The NZD is the strongest and the USD is the weakest as the NA session begins

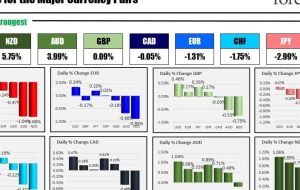

The strongest to the weakest of the major currencies As the North American session begins, the NZD is the strongest of the major currencies while the USD is the weakest. In Europe, data was largely weaker than expectations which has sent yields lower and led to gains in stocks in Europe and the US. In

The strongest to the weakest of the major currencies

As the North American session begins, the NZD is the strongest of the major currencies while the USD is the weakest. In Europe, data was largely weaker than expectations which has sent yields lower and led to gains in stocks in Europe and the US. In Europe today, German retail sales fell -1.2% versus 0.5% expected. Europe core CPI flash estimate came in at 4.5% versus 4.8% estimate and 5.3% prior month, while headline inflation fell to 4.3% which was lower than 4.5% expectations and 5.2% prior. Next, the US PCE data will be released today at 8:30 AM and will be eyed for continued declines in inflation. The year-on-year measures are expected to fall to 3.9% from 4.2%. The focus today is on the lower-inflation as economies tiptoe between falling off an edge and lowering inflation while keeping growth and employment OK.

The not so good, is the US government sits on the edge of a shutdown. The U.S. House of Representatives is poised to vote on a short-term funding bill this Friday, a crucial step to avoid an impending government shutdown scheduled for this weekend. However, the passage of the bill is uncertain as it faces opposition from hardline Republicans, who have expressed discontent with the spending levels established in an agreement with President Joe Biden earlier this year. Although the House successfully passed three bills that allocate funds to certain government sectors on Thursday, these are not anticipated to gain support in the Democratic-majority Senate and are inadequate to prevent the fourth federal shutdown in a decade. OH NO.

In the Senate, a separate stop-gap bill, which proposes to extend spending until November 17 and includes provisions for aid to Ukraine and domestic disaster relief, is under consideration. However, this too faces rejection from House Republicans. Wall Street is observing these developments with caution, still reeling from the recent intense debate over the U.S. debt ceiling. Adding to the gravity of the situation, Moody’s has issued a warning that a shutdown could potentially endanger the country’s esteemed “Aaa” credit rating. OH NO.

The good from all that is government tends to come to some agreement at some point. So the markets can and will ignore the problems. However, the US fiscal issues are still a major concern.

The economic calendar today will have US PCE data (the favored Fed inflation gauge) and the final University of Michigan consumer sentiment data.

Economic Indicators and Their Revised Details

8:30 AM ET

- CAD GDP m/m:

- Estimate: 0.1%

- Prior: -0.2%

- US Core PCE Price Index m/m:

- Estimate: 0.2%

- Prior: 0.2%

- US Core PCE YoY

- Estimate: 3.9%

- Prior: 4.2%

- Estimate 3.5%Dammit

- Prior 3.3%

- US Goods Trade Balance:

- Estimate: -91.4B

- Prior: -90.9B

- US Personal Income m/m:

- Estimate: 0.4%

- Prior: 0.2%

- US Personal Spending m/m:

- Estimate: 0.5%

- Prior: 0.8%

- US Prelim Wholesale Inventories m/m:

- Estimate: -0.1%

- Prior: -0.2%

- 10:00 AM ET

- US Revised UoM Consumer Sentiment:

- Estimate: 67.7

- Prior: 67.7

- US Revised UoM Inflation Expectations:

- Estimate: 3.1%

- No prior data available.

A snapshot of the markets as the NA session gets underway shows:

- Crude oil is trading up $1.14 or 1.24% $92.85

- Spot gold is trading up up $4.08 or 0.22% $1868.58

- Spot silver is trading up $0.48 or 2.14% to $23.08

- Bitcoin is trading at $26,971. At this time yesterday, the price was trading at $26,441.

In the US premarket for US stocks, futures are implying a higher open across the board after yesterday’s gain

- Dow Industrial Average futures are implying a gain of 160 points after yesterday’s 116.07 point rise

- S&P index futures are implying a gain of 21 points after yesterday’s 25.17 point cane

- NASDAQ futures are implying a gain of 102 points after yesterday’s 108.43 point rise

In the European equity markets, the major indices are trading higher:

- German DAX, +0.90%

- France’s CAC, +0.97%

- UK’s FTSE 100, +0.62%

- Spain’s Ibex, +0.48%

- Italy’s FTSE MIB, +0.93% (10 minute delay)

In the Asian Pacific today, equity markets closed mixed

- Japan’s Nikkei 225, -0.05%

- China’s Shanghai Composite +0.10%

- Hong Kong’s Hang Seng, +2.51%

- Australia’s S&P/ASX 200, +0.34%

In the US debt market, yields are lower with the yield curve flattening

- 2-year yield, 5.043% -2.7 basis points

- 5-year yield, 4.609% -3.4 basis points

- 10-year yield, 4.563% -3.4 basis points

- 30-year yield, 4.700% -2.9 basis points

- 2 – 10 year spread is trading at -48 basis points after trading at -49 basis points at this time yesterday

In the European debt market, benchmark 10-year yields are trading sharply lower after the weaker data and lower inflation in Europe today:

European benchmark 10 year yields

| آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA + مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