GBP/USD, GBP/JPY, GBP/AUD Price Action

[ad_1] British Pound Vs US Dollar, Japanese Yen, Australian Dollar – Price Setups: UK jobs and business activity data further reinforce the market’s expectation of peak UK rates. Key focus is on US GDP due Thursday and US PCE data due Friday. What is the outlook and key levels to watch in select GBP crosses?

[ad_1]

British Pound Vs US Dollar, Japanese Yen, Australian Dollar – Price Setups:

- UK jobs and business activity data further reinforce the market’s expectation of peak UK rates.

- Key focus is on US GDP due Thursday and US PCE data due Friday.

- What is the outlook and key levels to watch in select GBP crosses?

Curious to learn how market positioning can affect asset prices? Our sentiment guide holds the insights—download it now! It’s free!

Recommended by Manish Jaradi

Improve your trading with IG Client Sentiment Data

The British pound’s ongoing downward correction looks set to continue amid signs of cooling labor market conditions and price pressures.

Data released on Tuesday further reiterated the notable slowing of broader macro data since mid-August – the UK Economic Surprise Index has fallen sharply from mid-August. As a result, money markets believe UK interest rates have peaked, with the Bank of England expected to keep benchmark rates on hold when it meets next week.

In contrast, the US Federal Reserve projections show one more rate hike before the end of the year, even though a number of Fed officials have toned down the hawkish rhetoric this month. Furthermore, US economic growth appears to be solid – US 3Q GDP data due tomorrow is expected to show a resurgence to 4.3% from 2.1% in 2Q. Markets will also be watching the PCE report for further evidence of moderation in price pressures toward the Fed’s 2% target.

