AUD/USD ANALYSIS & TALKING POINTS

- Chinese and Australian PMI’s disappoint.

- US PMI data and Fed guidance to come later today.

- AUD long upper wick suggests the possibility for further downside.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian dollar opened the week on the backfoot after Chinese and Australian PMI’s (see economic calendar below) weighed on the local currency. Being so closely linked to the Chinese economy primarily through commodity exports, the humble expansion shown via the Caixin report reflects a sluggish economy. With China celebrating their Golden Week, trade will decline and may limit AUD upside.

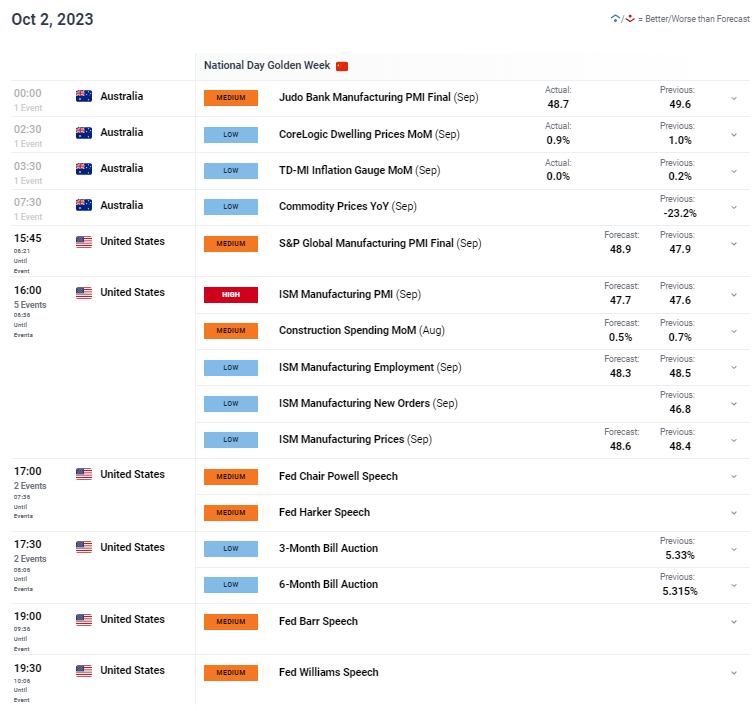

AUD/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

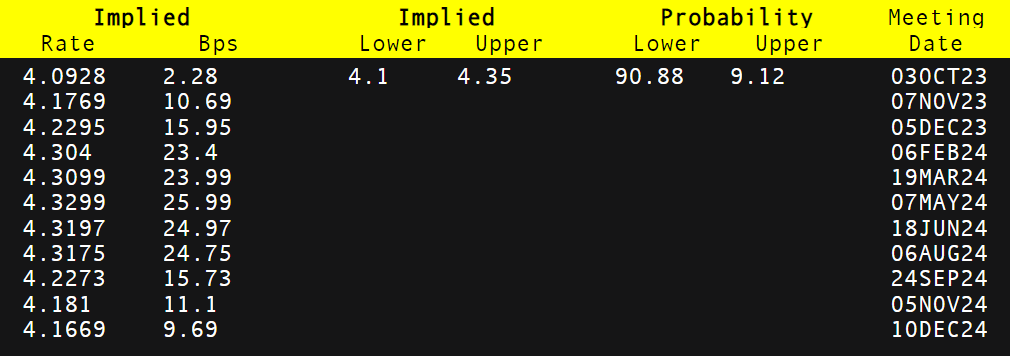

Australian Manufacturing PMI remained in contractionary territory while the inflation gauge ticked lower. The softer inflation print should minimize hawkish pressure on the Reserve Bank of Australia (RBA) tomorrow at their interest rate announcement with money markets (refer to table below) currently pricing in only a 9% chance of a hike. More focus will likely be placed on guidance from the new RBA Governor Michele Bullock as to any change or shift in tone from the prior meeting.

Later today, US ISM PMI’s will come into focus alongside Fed speak that should provide some volatility for the pair.

