Nikkei at Near-Term Support, Brent Crude Eyeing September High

[ad_1] Market Recap of clients are net long. of clients are net short. Change in Longs Shorts OI Daily 0% -5% -2% Weekly 39% -21% 5% Wall Street managed to stabilise overnight from its recent sell-off, despite another climb in Treasury yields and a pull-ahead in the US dollar (+0.4%). The US 10-year yields were

[ad_1]

Market Recap

| Change in | Longs | Shorts | OI |

| Daily | 0% | -5% | -2% |

| Weekly | 39% | -21% | 5% |

Wall Street managed to stabilise overnight from its recent sell-off, despite another climb in Treasury yields and a pull-ahead in the US dollar (+0.4%). The US 10-year yields were up another 5 basis-point (bp) to reach above 4.60%, with the yield curve presenting a prolonged bear steepening trade as market participants buy into the narrative that high interest rates will linger for longer. Perhaps one to watch over the medium term is an eventual un-inversion of the 10 year/2 year Treasury yield spread, which tends to precede a recession on the past four occasions.

Ahead, the final reading for US 2Q GDP will be on watch. Given that the data may be backward looking, reaction to the data may be short-lived, barring any significant deviation from the initial read. Current expectations are looking for a slight uptick in the GDP growth rate to 2.1% from previous 2%.

The key focus may instead revolve around any clues on US monetary policy outlook from Fed Chair Jerome Powell’s speech. Given the lack of key economic data from the recent Federal Open Market Committee (FOMC) meeting till now, he may likely stick to his original Federal Reserve (Fed) meeting script and leave the door open for additional hike, albeit still very much dependent on upcoming data.

