AUD/USD, AUD/JPY, EUR/AUD Setups Ahead of Inflation Data

[ad_1] AUSTRALIAN DOLLAR PRICE, CHARTS AND ANALYSIS: Most Read: Short USD/JPY: A Reprieve in the DXY Rally and FX Intervention by the BoJ (Top Trade Q4) Elevate your trading skills and gain a competitive edge. Get your hands on the Aussie Dollar Q4 outlook today for exclusive insights into key market catalysts that should be

[ad_1]

AUSTRALIAN DOLLAR PRICE, CHARTS AND ANALYSIS:

Most Read: Short USD/JPY: A Reprieve in the DXY Rally and FX Intervention by the BoJ (Top Trade Q4)

Elevate your trading skills and gain a competitive edge. Get your hands on the Aussie Dollar Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Zain Vawda

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian economy has shown some signs of resilience of late while the Chinese GDP data last week providing further support. The Chinese recovery had been viewed by many as the catalyst for a speedy global recovery which would have seen Australia benefit as well given the connectedness of the two economies. The slow and uneven recovery has however weighed on the Aussie Dollar for a large part of 2023. Recent labor data Australia has been favorable as well while the minutes of the recent RBA meeting indicated the concern from policymakers around inflationary pressure which remains visible.

This rhetoric was echoed by recently appointed Governor Michele Bullock who stated the Central Bank won’t have any patience if incoming inflation data shows a material rise in price pressures across the economy. Tomorrow will bring inflation data from Australia which looks even more important following Governor Bullocks comments. Will Inflation data keep the Aussie Dollar marching forward and will the RBA hike at its upcoming meeting? All of the answers to these questions may hinge on the inflation print tomorrow.

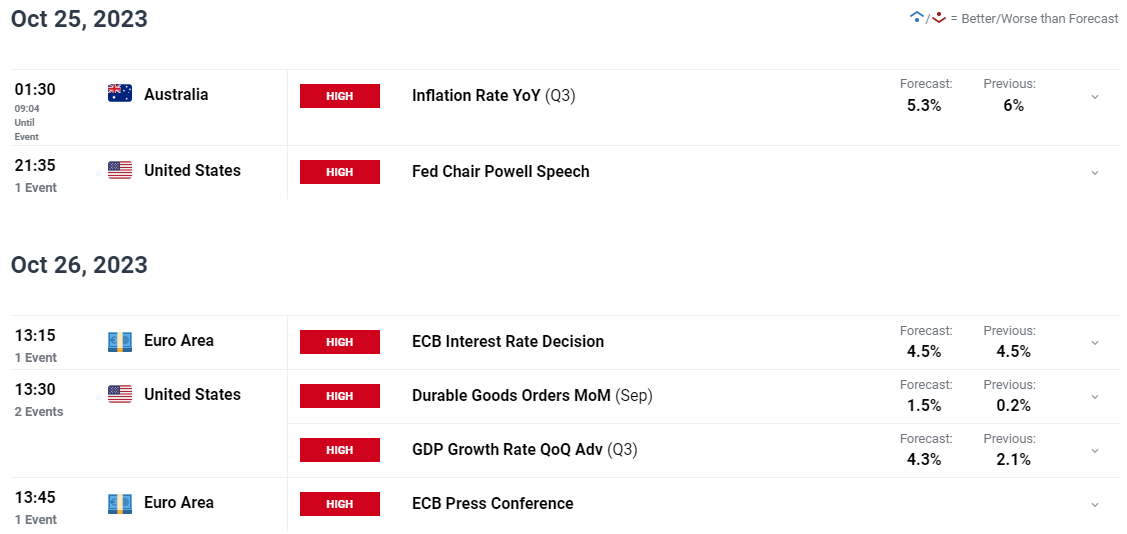

RISK EVENTS AHEAD

The economic calendar Is packed this week but the most immediate threat in the Australian CPI data tomorrow. This will be followed by the ECB rate decision which could have an impact on the EURAUD pair as well, with consensus for another hold by the ECB, it could just turn into a non-event.

For all market-moving economic releases and events, see the DailyFX Calendar

Looking for Tips, Tricks and Insight to AUDUSD, Download the How to Trade Guide Below Now!!

