DAX, EU Stocks 50 News and Analysis

- ECB officials have their say, Villeroy, Schnabel, Lagarde

- German Bund yields reach yearly high, Euro falls

- EU Stoxx 50 breaches crucial support, focusing on

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

ECB Officials Have Their Say: Villeroy, Schnabel and Lagarde

First up this morning was the Governor of the Bank of France, Francois Villeroy de Galhau whose words jolted European markets early in the session. Villeroy, who is thought to be slightly on the hawkish side of central, reiterated that the risks of doing too much or too little are more symmetrical. However, he did state that more can still be done if needed.

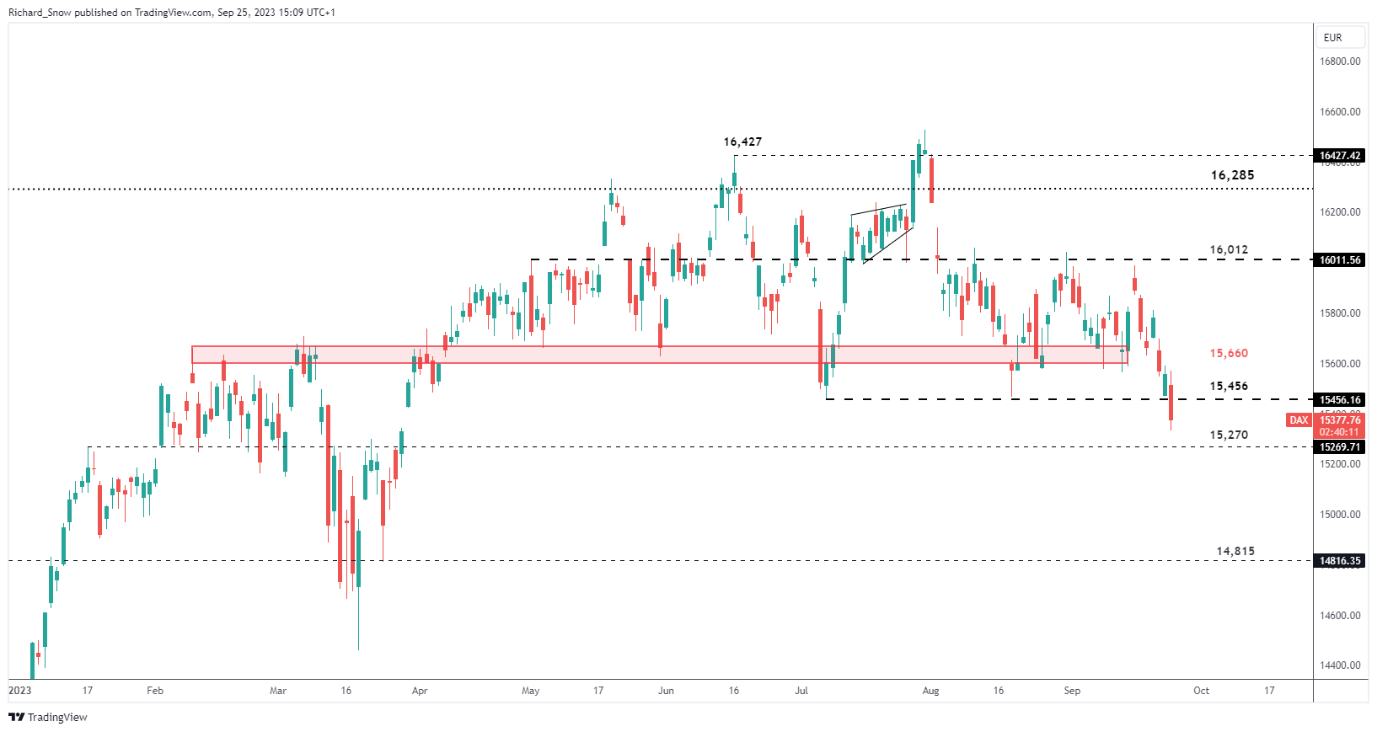

Soon after, the DAX followed the bulk of Asian indices lower, trading below 15,456. The Ifo business climate report did little to arrest the slide, printing a fourth straight decline as European fundamentals sour further. Isabel Schnabel outlined that the inflation problem remains and Christine Lagarde confirmed as much while stating the job market has also seen some easing.