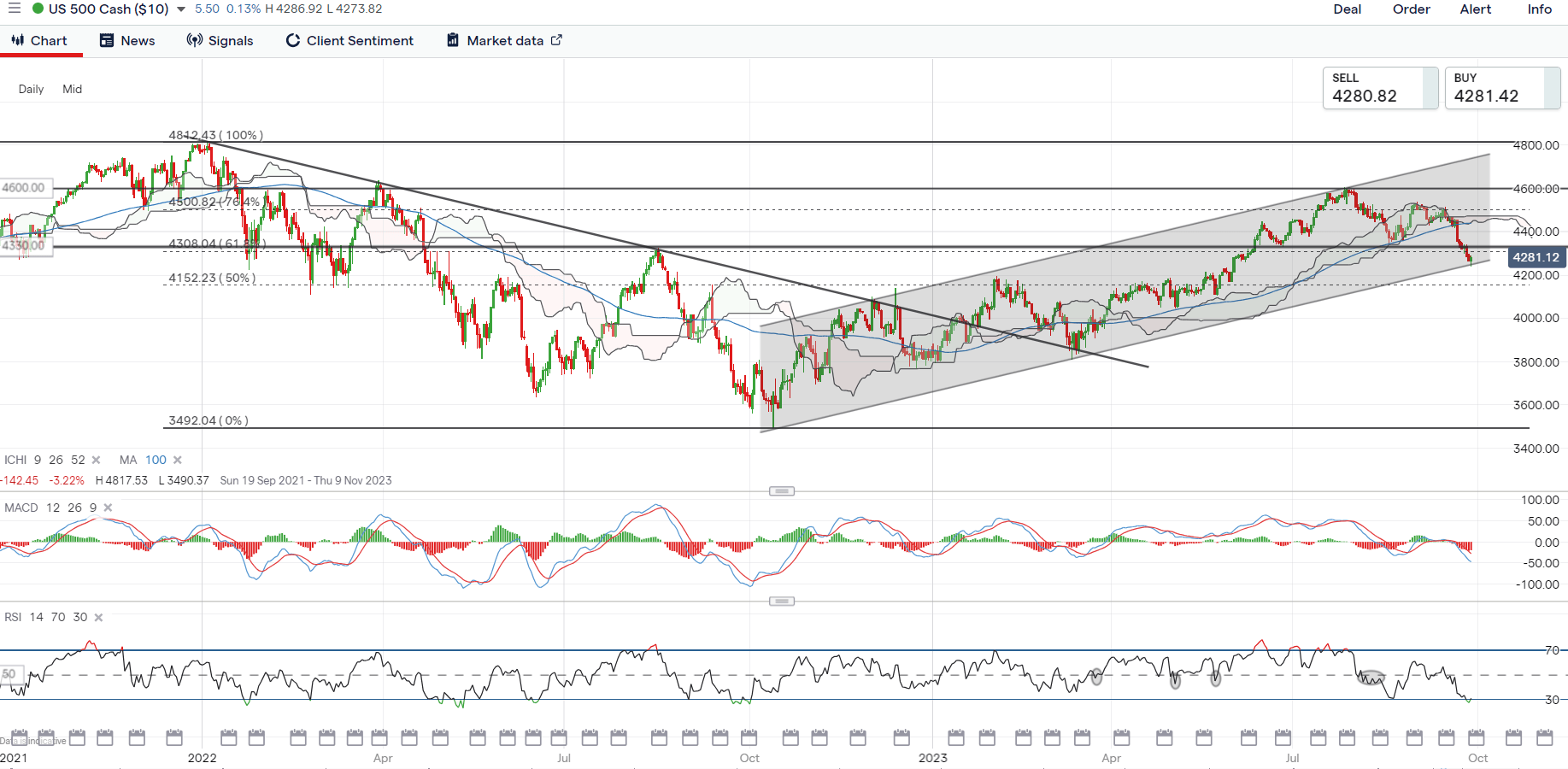

The S&P 500 is currently back to retest the lower trendline of an ascending channel pattern in place since October 2022, providing a moment of reckoning for buyers. Its weekly Relative Strength Index (RSI) is also back at the key 50 level – a midline that may determine the broader trend ahead. Any failure to defend the lower channel trendline support may pave the way to retest the 4,150 level next.

Source: IG charts

Asia Open

Asian stocks look set for a mixed open, with Nikkei -0.70% and ASX +0.24% at the time of writing. Korean markets are closed for Mid-Autumn Festival today and tomorrow. The relatively quiet economic calendar today may lead sentiments on a more subdued tone, while reservations on risk-taking may continue to revolve around developments on China’s property sector. Suspension of trading in China Evergrande’s shares and its chairman placed under police surveillance further reinforces the odds of liquidation, while a bailout from authorities remains unlikely, given their series of more indirect measures to support the property sector.

