EUR/USD, PRICE FORECAST:

MOST READ: Oil Latest – US Crude Trying to Nudge Higher After Another Week of Heavy Losses

The Euro continues to hold the high ground against the Greenback following Tuesday’s explosive move to the upside. EURUSD is currently trading between two key levels with support provided around the 1.0840 handle and resistance at the 1.0900 mark.

Recommended by Zain Vawda

Get Your Free Top Trading Opportunities Forecast

US DATA WEAKENS

Macroeconomic data from the US continued its less than impressive prints this week with both initial jobless claims and Industrial Production coming in worse than expected. Initial jobless claims rose to 231k for the week ended November 11, while industrial production contracted by 0.6% for the month of November. The data continued to weigh on the US Dollar and hindering any attempt at a sustained recovery.

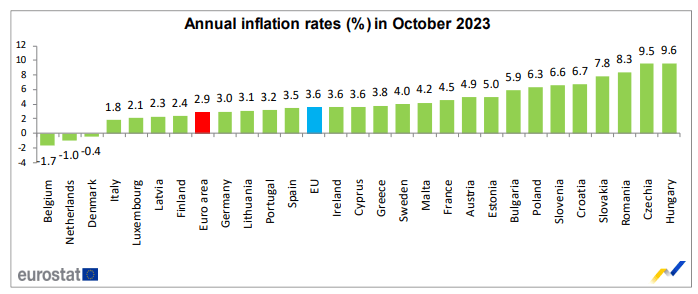

EURO AREA DATA

Euro Area final inflation data was released this morning with no surprises or adjustments to the preliminary number. Despite positives reflected in falling inflation, ECB Member Holzmann refuses to commit to rate cuts or call an end to rate hikes. Holzmann stated that the ECB will not cut interest rates in Q2 of 2024, a narrative that continues to gain traction both in the EU and the US. This in my opinion still remains a bit premature given all the changes we have seen during the course of 2023. A key area of focus for the ECB has been wage growth which the Central Bank would like to monitor in the first half of 2024 which looks like it may be cooling as well. We might only see ECB members commit to calling the end of the rate hike cycle during Q1 or Q2 of 2024 with the Central Bank hoping for no further shocks to inflation.

Source: EuroStat

LOOKING AHEAD TO NEXT WEEK

EURUSD may remain stuck in the range between 1.0800-1.0900 without a catalyst to keep the Euro advance against the Greenback going. Next week we do have the Fed Meeting Minutes which if it does backup the market narrative that the Fed are done with rate hikes could help spur EURUSD above the 1.0900 resistance hurdle.

Recommended by Zain Vawda

How to Trade EUR/USD

On the Euro side we have PMI data which is unlikely to show any major change as the economy in the Euro Area continues to limp along. As the clouds darken on the Euro Area it does appear like Q4 may see negative GDP growth with a potential recovery looking more likely in the second half of 2024. Let’s hope the data can at least spark some form of volatility next week to keep traders engaged even if the medium-term outlook remains murky.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

