Japanese Inflation (MoM) Accelerates to 10-Year High, USD/JPY Holds Firm

[ad_1] Japanese Yen News and Analysis Month on month Japanese inflation rose at its fastest pace in 10 years Extreme short yen positioning yes to be tested during thin, holiday affected trading USD/JPY on track for a flat two-day period ahead of Thanksgiving weekend The analysis in this article makes use of chart patterns and

[ad_1]

Japanese Yen News and Analysis

- Month on month Japanese inflation rose at its fastest pace in 10 years

- Extreme short yen positioning yes to be tested during thin, holiday affected trading

- USD/JPY on track for a flat two-day period ahead of Thanksgiving weekend

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Japanese Inflation Accelerates at its Fastest Pace Over the Last 10 Years

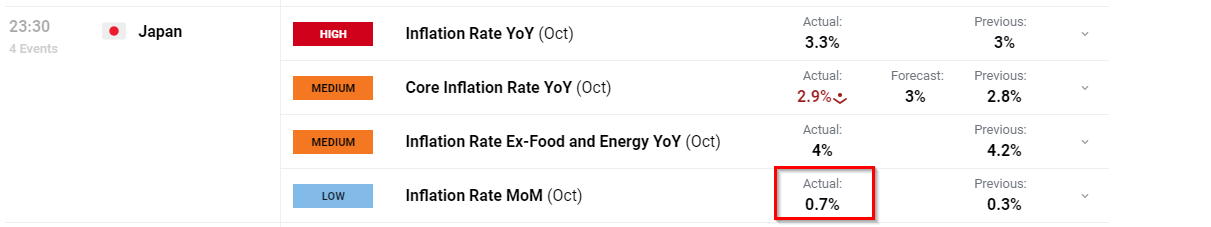

Japanese inflation (headline CPI) rose to 3.3% from the prior 3.0% for the month of September, while the global measure of core inflation (inflation minus volatile items like food and energy) dipped from 4.2% to 4%. However, the standout from the data was the month-on-month number which revealed a notable acceleration of inflation heading into the end of the year. The Bank of Japan Governor Kazuo Ueda has previously expressed that the board will have enough data on hand by year end to make a decision on potential policy normalization, in other words removing negative interest rates.

Customize and filter live economic data via our DailyFX economic calendar

Recommended by Richard Snow

Trading Forex News: The Strategy

The chart below shows the pace of month on month inflation data in Japan which has revealed a trend of making higher highs despite the volatile spikes lower too. The bank is closely watching inflation and wage growth data as these are the main determinants of whether demand-driven pressures are likely to persist at elevated levels sustainably.

Japanese Inflation (Month on Month)