The DAX now has 15,270 as the next level of support, followed by the longer-term 15,070. German and EU inflation data are due on Thursday and Friday this week respectively. The ECB will be desperate for the disinflationary trend to show more progress after hinting last week that the committee may have already reached peak rates.

DAX Daily Chart

Source: TradingView, prepared by Richard Snow

| Change in | Longs | Shorts | OI |

| Daily | 26% | 31% | 29% |

| Weekly | 43% | -8% | 12% |

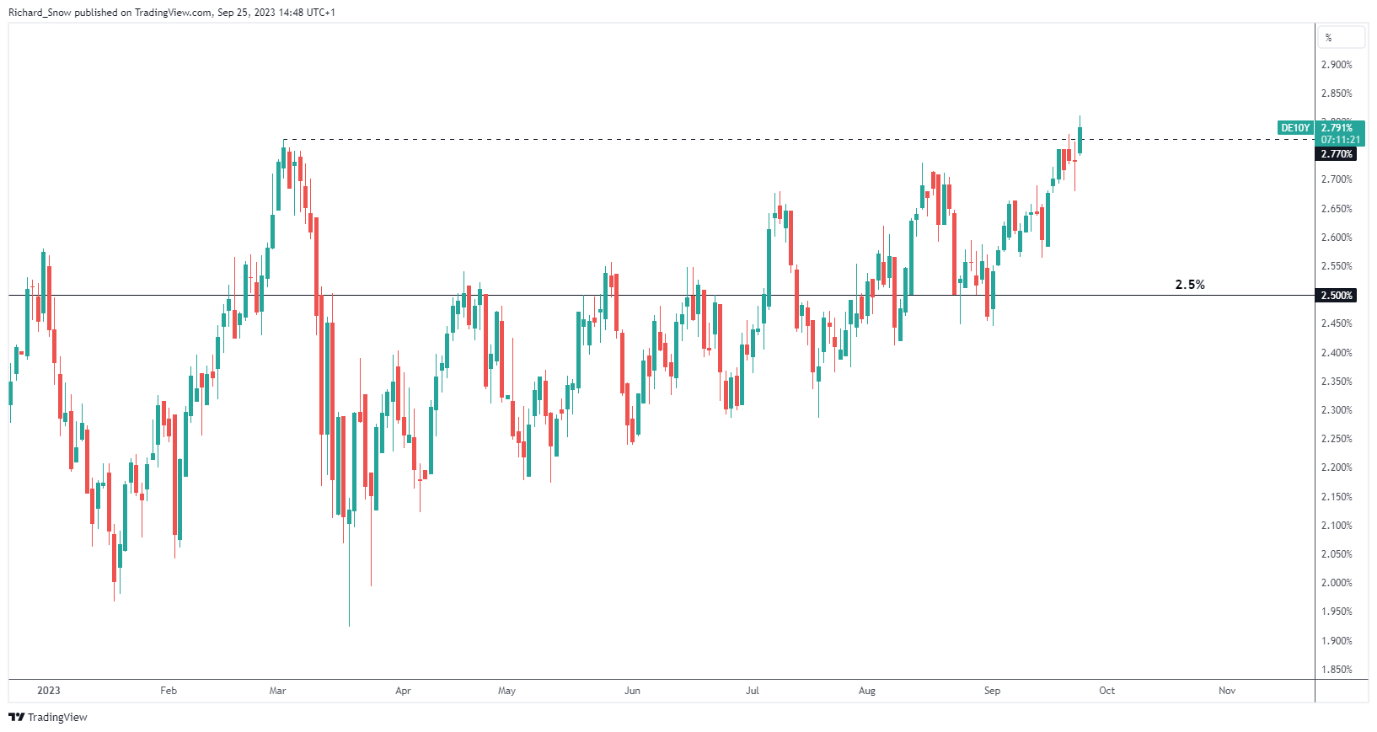

In addition, German Bund yields hit a new yearly high of 2.811% as the bond markets envision a scenario where rates remain higher for longer, even in Europe. However, this did little for the Euro which has broadly declined at the start of the week.

