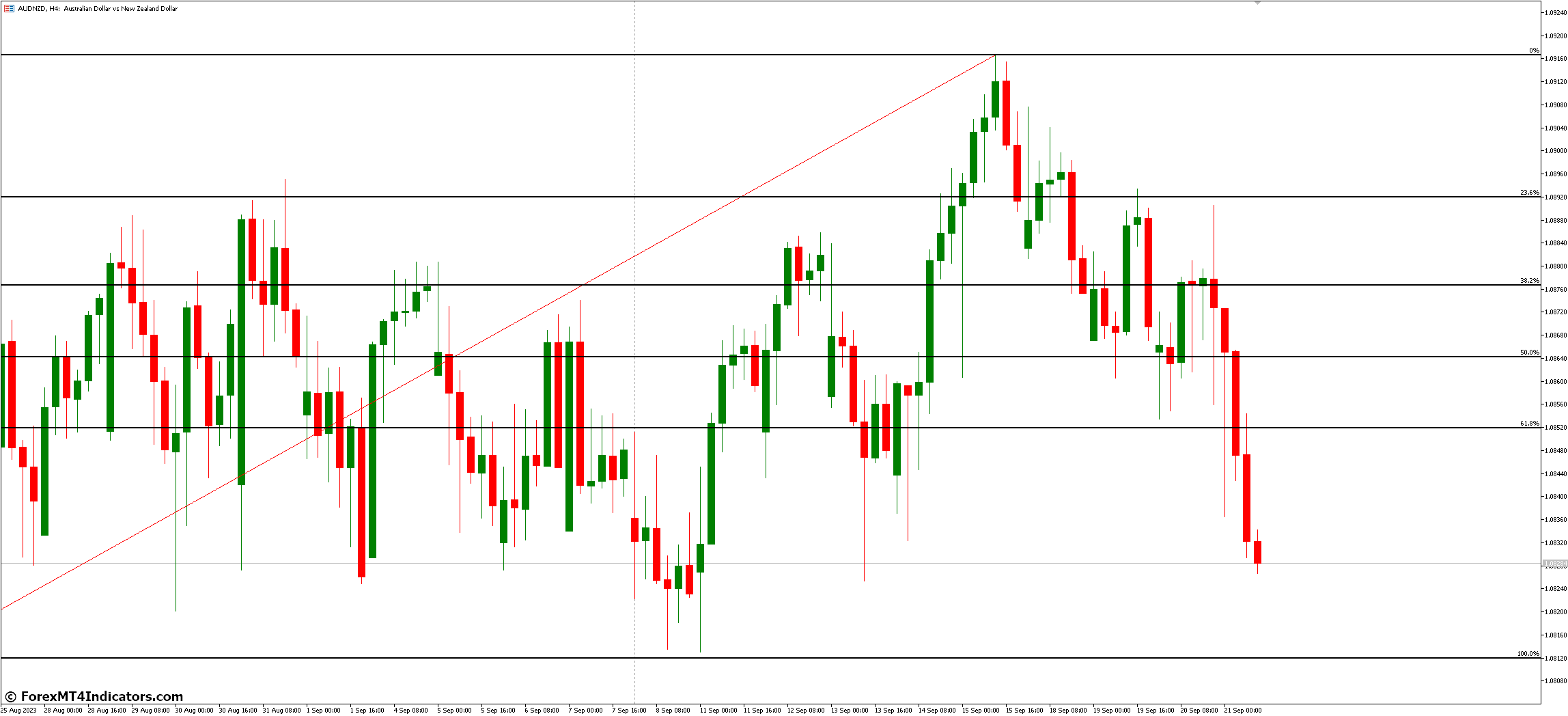

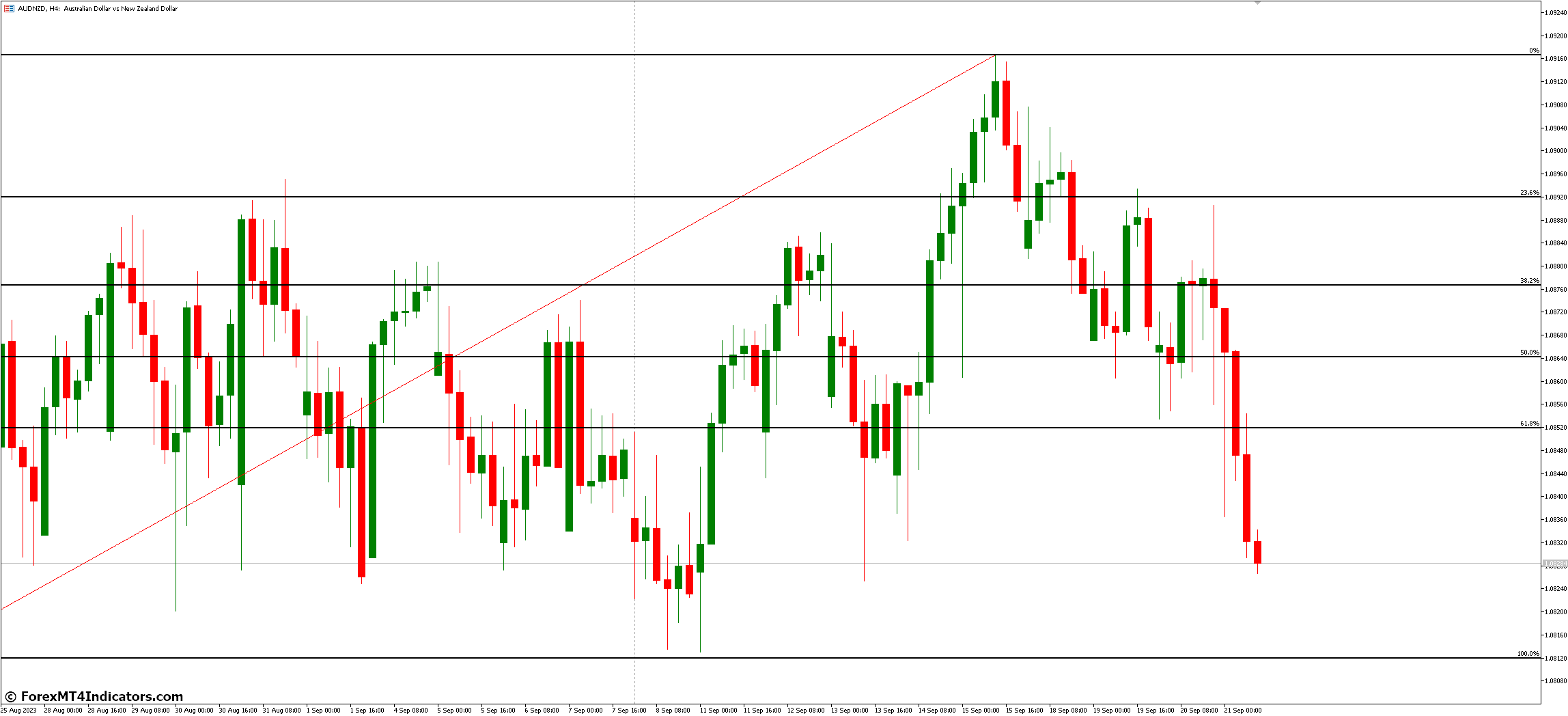

Fibonacci Retracement

Fibonacci Retracement uses math based on the golden ratio, 1.618. Traders use it to find entry points and stop-loss levels in trending markets. Lines are drawn at key percentages like 23.6%, 38.2%, 50%, and 61.8% of a price move.

These levels predict areas where prices might pause or reverse. For example, if EUR/USD rises from $1.1000 to $1.2000, the 61.8% retracement would be near $1.1380 ($100 drop x 0.618).

Many traders plot these levels on charts for better decision-making in forex trading strategies like trend-following indicators or price action tools such as RSI or MACD combinations for confirmation steps forward!