Source: Refinitiv, prepared by Richard Snow

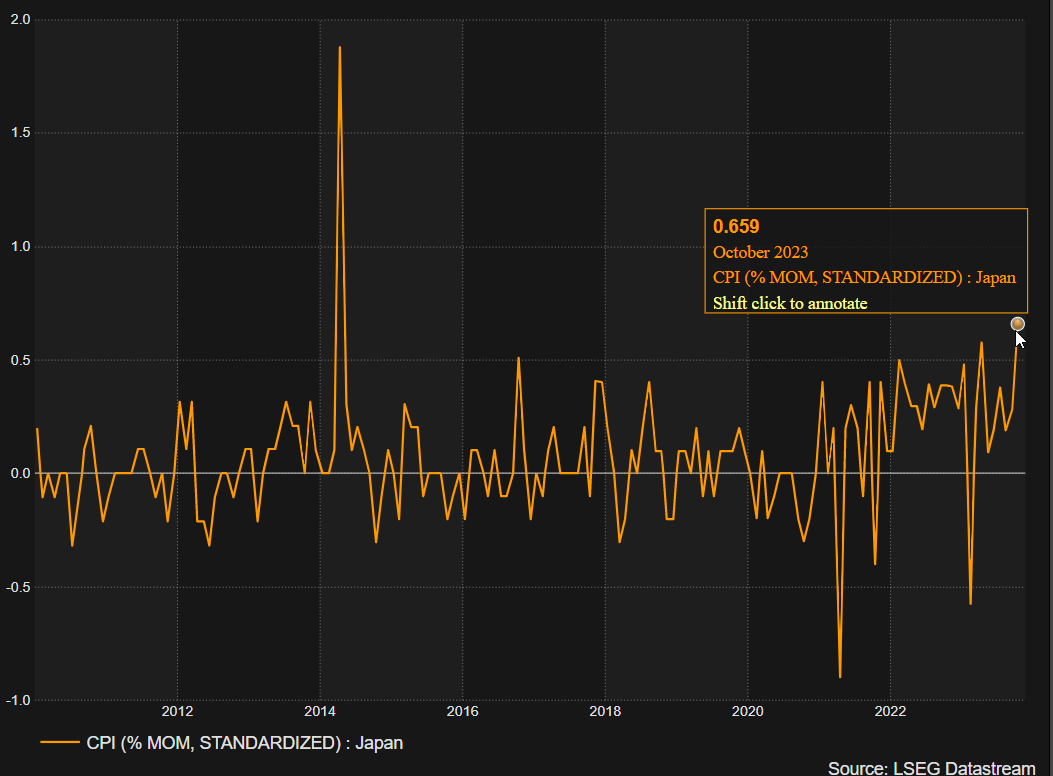

The Japanese Yen has surrendered the majority of last week’s gains as can be seen by the Japanese Yen Index below. The index is a equal-weighted index consisting of four major currencies against the yen.

Japanese Yen Index (USD/JPY. GBP/JPY, EUR/JPY, AUD/JPY)

Source: TradingView, prepared by Richard Snow

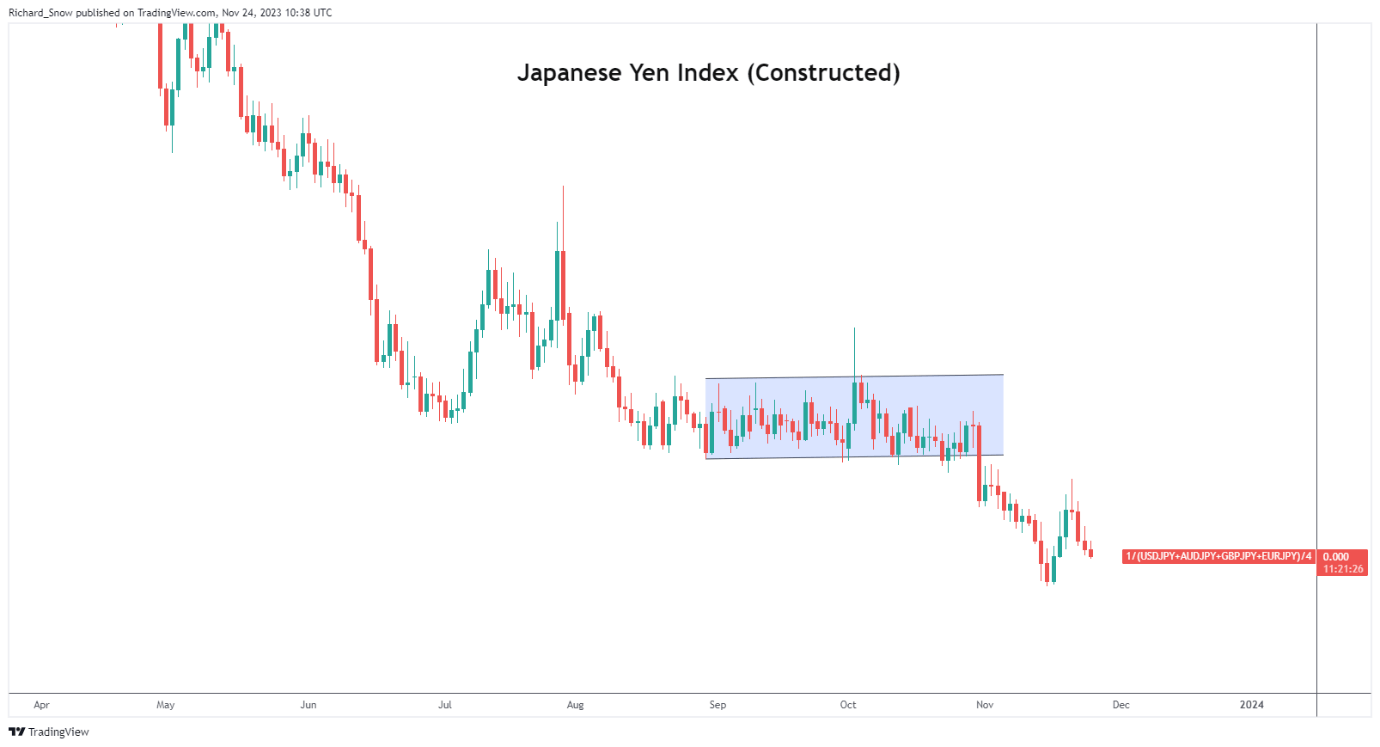

USD/JPY Gives Little Away, Testing Dynamic Resistance

USD/JPY came in flat yesterday and appears to be on track for a second day in a row of little change in the opening and closing price. The pair has rallied for the week and is on track for a weekly advance which appears to be capped around 150 once again.

