Hang Seng, Kospi, Topix Setups

[ad_1] HANG SENG, KOSPI, TOPIX – Price Action: The Hang Seng Index, Kospi, and Topix have rebounded from key support despite the latest escalation in geopolitical tensions. Hang Seng has some tough hurdles to clear before the weak outlook changes. What is the outlook and the key levels to watch in select Asian indices? –

[ad_1]

HANG SENG, KOSPI, TOPIX – Price Action:

- The Hang Seng Index, Kospi, and Topix have rebounded from key support despite the latest escalation in geopolitical tensions.

- Hang Seng has some tough hurdles to clear before the weak outlook changes.

- What is the outlook and the key levels to watch in select Asian indices?

– Elevate your trading skills and gain a competitive edge. Get your hands on the U.S. dollar Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Manish Jaradi

Get Your Free USD Forecast

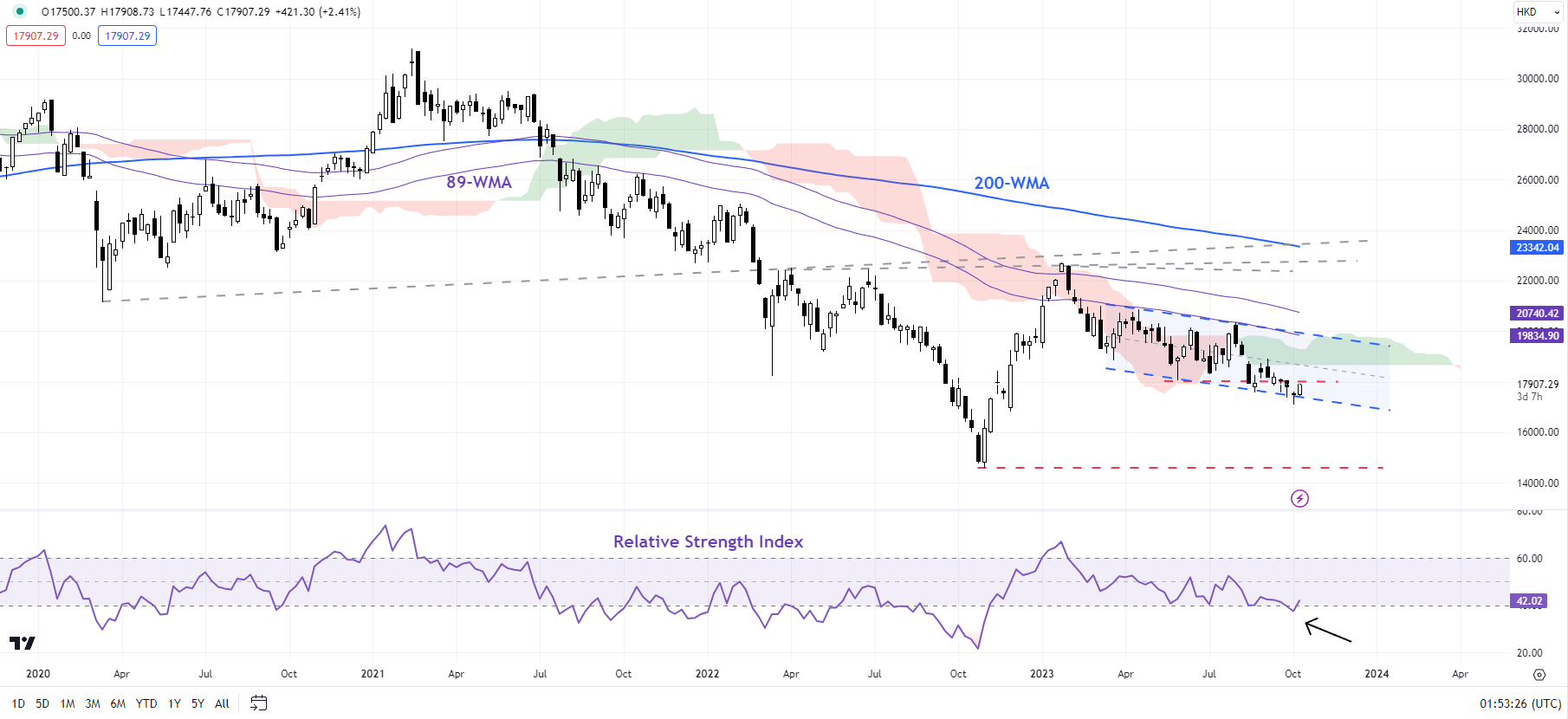

Hang Seng Index: Downward momentum is picking up

Hang Seng is attempting to rebound from near a crucial cushion area, including the May low of about 18000 and the lower edge of a declining channel since early 2023 (at about 17400). Oversold and under-ownership conditions limit a significant downside potential from here, especially given a spate of policy support measures recently. For more discussion see, “Q4 Trade Opportunity: HK/China Equities Could be Due for a Rebound,” published October 9. Below that, the next support is at the 2022 low of 14600.