Top 3 Best Fibonacci Retracement Indicators

- Fibo Retracement Indicator for MetaTrader 4

- Auto Fibo MT4 Indicator

- Squd Fibo Indicator for MetaTrader 4

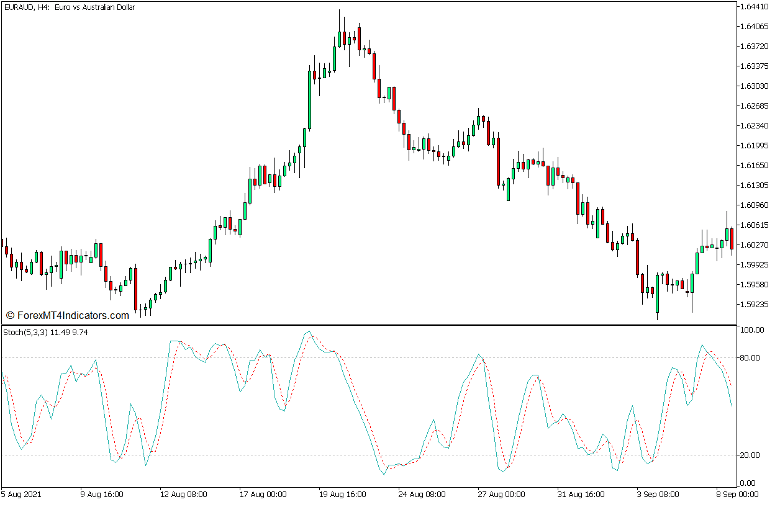

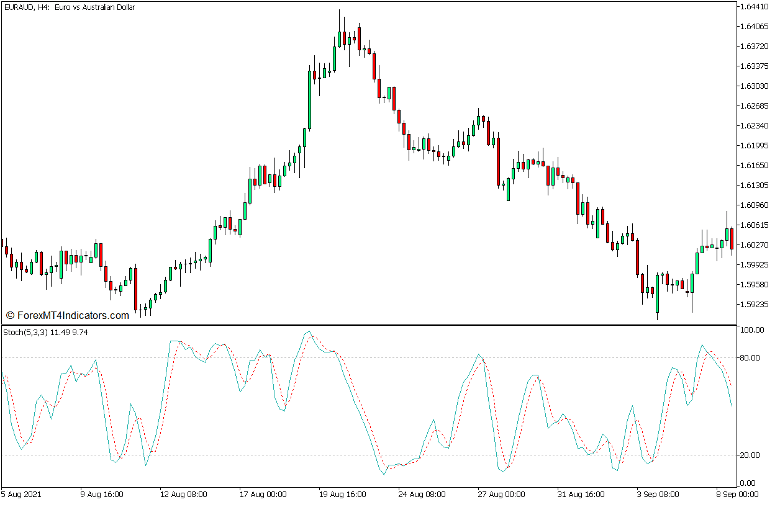

Stochastic Oscillator

The Stochastic Oscillator measures price momentum. It compares a currency pair’s closing price to its range over a set period. Values move between 0 and 100. Below 20 signals oversold conditions, while above 80 indicates overbought levels.

This momentum candle helps traders spot reversals or trend strengths. For example, if a pair stays near the high range with values around 90, it might continue upward. Use it with other best technical analysis tools for clearer trading platform signals.