The 50-day simple moving average, which acted previously as dynamic support has now switched to dynamic resistance and is keeping the pair contained. If US growth and inflation data next week registers disappointing numbers, we could see another drift lower. EU GDP was revised lower yesterday and the US is hoping not to follow in the same steps as Europe but the warning signs are there.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Understand the intricacies and nuances relating to trading USD/JPY. The many fundamental differences as well as the global importance of these two currencies makes it one of the most frequently traded – learn more by downloading the comprehensive guide below:

Recommended by Richard Snow

How to Trade USD/JPY

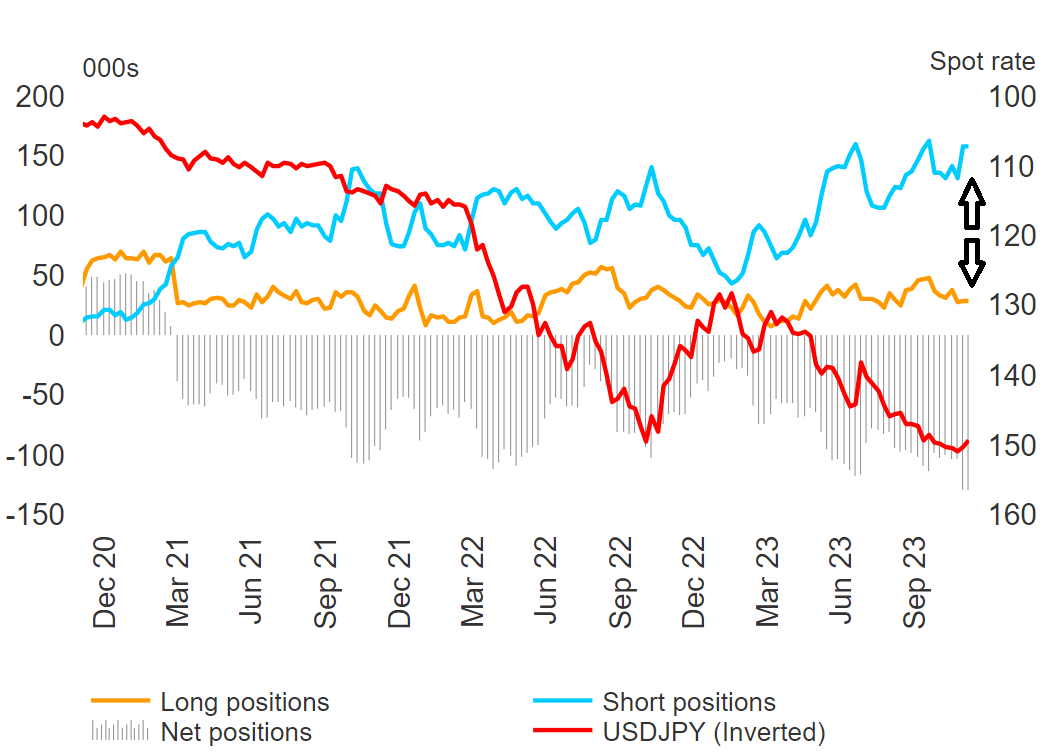

Positioning Remains Heavily Short Yen, Long USD/JPY is Overcrowded

According to the latest CoT data, smart money positioning remains heavily short compared to readings over the last three years, with the gap appearing to widen still. The risk here is that upside potential in USD/JPY appears limited with the 150 market watched closely despite the lack of urgency surrounding potential FX intervention from Tokyo; and a sharp move to the downside could force a liquidation in long USD/JPY positions, exacerbating the potential move. The dollar has come under pressure as weaker fundamental data now has the US heading in the same direction as other less resilient major economies, suggesting there still may be more easing to come from the greenback.

Source: Refinitiv, prepared by Richard Snow

USD/JPY may struggle for direction at the start of next week until we get US GDP and PCE data on Wednesday and Thursday respectively.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0