FTSE 100, DAX 40, CAC 40 Track Asia Higher

Article by IG Senior Market Analyst Axel Rudolph FTSE 100, DAX40, CAC 40 Analysis and Charts FTSE 100 begins the week on a positive note The FTSE 100 extends its gains following a positive session in Asia on growing expectations that the Federal Reserve (Fed) won’t continue to hike its rates. The UK blue chip

Article by IG Senior Market Analyst Axel Rudolph

FTSE 100, DAX40, CAC 40 Analysis and Charts

FTSE 100 begins the week on a positive note

The FTSE 100 extends its gains following a positive session in Asia on growing expectations that the Federal Reserve (Fed) won’t continue to hike its rates.

The UK blue chip index is expected to overcome last week’s high at 7,510 with the 10 August high and 200-day simple moving average (SMA) at 7,624 to 7,641 representing the next technical upside targets for the days and weeks to come. This bullish scenario will remain intact as long as Thursday’s low at 7,419 underpins on a daily chart closing basis.

Support above this low can be seen along the one-month uptrend line at 7,455.Intraday support can be found slightly higher up along the 55-day simple moving average (SMA) at 7,481.

FTSE 100 Daily Chart

Download the Updated FTSE 100 IG Client Sentiment Report

| Change in | Longs | Shorts | OI |

| Daily | 9% | -7% | 4% |

| Weekly | -18% | 22% | -8% |

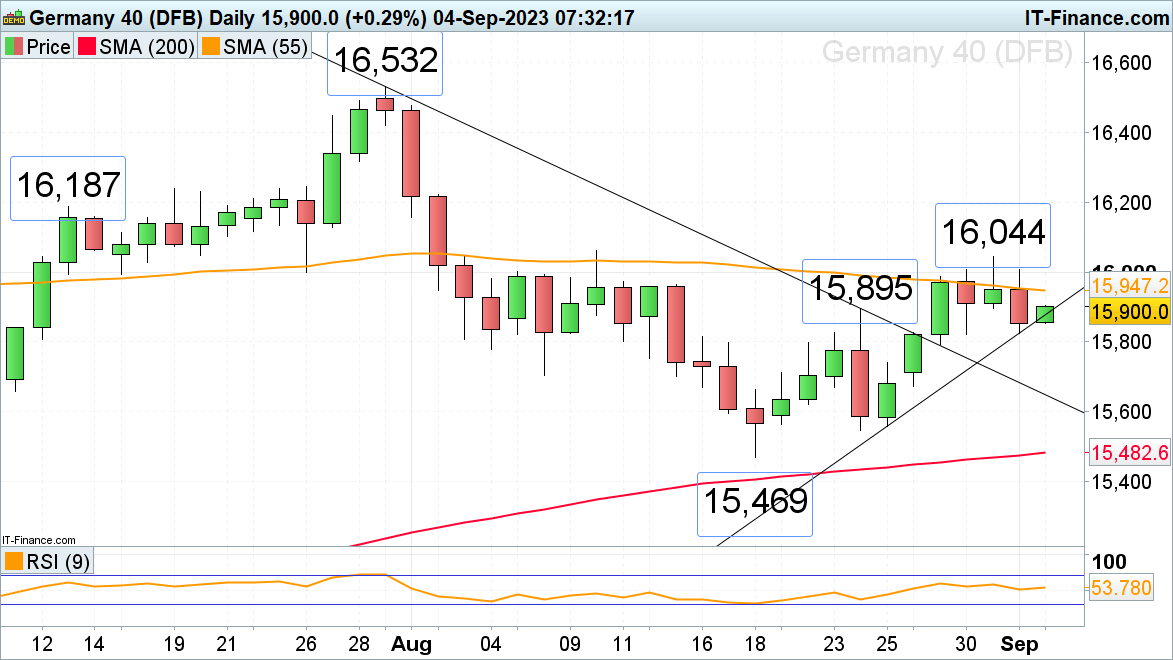

DAX 40 expected to regain Friday’s losses

The DAX 40, despite its second consecutive weekly close in the green, declined last week following last week’s European and US cooling employment data. While Friday’s low at 15,824 holds on a daily chart closing basis, the 55-day simple moving average (SMA) at 15,947 is to be revisited. Above it beckon last week’s high at 16,044 and the 10 August high at 16,062. These highs need to be exceeded for a medium-term bullish reversal to occur.