Top 3 Best Fibonacci Retracement Indicators

- Solar Wind Joy Histogram MT4 Indicator

- DSS Bressert MT4 Indicator

- Relative Vigor Index MT4 Indicator

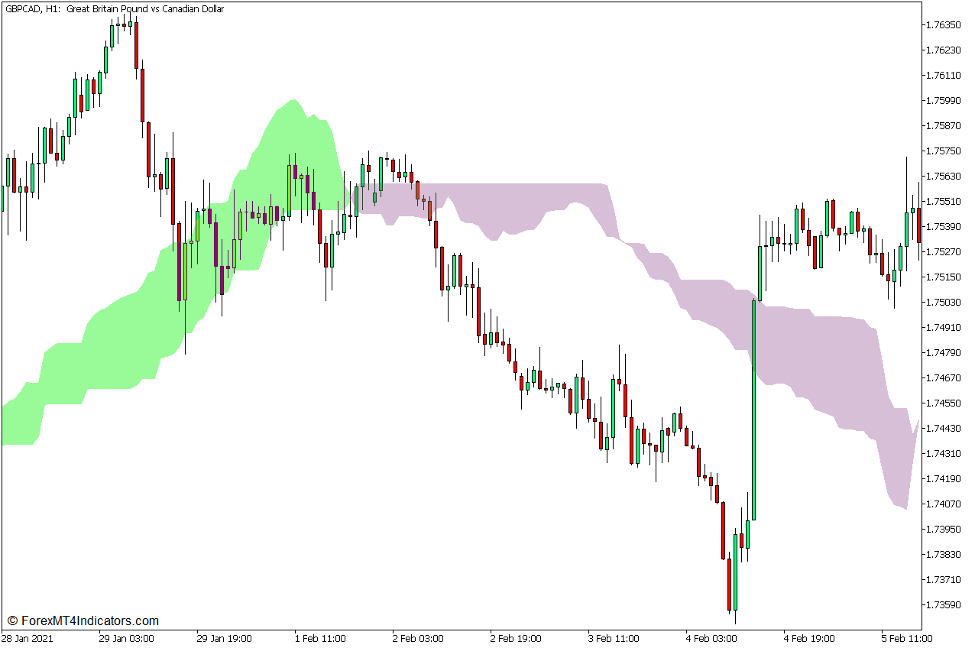

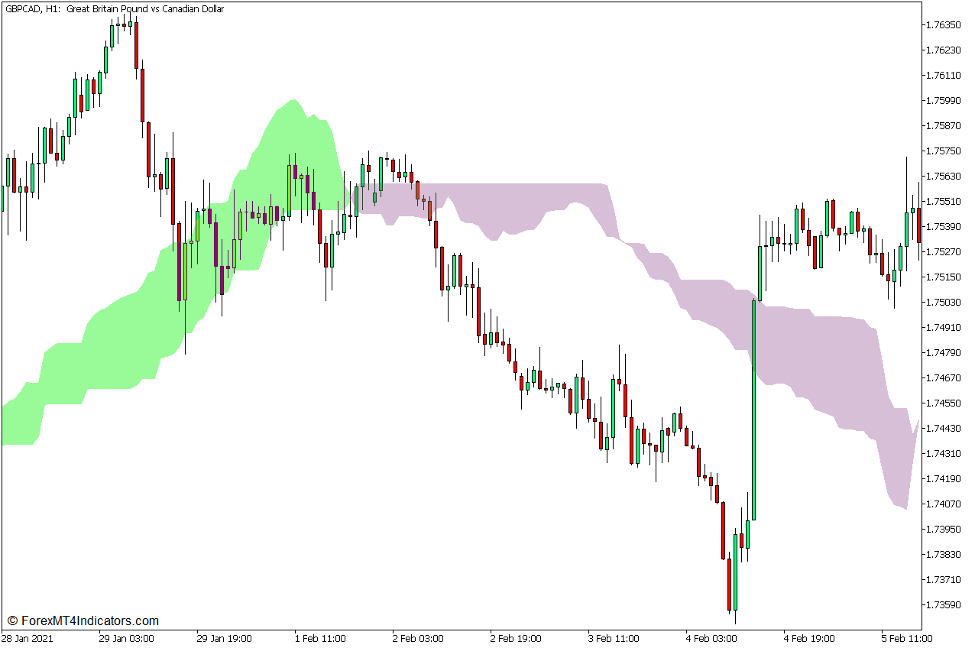

Ichimoku Cloud

Unlike the Stochastic Oscillator, which tracks momentum, the Ichimoku Cloud shows a full-picture view of trends and potential price movements. It uses five components: Tenkan-sen (short-term), Kijun-sen (medium-term), Senkou Span A, Senkou Span B, and Chikou Span.

These parts together help traders find support/resistance levels, market trends, and momentum strength instantly.

Traders rely on its \”cloud\” feature to spot bullish or bearish signals. For example, prices above the cloud suggest an uptrend; below means a downtrend. The space between Senkou Spans forms this “cloud,” with thickness showing volatility.

Beginners can use it to trace reversals more effectively while combining it with other forex technical indicators available like RSI for better decision-making.

How to Use Forex Indicators Effectively

Use forex indicators to read trends, spot reversals, and plan trades smartly. Learn how these tools can guide your next move—read more to improve your strategy!

Combining multiple indicators

Traders often combine indicators to improve their forex strategies. This method helps confirm signals and reduce mistakes.

- Pair trend indicators like Moving Averages with momentum tools such as RSI. This shows both the direction and strength of the market trend.