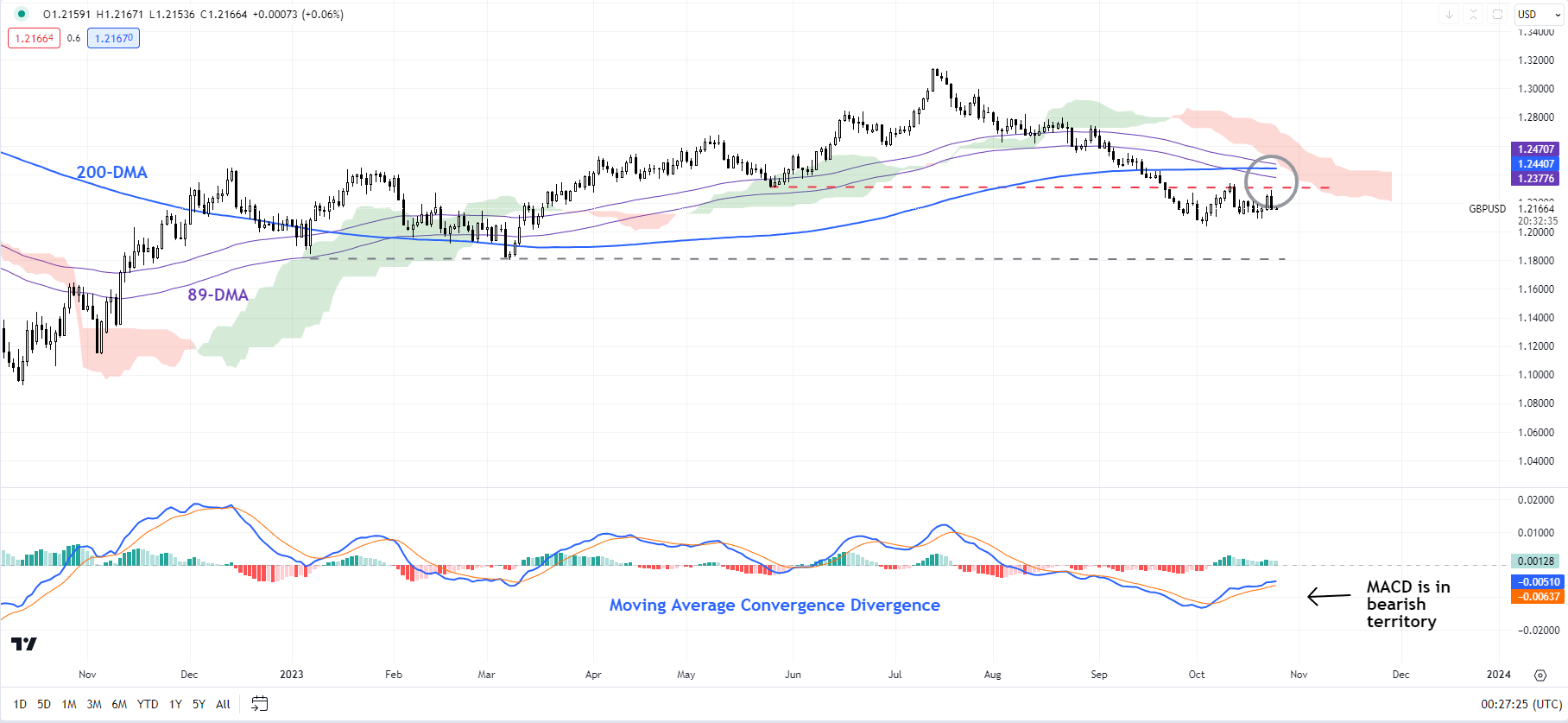

GBP/USD Daily Chart

Chart Created by Manish Jaradi Using TradingView

GBP/USD: Ongoing downward correction

GBP/USD faces stiff resistance at the October 11 high of 1.2350, slightly below the 200-day moving average (now at about 1.2450). While any break above 1.2350 would imply that the immediate downward pressure had faded, cable would need to cross above the upper edge of the Ichimoku cloud on the daily chart, near the mid-August high of 1.2825, for the interim weak outlook to change. Until then the balance of risks remains tilted toward the downside toward the March low of 1.1800. For more discussion, see “Pound’s Resilience Masks Broader Fatigue: GBP/USD, EUR/GBP, GBP/JPY Setups,” published August 23.

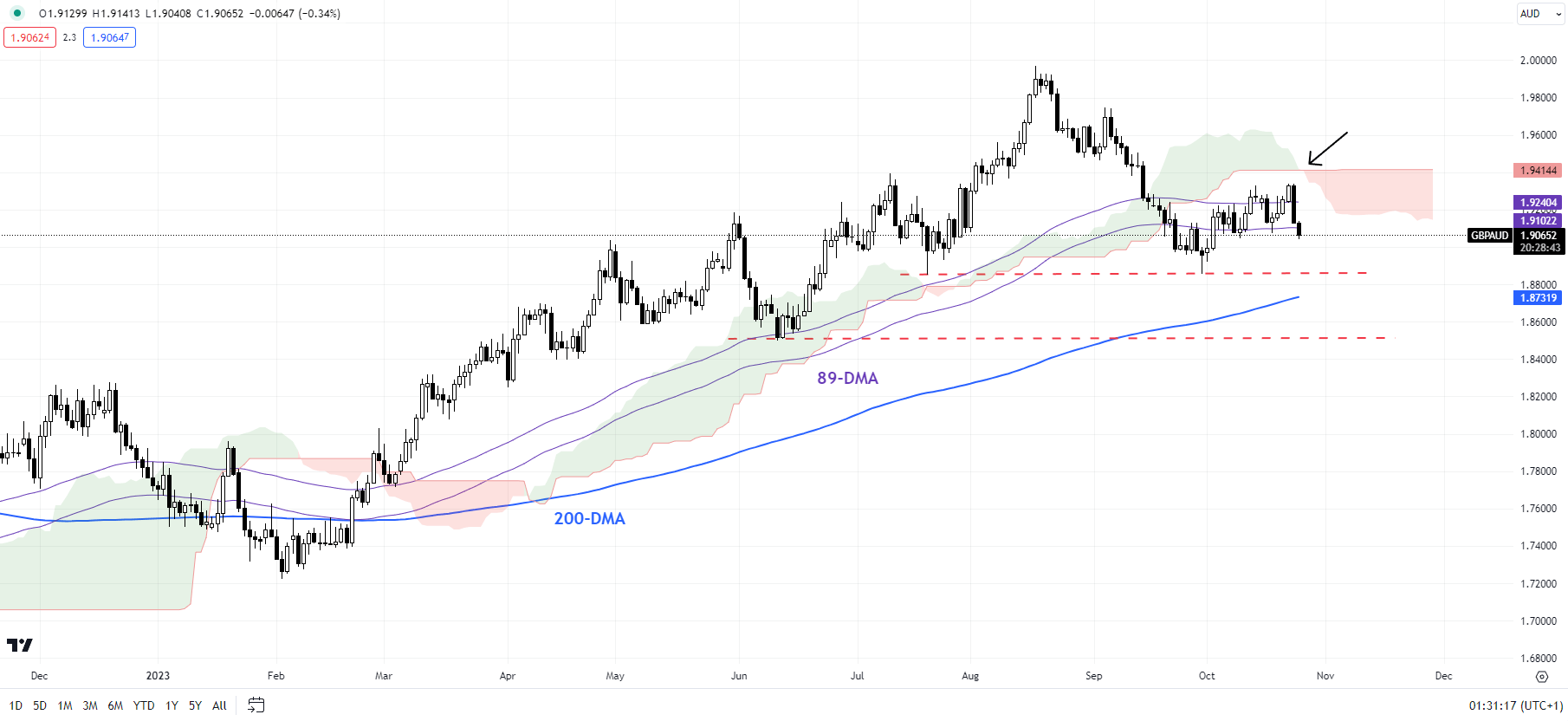

GBP/AUD Daily Chart

Chart Created by Manish Jaradi Using TradingView

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the fourth quarter!

