GBP/USD News and Analysis

- GBP/USD oscillates around key level as uptrend takes shape

- Sterling holds narrow advantage over the US in terms of expected rate cuts

- Fed speakers and UK Autumn Statement next up on the calendar

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

GBP/USD Oscillates Around Key Level as New Uptrend Takes Shape

Despite a broad lack of bullish drivers, the pound continues to build a series of higher highs and higher lows, clawing back lost ground after the pair declines for the majority of 2H so far.

Recent spikes to the upside have primarily been driven by USD sell-offs sparked by worsening fundamental data experienced by the world’s largest economy. Once again, the pair has eased lower in the days following the sharp rise on Tuesday after better-than-expected US CPI data.

The 200-day SMA is the new challenge for a bullish extension with a daily close above it boding well for a continued move higher. The pair has put in a series of higher highs and higher lows meaning that from a technical perspective GBP/USD is no longer in a downtrend. Look out for any pushback from Fed officials today regarding the recent risk off sentiment and general loosening in financial conditions which may limit GBP/USD upside.

Resistance appears at 1.2585 with support at 1.2345, followed by 1.2200 flat.

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade GBP/USD

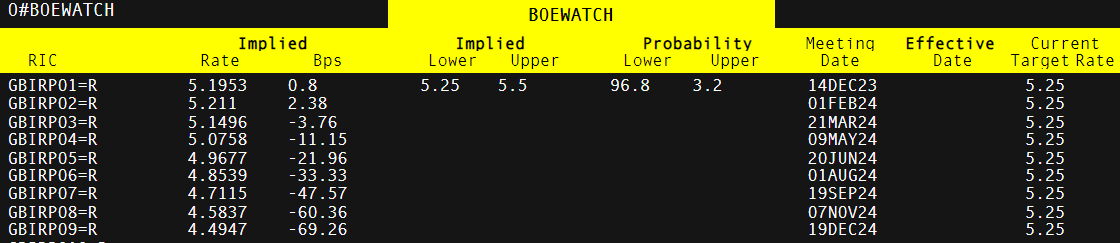

Interest rate markets across the UK, Europe and the US no longer hold out for another potential rate hike and now only consider rate cuts with a high degree of confidence. Sterling may find the slightest bit of enjoyment out of a slightly delayed first rate cut (expected by August) when compared to the US which expects a first cut by June.

Market Implied Probabilities of UK Rate Cuts

Source: Refinitiv, prepared by Richard Snow

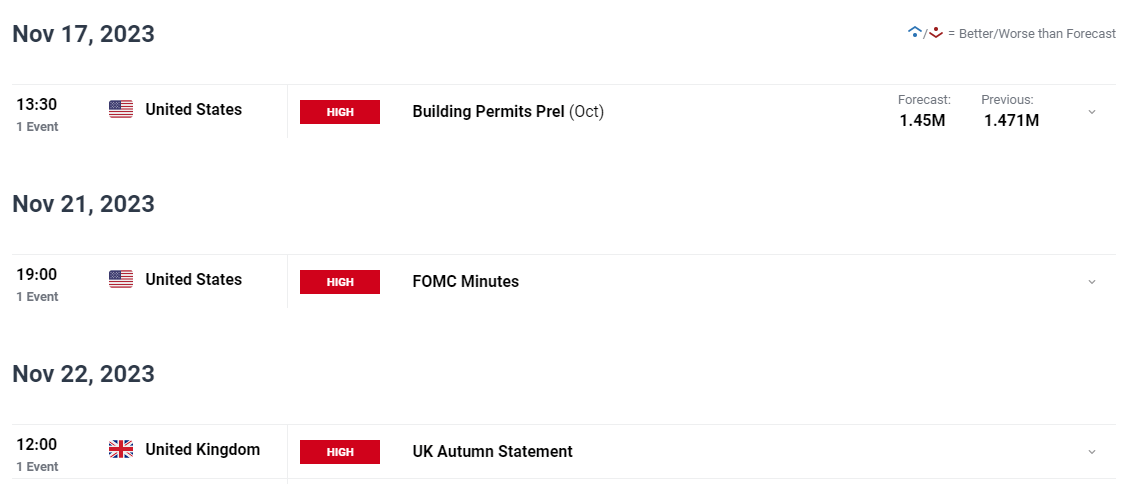

Main Risk Events on the Horizon

Apart from a considerable number of Fed speakers lined up for later today, there is the FOMC minutes next week that could provide intra-day volatility. The highlight for the UK next week is undoubtedly the Autumn Statement to be delivered by Jeremy Hunt. Earlier this week the UK Government highlighted the achievement of halving inflation in the UK before year end and political commentators now wonder if the prospect of tax cuts may be viewed in a more positive light by the Chancellor – particularly ahead of next general election.

Customize and filter live economic data via our DailyFX economic calendar

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