AUD/USD ANALYSIS & TALKING POINTS

- Fed guidance = elevated rates for longer.

- US initial jobless claims in focus later today.

- Long wick ominous for AUD.

Recommended by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

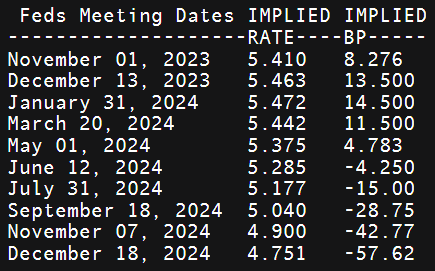

The Australian dollar took a turn lower after yesterday’s FOMC announcement and Westpac lending index data. The Fed kept their rates on hold but delivered a hawkish message that suggested sustained elevated interest rates for a longer period with fewer rate cuts in 2024 – now priced in at 56bps vs 100bps recently (see table below).

IMPLIED FED FUNDS FUTURES

Source: Refinitiv

Earlier this morning, the RBA bulletin was released with the key takeaway being the close scrutiny of wage developments due to its impact on inflation.

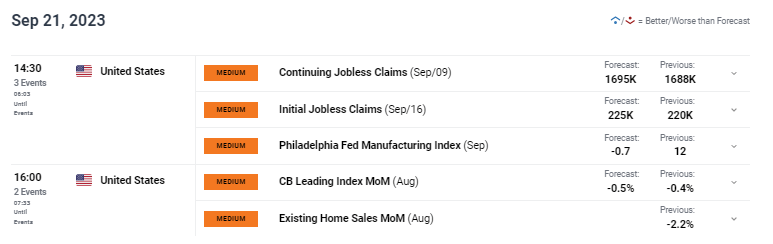

Later today, the pair will be largely driven by US factors including initial jobless claims data (see economic calendar below). Recent figures have reiterated the robust labor market in the US and this week look to exhibit little change. A strong initial jobless claims figure could supplement US dollar upside and weigh on the AUD.

AUD/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL ANALYSIS

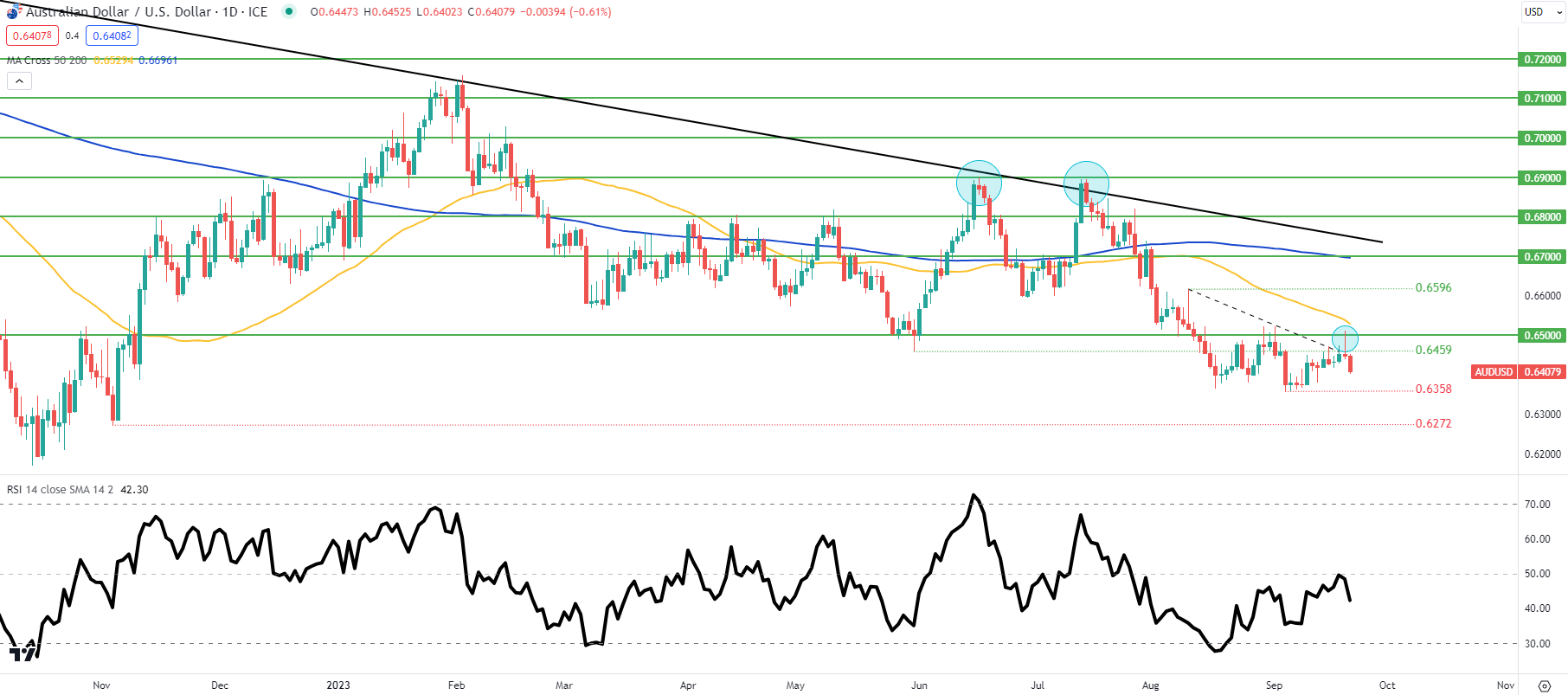

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, TradingView

Daily AUD/USD price action above shows Aussie bulls respectful of the medium-term trendline resistance (dashed black line) after levels breached the 0.6500 psychological handle yesterday. The candle subsequently closed with a long upper wick (blue), suggestive of impending downside to come. Subsequent support zones could be under threat if markets buy into the Fed’s ‘higher for longer’ stance.

Key resistance levels:

- 50-day moving average (yellow)

- 0.6500

- Trendline resistance

- 0.6459

Key support levels:

IG CLIENT SENTIMENT DATA: BEARISH (AUD/USD)

IGCS shows retail traders are currently net LONG on AUD/USD, with 81% of traders currently holding long positions. Download the latest sentiment guide (below) to see how daily and weekly positional changes affect AUD/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0