RBA INTEREST RATE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

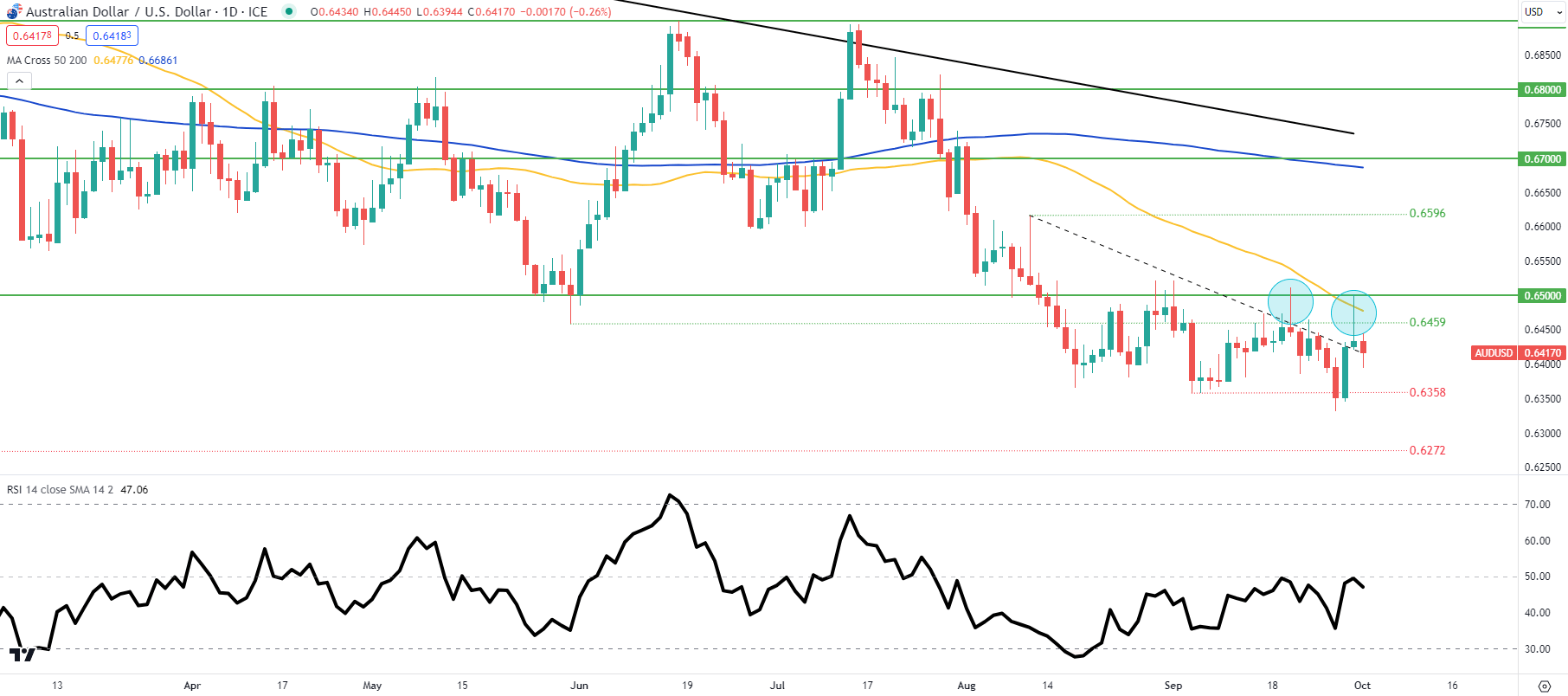

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, TradingView

Daily AUD/USD price action above looks ominous short-term after last week Friday’s long upper wick (blue) close after bulls attempted to retest the 0.6500 psychological handle. The pair continues to respect the medium-term trendline resistance (dashed black line) and another close below this zone could weigh negatively on the Aussie dollar.

Key resistance levels:

- 0.6500

- 50-day moving average (yellow)

- 0.6459

Key support levels:

- Trendline resistance

- 0.6358

- 0.6272

IG CLIENT SENTIMENT DATA: MIXED (AUD/USD)

IGCS shows retail traders are currently net LONG on AUD/USD, with 76% of traders currently holding long positions. Download the latest sentiment guide (below) to see how daily and weekly positional changes affect AUD/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0