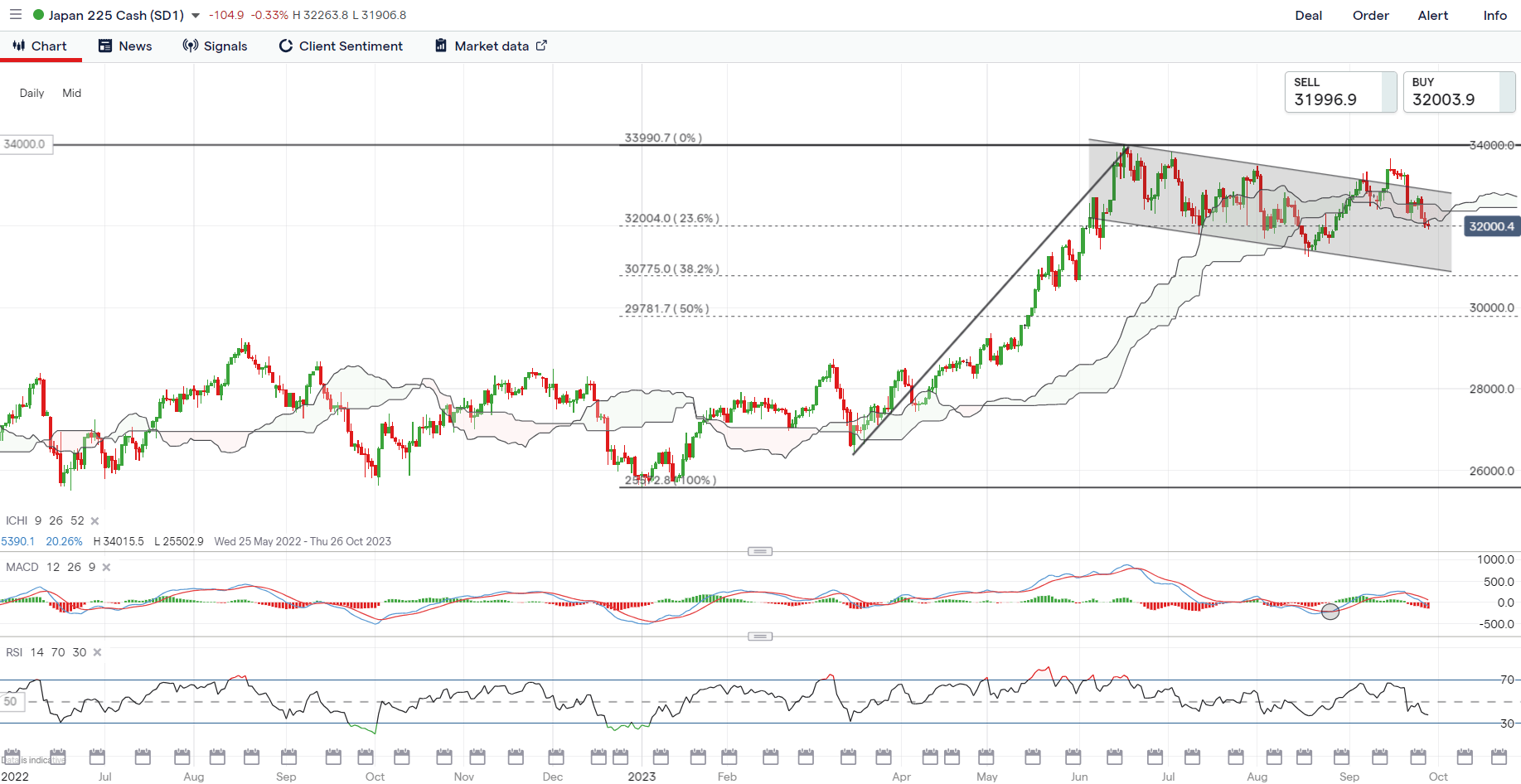

Perhaps one to watch may be the Nikkei 225 index, which is struggling to defend the lower edge of its Ichimoku cloud on the daily chart at the 32,000 level. This level also coincides with a 23.6% Fibonacci level of retracement, with any failure to hold potentially paving the way to retest the 30,800 level next, where the lower channel trendline support resides. Near-term upward momentum still remains weak for now, with its daily Moving Average Convergence/Divergence (MACD) looking to cross below the zero line.

