USD/JPY KEY POINTS

- The U.S. dollar, as measured by the DXY index, gains on soaring yields, boosting USD/JPY to its higher level since November 2022

- The fundamental picture remains negative for the Japanese yen against the U.S. currency

- This article discusses the main technical levels of the USD/JPY pair that Forex traders should be aware of in the coming days.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: Silver, Gold Price Forecast – Market Trend Hinges on Data, Key Levels in XAU/USD

The U.S. dollar index soared to a six-month peak on Tuesday (104.90) on the back of a strong advance in U.S. government rates. Against this backdrop, USD/JPY (U.S. dollar – Japanese yen) staged a solid rally, rising around 0.8% to 147.65 in early afternoon trading in New York, hitting its highest level since November 2022 and coming within striking distance from clearing a key ceiling located just a touch below the 148.00 handle.

The predominant driving force behind the U.S. dollar’s bullish momentum since mid-July has been the surge in yields. Although the Fed’s pledge to “proceed carefully” may put a lid on this uptrend, the resilience of the U.S. economy and surging oil prices will likely ensure rates remain elevated across the curve for the foreseeable future, putting upward pressure on USD/JPY.

Elevate your trading game. Download the “How to Trade USD/JPY” guide to unlock key insights and strategies!

Recommended by Diego Colman

How to Trade USD/JPY

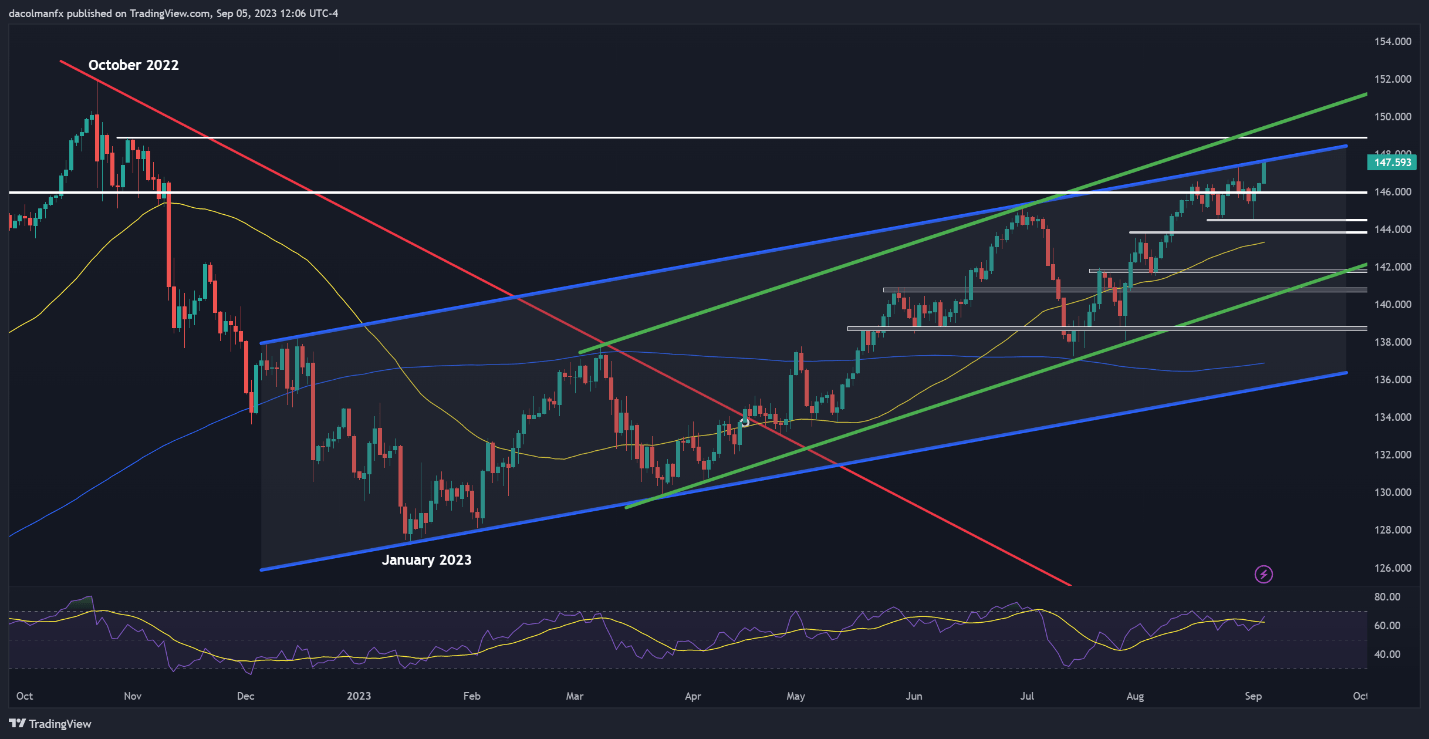

From a technical standpoint, USD/JPY briefly dipped toward 144.55 late last week, but was ultimately repelled to the upside, with buyers reclaiming decisive control of the market following the support rejection. The pair has since gained additional ground, as shown in the chart below, where prices are seen steadily progressing toward the channel resistance at 147.75.

In terms of possible scenarios, successfully piloting above the 147.75 barrier could reinforce buying impetus, setting the stage for a rally toward 149.00. On further strength, we could see a climb towards the psychological 150.00 level. In case of setback and bearish reversal, initial support appears at 146.00, followed by 144.55. Further down the line, the next area of interest is located at 143.85.

Gain confidence and stay ahead of USD/JPY trends. Download the sentiment guide to understand how market positioning can offer clues about price action.

| Change in | Longs | Shorts | OI |

| Daily | -12% | 6% | 2% |

| Weekly | 2% | 8% | 7% |

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Using TradingView

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0