- Match a lagging indicator, like MACD, with a leading indicator, such as a Stochastic Oscillator. It confirms reversals early while avoiding false alarms.

- Use Bollinger Bands alongside a volume indicator. This highlights price volatility and trading system activity during key movements.

- Combine Fibonacci Retracement with Parabolic SAR to identify entry points in trending markets.

- Mix the Ichimoku Cloud with the Average True Range for clear trend analysis and risk evaluation.

- Keep combinations limited to 2-3 tools at once. Too many popular indicators lead to confusion or “paralysis by analysis.

Identifying trends and reversals

Trends show the market’s direction. Reversals signal a change in that direction.

- Use Moving Averages (MA). If the 50-period MA is above the 200-period MA, it indicates an uptrend. A crossover below signals a downtrend.

- Track Relative Strength Index (RSI). Values above 70 suggest overbought conditions—possible trend reversal. Below 30 means oversold.

- Check MACD lines. A line crossing above the signal line hints at upward movement. A cross below suggests downward movement.

- Watch Bollinger Bands for price breaks. Prices pushing against upper bands may reverse downward. The lower band touches hint at an upward reversal.

- Apply Fibonacci Retracement to find reversal levels. Key levels like 38.2%, 50%, and 61.8% often predict price turning points.

- Monitor Stochastic Oscillator values near 80 or higher for potential drop-offs, while values near 20 suggest possible gains.

- Review Ichimoku Cloud trends. Price above the cloud shows strength; below indicates weakness; within predicts consolidation or reversals.

Setting entry and exit points

Setting entry and exit points is key in forex trading signals. Indicators can help traders make accurate decisions for buying or selling.

- Use the RSI to find overbought or oversold levels. For example, if the RSI hits 80, it may signal a selling point, while 20 could mean a good time to buy.

- Apply the ATR to calculate trailing stops. Multiply the ATR by five over three days to set better stop-loss levels.

- Combine moving averages like MA or EMA for trend confirmation. A cross between short-term and long-term MAs can show potential entry or exit signals.

- Plot Fibonacci retracement levels on price charts. Common ratios like 38.2% or 61.8% often indicate areas of reversal for trade entries or exits.

- Check MACD crossovers for momentum shifts. For example, when the MACD line crosses above the signal line, it might suggest an entry point.

- Use Bollinger Bands for market volatility analysis. Price touching either band could hint at possible reversals or continuations for exiting trades.

- Pay attention to candlestick patterns near support and resistance zones confirmed by indicators, like Ichimoku Cloud for precise entries/exits.

- Look at the Stochastic Oscillator’s values between 0-100 to gauge momentum changes and time your trades accordingly.

Benefits of Using Technical Indicators in Forex

Forex indicators make trading decisions clearer. They help traders spot opportunities and manage risks effectively.

Enhanced decision-making

Indicators provide data-driven facts to guide traders. They help analyze market sentiment and supply-demand trends. Tools like the RSI or MACD generate signals for potential trades, reducing guesswork.

Setting clear entry and exit points becomes easier with indicators. By studying patterns or volatility, traders can make accurate choices. Next, learn how they improve accuracy in trading strategies.

Improved trading accuracy

Top forex indicators improve accuracy by predicting market moves. Tools like Bollinger Bands highlight profit points, while the RSI signals overbought or oversold conditions. Combining such data increases the success rate of trades.

Using multiple forex best technical indicators confirms trends and reduces mistakes. For example, pairing Fibonacci Retracement with the MACD pinpoints strong entry levels. These methods lead to better decisions—next is risk management.

Risk management

Risk management protects traders from losing too much. Using indicators, like the Average True Range (ATR) helps control risk by showing market volatility. If ATR rises, position sizes should shrink, and stop losses need to increase for safety.

Professional clients can lose more than they deposit. This makes planning trades even more important. Combine tools like RSI or Bollinger Bands with clear entry and exit rules to limit losses.

Always manage risks carefully to protect your money while trading forex.

Conclusion

Forex trading indicators help traders make better choices. They show trends, signals, and chances to profit. Combining tools like RSI or MACD improves accuracy and timing. Use them wisely to manage risks and boost results.

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :Analysis ، Forex ، Indicators ، Trading

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0