AUD/USD Charts Bullish Technical Setup as USD/JPY Defies Channel Resistance

Trade Smarter – Sign up for the DailyFX Newsletter Receive timely and compelling market commentary from the DailyFX team Subscribe to Newsletter AUD/USD TECHNICAL ANALYSIS AUD/USD retreated on Wednesday, dragged down by the Fed’s hawkish monetary policy outlook, but continued to carve out a double bottom, a reversal technical formation typically symptomatic of a waning

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

AUD/USD TECHNICAL ANALYSIS

AUD/USD retreated on Wednesday, dragged down by the Fed’s hawkish monetary policy outlook, but continued to carve out a double bottom, a reversal technical formation typically symptomatic of a waning selling pressure that often precedes a sustained recovery in the underlying asset.

To elaborate further, a double bottom is a pattern characterized by two comparable troughs separated by a peak in the middle, normally observed within the context of a prolonged downtrend. Confirmation of this bullish configuration occurs when the price completes the “W” shape and breaches resistance at the neckline, marked by the intermediate crest.

Examining the daily chart presented below, neckline resistance can be seen in the 0.6500/0.6510 range. Successfully piloting above this ceiling could reinforce buying impetus, opening the door to a move to 0.6600.

Conversely, if sentiment shifts in favor of the bears and leads to a selloff, initial support is situated at 0.6360. While AUD/USD might find a foothold in this area during a pullback, a breakdown might precipitate an outsize slump, paving the way for a drop toward 0.6275, at which point the double bottom would be no longer valid.

Take your trading skills up a notch. Uncover opportunities in AUD/USD, with a holistic strategy that integrates insights from fundamental and technical analysis. Don’t miss out on your free quarterly guide!

Recommended by Diego Colman

Get Your Free AUD Forecast

AUD/USD TECHNICAL CHART

AUD/USD Technical Chart Prepared Using TradingView

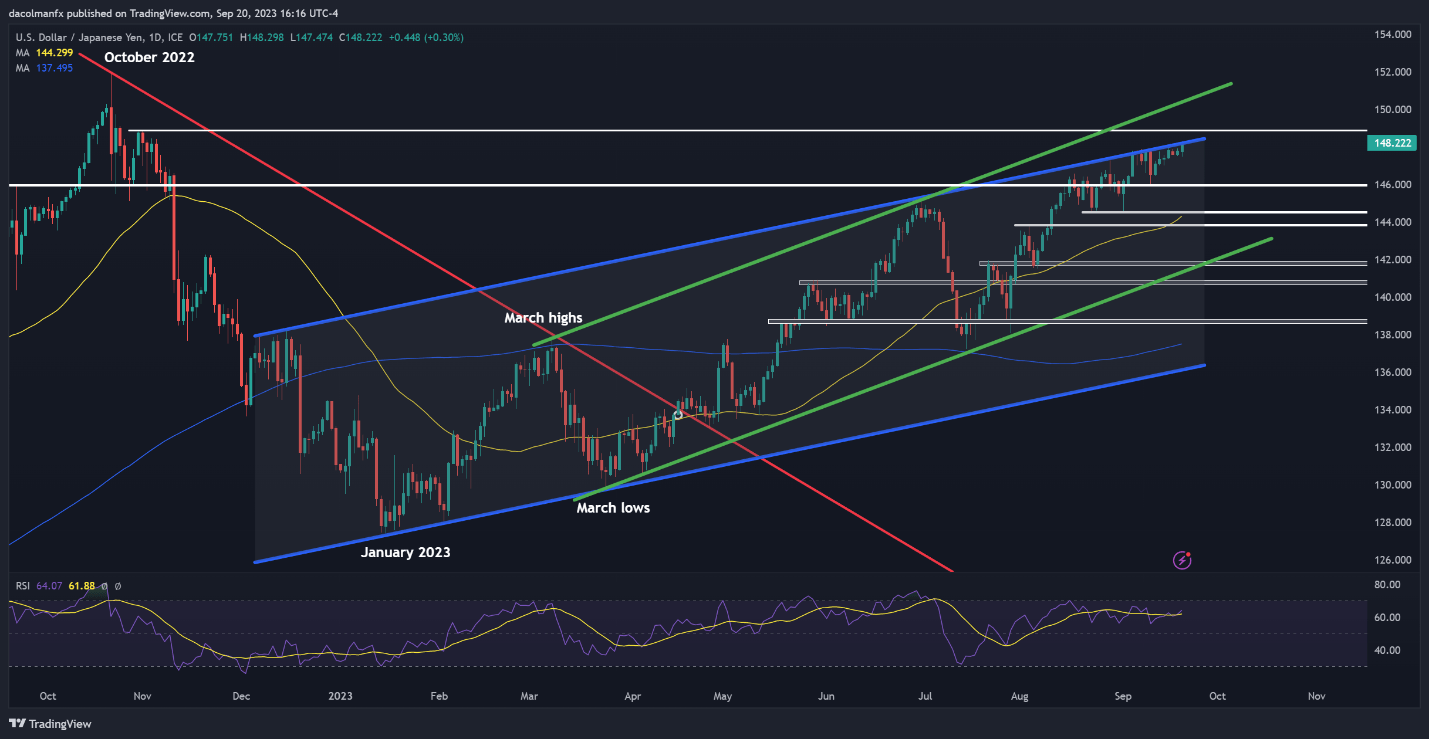

USD/JPY TECHNICAL ANALYSIS

USD/JPY fell at the onset of the previous week, but promptly encountered support just above the psychological 146.00 level. This resilience paved the way for a rapid rebound in the subsequent trading sessions, with the pair steadily climbing in recent days, seemingly intent on capturing the 148.00 handle once and for all.

Over the course of this month, USD/JPY has failed to clear the 148.00 threshold decisively. Every concerted effort made by the bullish camp to take out this barrier has been met with steadfast rejection, indicating the presence of a substantial number of sellers in this region. That said, a similar outcome may play out on a retest, but a rally towards 148.80 could unfold on a breakout, followed by a climb to 150.00.

Taking the opposite side, if U.S. dollar sentiment takes a bearish turn and gives way to meaningful pullback, initial support appears at 145.90. On further weakness, the focus shifts to 144.55 and 143.85 thereafter. It’s worth highlighting, however, that the bearish outlook could face substantial hurdles, especially in the context of the Federal Reserve’s hawkish posture.

Improve you trading acumen and get an edge in the Forex space. Secure your copy of the yen’s outlook today for exclusive insights into the key risk factors influencing the market!

Recommended by Diego Colman

Get Your Free JPY Forecast

USD/JPY TECHNICAL CHART

USD/JPY Chart Prepared Using TradingView

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