Recommended by Zain Vawda

How to Trade AUD/USD

PRICE ACTION AND POTENTIAL SETUPS

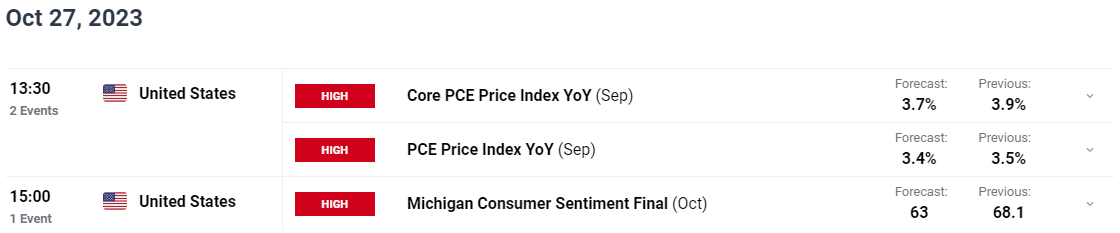

AUDJPY

AUDJPY has been trading sideways since printing a high of around 97.70 early in June. Price action has been rather choppy and this could continue as we have seen on a host of Japanese Yen pairs as market participants fear FX intervention by the Bank of Japan. AUDJPY is currently caught in a symmetrical triangle pattern with a daily close above or below opening up a potential 370 pip move.

All i would caution for is the potential for FX intervention are comments hinting at such (even though this seems to be having a limited effect of late). If FX intervention does occur AUDJPY could be in for a retracement back toward the YTD Lows around the 87.00 mark.

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

AUD/JPY Daily Chart

Source: TradingView, prepared by Zain Vawda

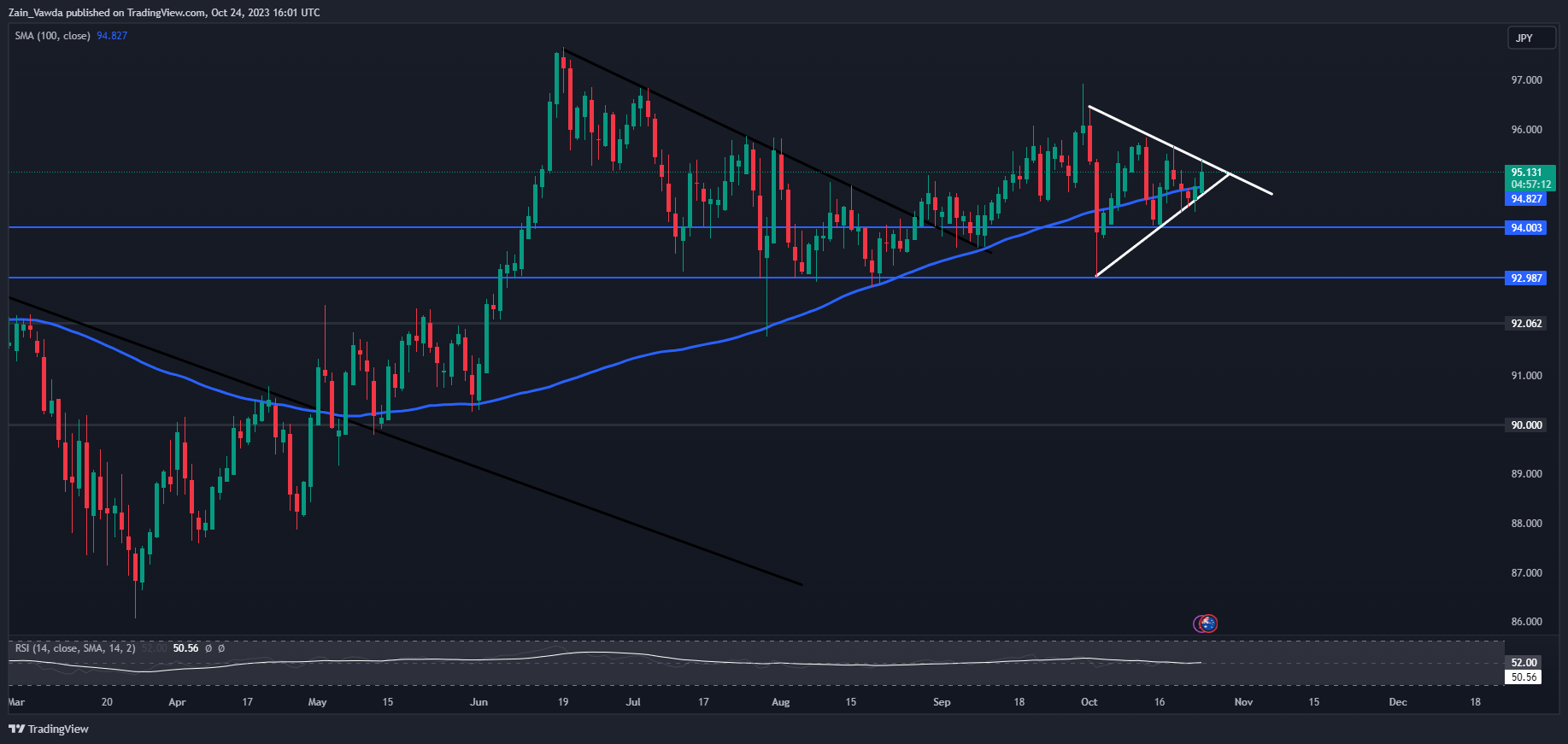

EURAUD

EURAUD has been staircasing its way higher for the entire year with a rally that began in August 2022. At the moment price action is a bit choppy but EUR bulls appear exhausted with a positive inflation print likely to provide the needed catalyst.