Hang Seng Index Daily Chart

Chart Created Using TradingView

On lower timeframe charts, the index is testing a stiff hurdle at Friday’s high of 17935 – a break above this ceiling is needed for immediate downside risks to fade. Beyond the very near term, Hang Seng needs to, at minimum, clear the early-September high of 18900 to raise the odds for a turnaround in the medium-term downtrend.

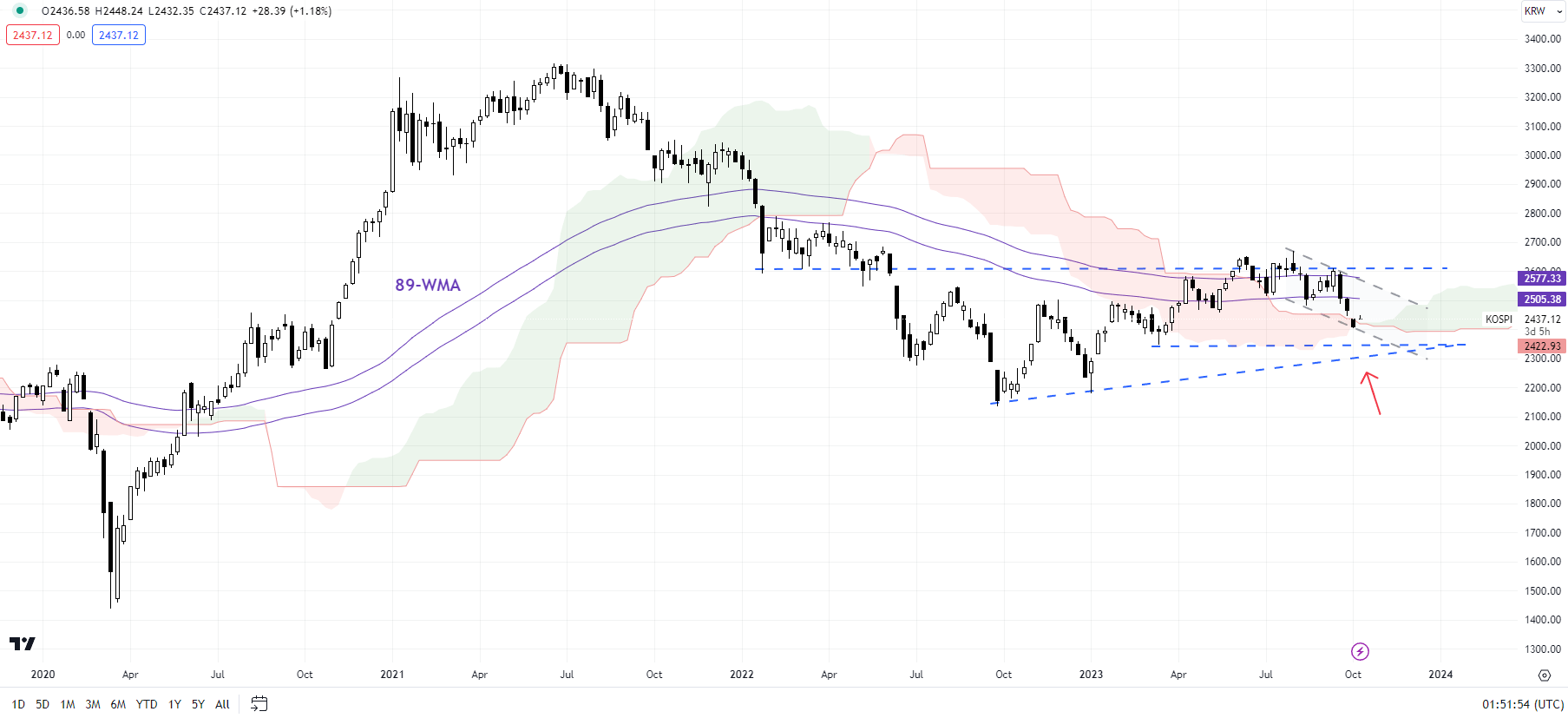

Kospi: The downside could be limited for now

Kospi is nearing fairly strong converged support, including the lower edge of the Ichimoku cloud on the weekly charts, around the lower edge of a declining channel from August. While the upward pressure had undoubtedly eased in the near term, Kospi would need to fall below the March low of 2350 for material downside risks to emerge. In the absence, the bias appears to be sideways to up.