German 10-Year Bund Yield Source: TradingView, prepared by Richard Snow

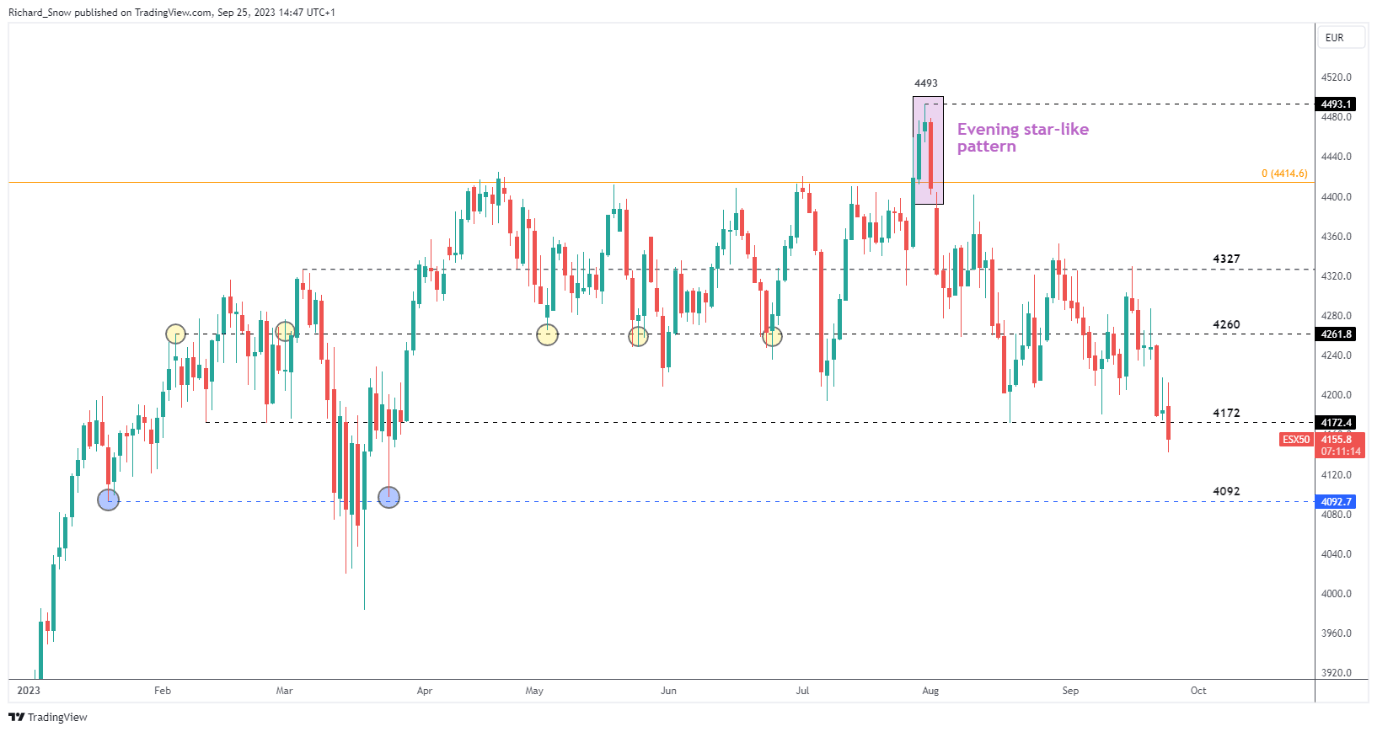

EU Stoxx 50 Breaches Crucial Support

EU Stoxx 50 traded lower at the start of the week, breaching 4,172 – a level of support that had prevented further selling in August and September. The level also came into play in February this year, highlighting its importance as a pivot point.

The decline places 4,092 in sight if the bearish selloff is likely to continue – another notable level of support. In the event of the breakdown, it’s not unusual to see a retest of the 4,172 level of support before a potential bearish continuation.

EU Stoxx 50 Daily Chart

Source: TradingView, prepared by Richard Snow

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0