A positive inflation print tomorrow could facilitate a break below the ascending trendline and bring the 200-day MA into focus around the 1.5920 area. A break lower and the 100-day MA becomes a support zone resting at 1.5670.

Alternatively, a sustained move higher will need to navigate the key resistance area around the 1.7000 mark which has remained firm till now.

EUR/AUD Daily Chart

Source: TradingView, prepared by Zain Vawda

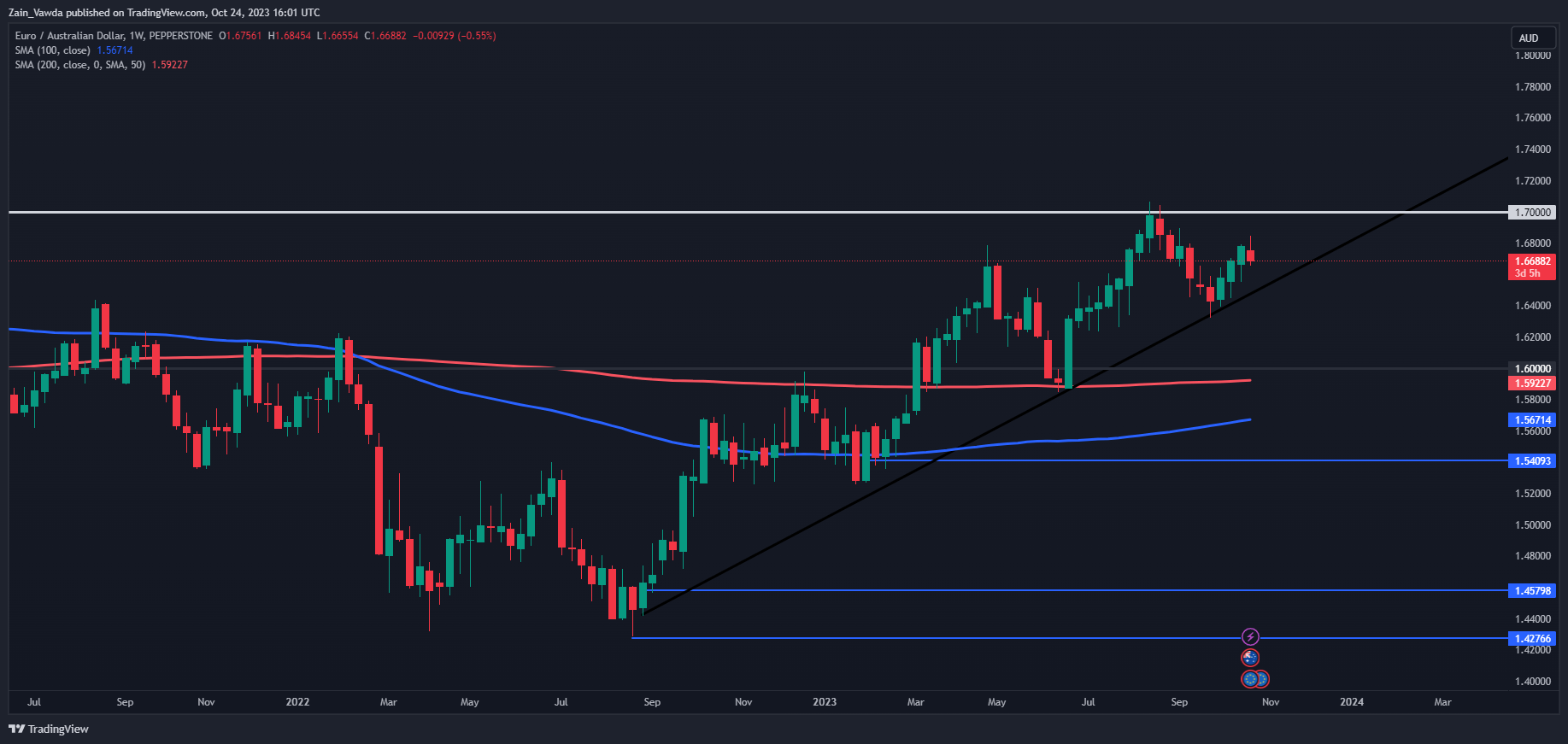

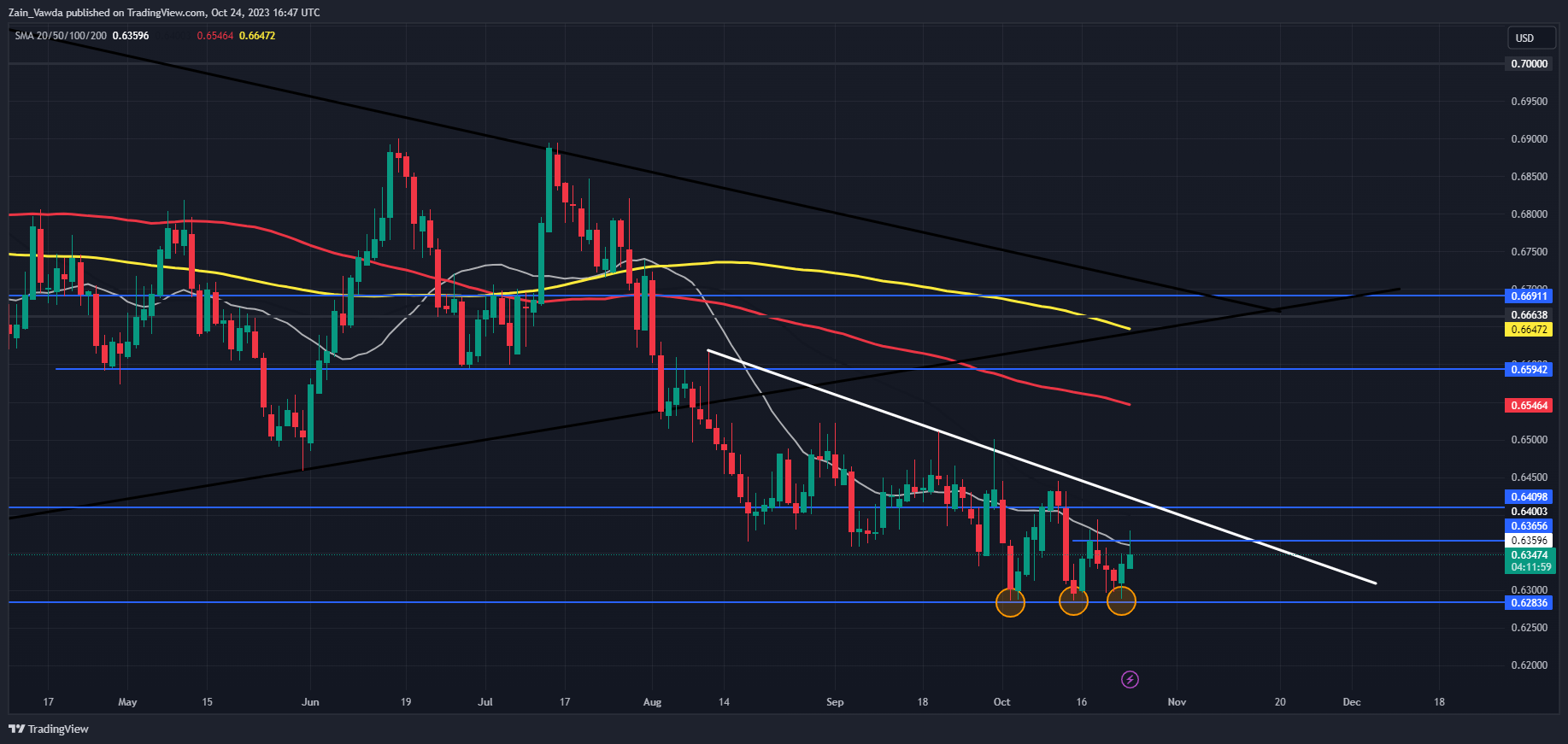

AUDUSD

The AUD/USD is interesting me the most at present as the 0.6280 level has held firm for three tests during the month of October. We are also seeing a potential triple bottom pattern on AUDUSD (marked off on the chart below) and given that i missed the triple bottom on WTI earlier this year i will be paying close attention to this one.

We still haven’t seen a change in structure though with a daily candle close above the 0.6366 mark needed to confirm a shift to bullish. Above that we have the descending trendline which prevents another challenge before focus can turn to the 100-day MA. A break of support here can see a retest of the October 2022 low around the 0.6170 mark.

AUD/USD Daily Chart

Source: TradingView, prepared by Zain Vawda

IG CLIENT SENTIMENT

Taking a quick look at the IG Client Sentiment Data whichshows retail traders are 75% net-long on AUDUSD. Given the contrarian view adopted here at DailyFX, is AUDUSD destined to create a fresh low?

Curious to learn how market positioning can affect asset prices? Our sentiment guide holds the insights—download it now!

| Change in | Longs | Shorts | OI |

| Daily | -10% | 38% | -1% |

| Weekly | -7% | 15% | -3% |

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0