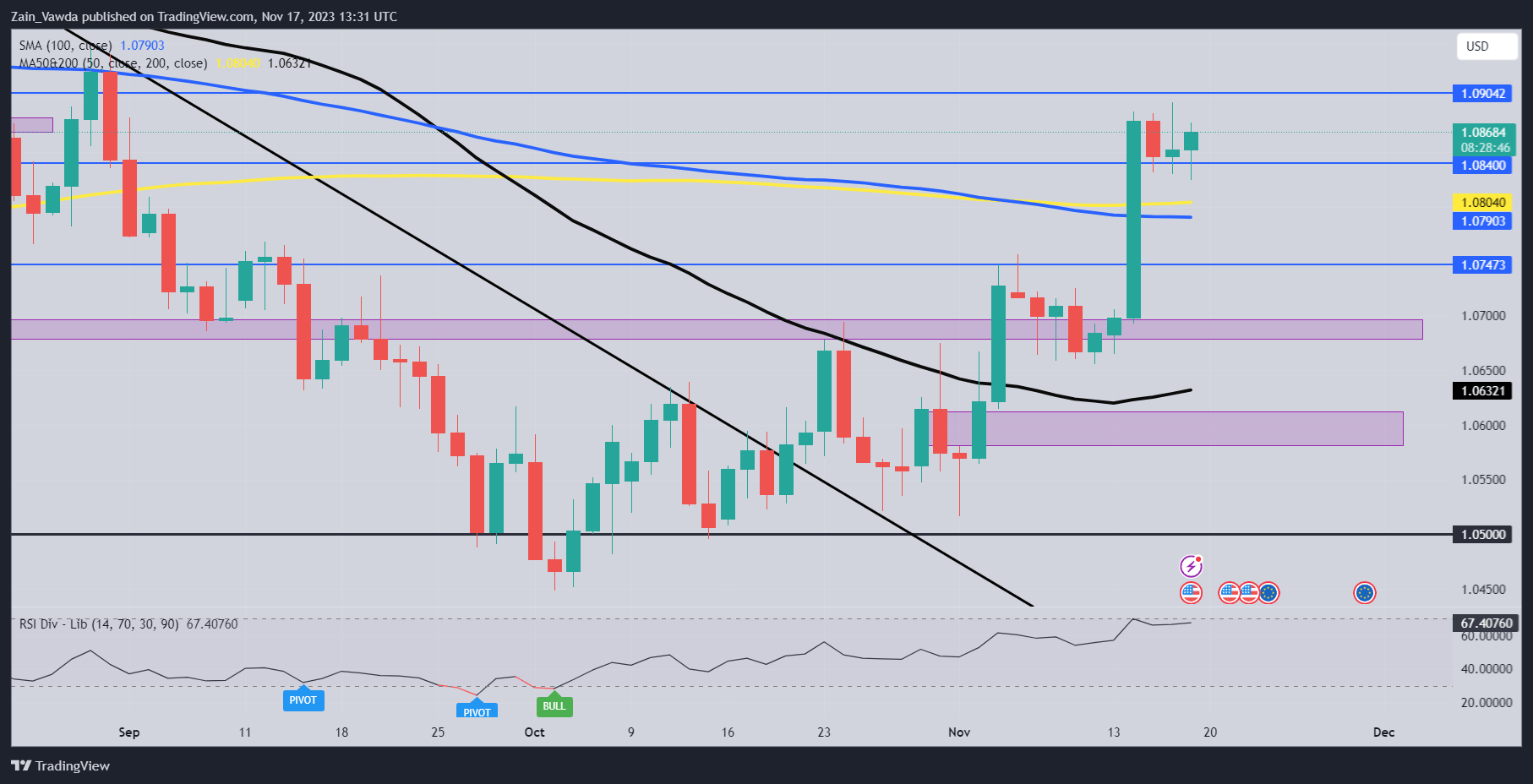

Looking at EURUSD and the technical picture is interesting in light of the volume and recovery of the Euro this week. Of course, most of the recovery can be laid at the feet of the US Dollar following a slowdown in US inflation. Following the massive candle we had on Tuesday we do appear to be in a consolidative mode right now between the 1.0800 and 1.0900 handles.

The 1.0800 has a lot of confluences and could serve to provide support should a beak of the immediate support resting at 1.0840. A break lower will bring the 1.0750 support level into focus, but this may also hinge on the USD outlook next week as the DXY seems to be driving the price action in EURUSD.

EUR/USD Daily Chart – November 17, 2023

Source: TradingView

IG CLIENT SENTIMENT DATA

IGCSshows retail traders are currently Net-Short on EURUSD, with 57% of traders currently holding SHORT positions.

To Get the Full IG Client Sentiment Breakdown as well as Tips, Please Download the Guide Below

| Change in | Longs | Shorts | OI |

| Daily | -4% | -1% | -2% |

| Weekly | -35% | 34% | -7% |

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0