Minor support comes in at the 24 August 15,895 high and more significant support between Friday’s and Wednesday’s lows at 15,824 to 15,821. Further support comes in along the breached one-month resistance line, now because of inverse polarity a support line, at 15,650.

DAX 40 Daily Chart

Recommended by IG

Trading Forex News: The Strategy

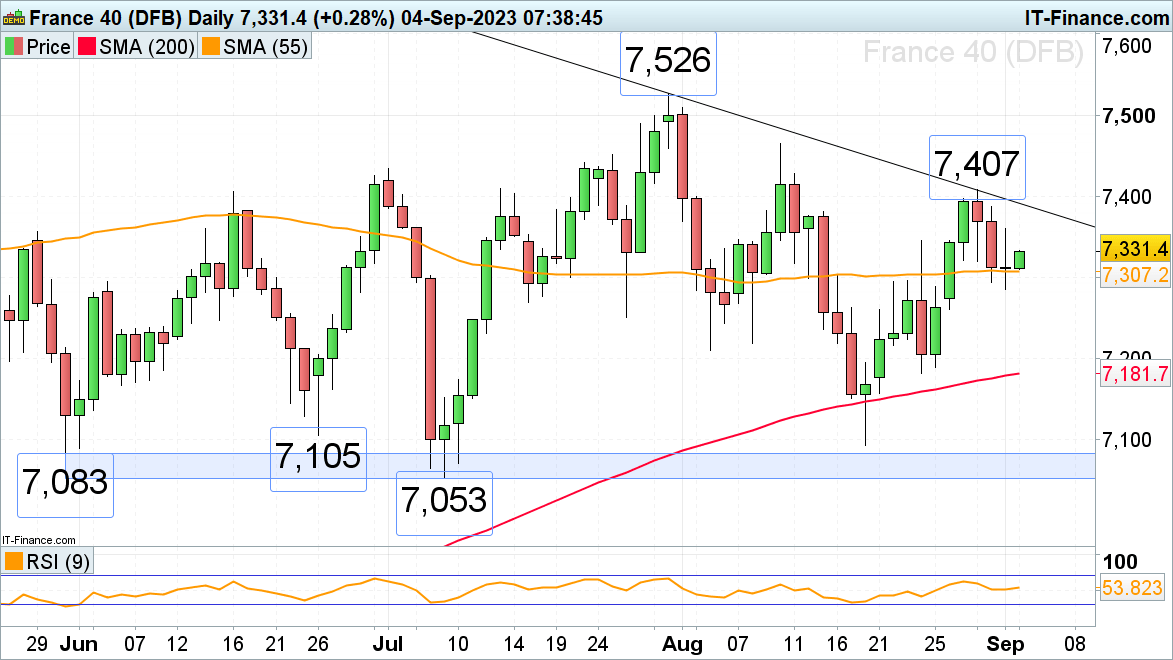

CAC 40 recovers from last few days’ of losses

The CAC 40 will likely attempt to break last week’s three-day losing streak whilst tracking Asian stock indices higher. These got a boost as hopes of more China stimulus, this time a relaxation on restrictions in buying property,lifted the Hang Seng and other markets in Asia. Trading will probably be light, though, as the US will be shut for Labor Day.

While the 55-day simple moving average (SMA) at 7,307 holds, the 24 August high at 7,345 may be revisited ahead of the August-to-September downtrend line at 7,392. For this short-term bullish scenario to play out, Friday’s low at 7,286 will need to hold, though. Should it not, the late July low at 7,251 may be revisited.

CAC 40 Daily Chart

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