Recommended by Manish Jaradi

Get Your Free Top Trading Opportunities Forecast

GBP/AUD: Downward correction may not be over

GBP/AUD has run into a tough hurdle, including the 89-day moving average and the upper edge of the Ichimoku cloud on the daily chart (at about 1.9350-1.9425). While the broader bullish trend remains in place, the cross may need to consolidate/correct a bit further before the uptrend resumes. It wouldn’t be surprising if GBP/AUD retests the end-September low of 1.8850, near the 200-day moving average, with strong support at the June low of 1.8500.

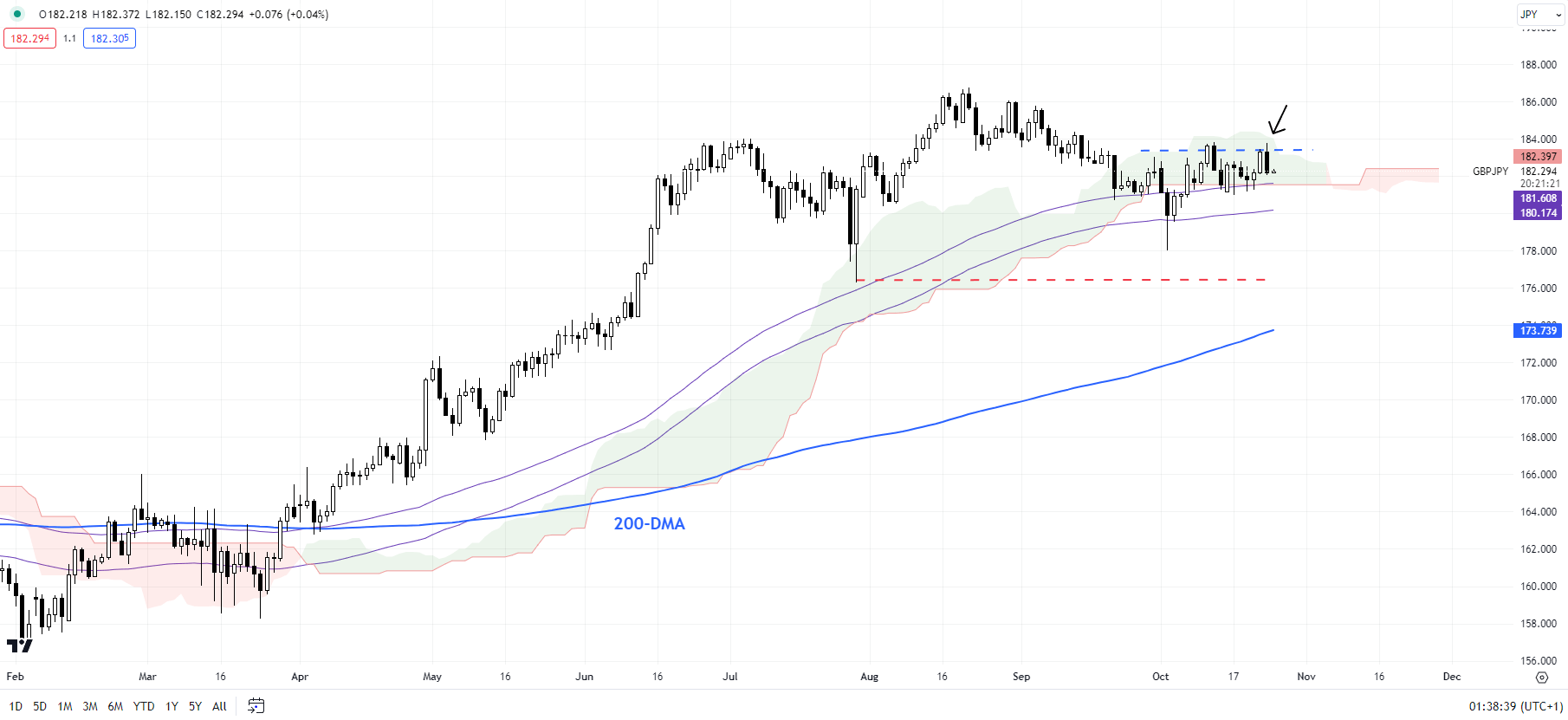

GBP/JPY Daily Chart

Chart Created by Manish Jaradi Using TradingView

GBP/JPY: Upside capped

GBP/JPY continues to face significant converged hurdle at the mid-October high of 183.75 and the upper edge of the Ichimoku cloud on the daily chart. As highlighted in the previous update (see “Japanese Yen Aided by Fed Pause View, Geopolitics; USD/JPY, GBP/JPY, AUD/JPY,” published October 11), the price action since August is a reflection of broader fatigue given sharp gains since the beginning of 2023. While the ongoing correction could run a bit further, the cross has major support at the July low of 176.25, which could limit the downside.

Elevate your trading skills and gain a competitive edge. Get your hands on gold‘s Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Manish Jaradi

Get Your Free Gold Forecast

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0