Recommended by Jun Rong Yeap

How to Trade FX with Your Stock Trading Strategy

Source: IG charts

On the watchlist: Brent crude prices eyeing for a retest of its recent high

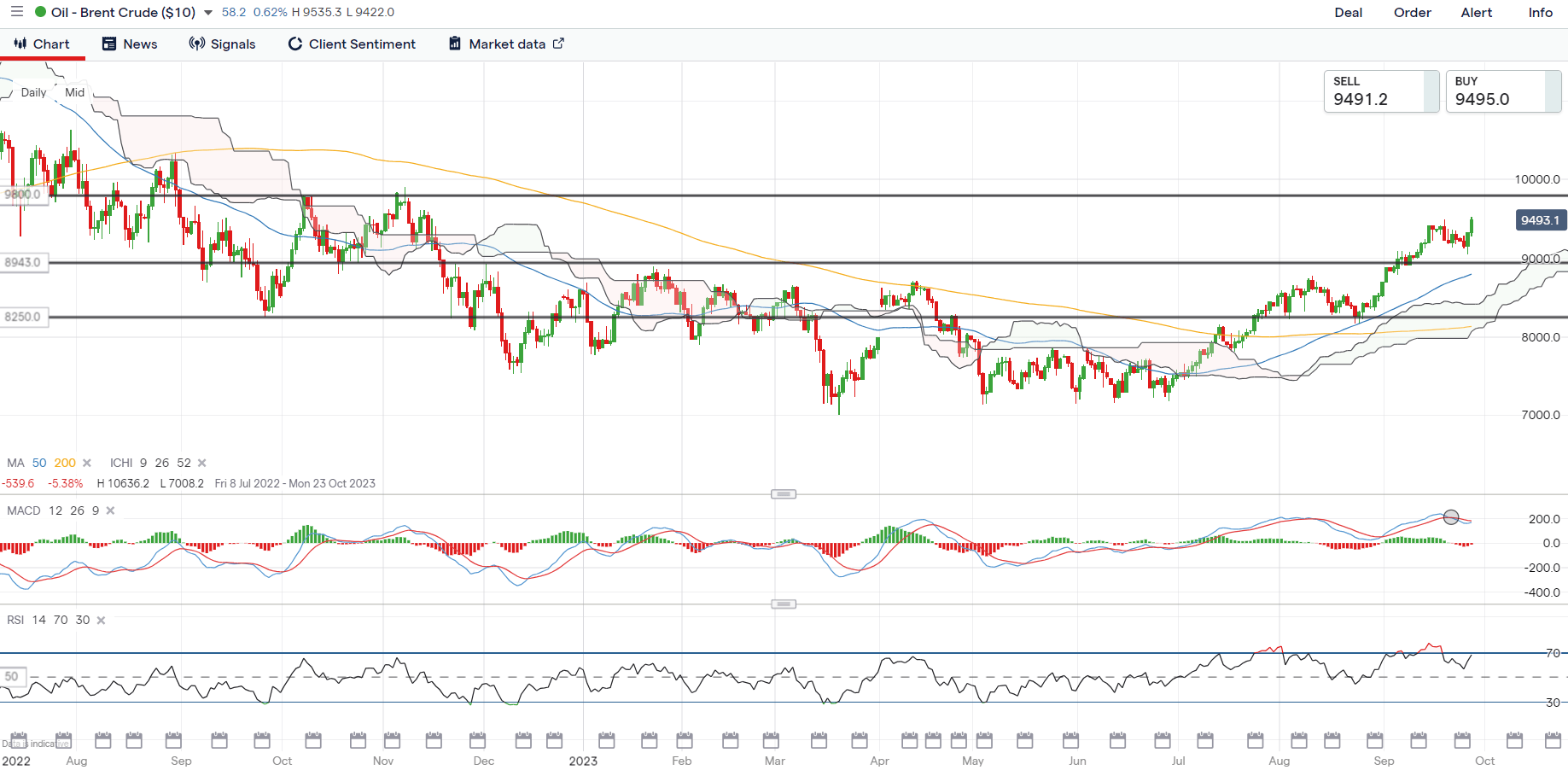

Recent retracement in Brent crude prices has proved to be short-lived as prices were up more than 3% over the past two trading days, seemingly eyeing for a retest of its recent September high at the US$95.00 level. Another week of significant drawdown in US crude oil inventories overnight continues to reinforce the trend of tighter supplies (-2.17 million vs -0.32 million expected) since August this year, which far overrides worries about China’s growth conditions and a stronger US dollar.

Ahead, one to watch if the September top may be overcome to form a new higher high and reinforce the prevailing upward trend since June this year. Its weekly MACD has crossed above the zero line as an indication of positive momentum in place, while its RSI above 50 also leaves buyers in control for now. Further upside may leave the US$98.00 level on watch as the next point of resistance to overcome.

Recommended by Jun Rong Yeap

How to Trade Oil

Source: IG charts

Wednesday: DJIA -0.20%; S&P 500 +0.02%; Nasdaq +0.22%, DAX -0.25%, FTSE -0.43%

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0