Kospi Weekly Chart

Chart Created Using TradingView

Earlier last month, Kospi fell below vital support at the July low of 2515, confirming that the multi-week uptrend was about to change. The index’s fall below 2515 has triggered a minor double top (the June and August highs) that opened the way toward 2380. Major support is at the March low of 2350 – the index needs to remain above this support if the eight-month-long rally has to extend.

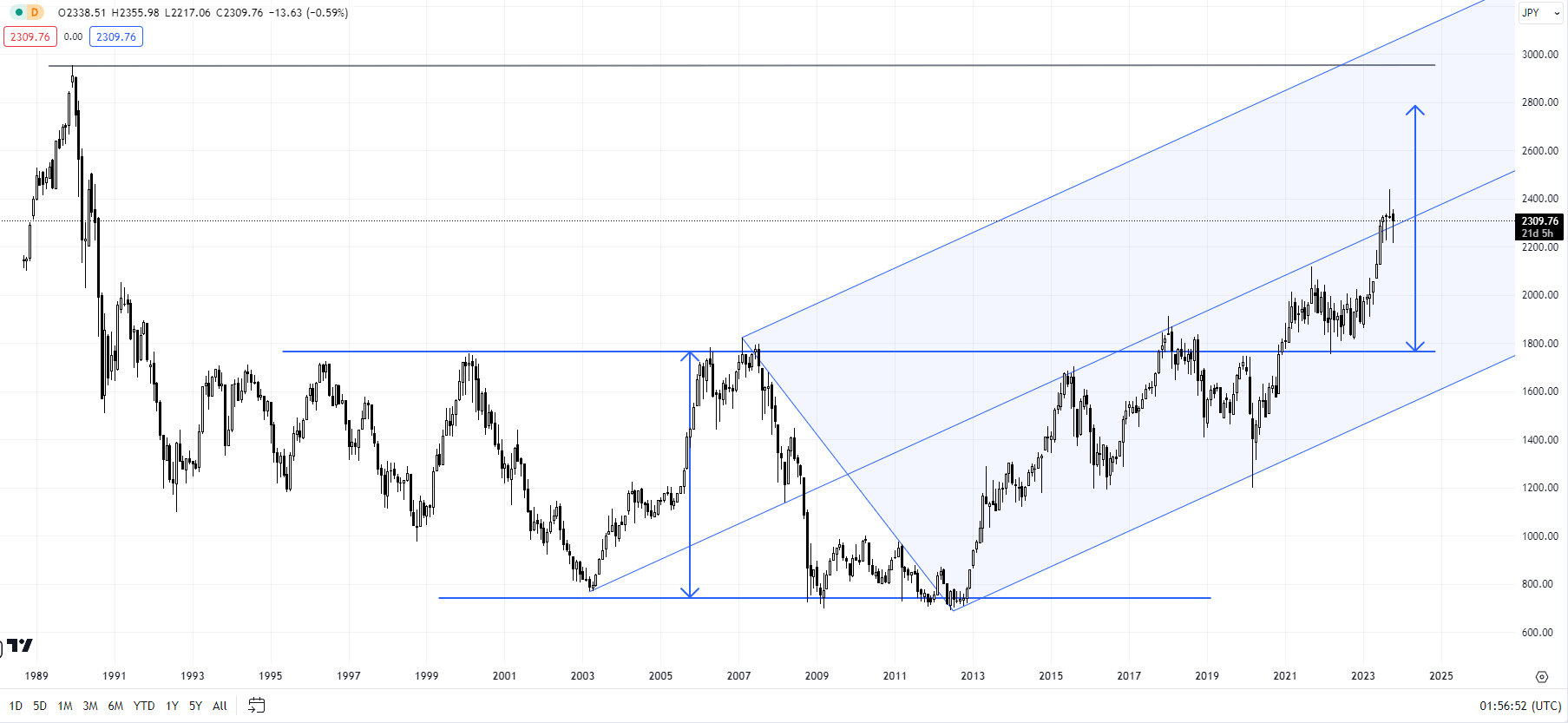

Topix: Tough support to restrict downside

Topix has rebounded from near a vital floor at the July and August lows of 2225. This support is strong and is unlikely to break easily in the context of the broader uptrend. Chances are that the recent retreat is nothing but a consolidation/pause within the uptrend. The retreat came about from around a tough resistance on the medium line of a rising pitchfork channel from 2003 – which has truncated rallies in recent years.

Topix Monthly Chart

Chart Created Using TradingView

The index has shown gradual signs of strength in recent years, with the break above a horizontal trendline from the mid-1990s turning out to be unambiguously bullish. Unless the index falls below the resistance-turned-support at the 2021 high of 2120, the broader upward pressure remains intact

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the fourth quarter!

Recommended by Manish Jaradi

Get Your Free Top Trading Opportunities Forecast

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0