EUR/USD ANALYSIS

- German balance of trade data echoes growth fears.

- ECB officials under the spotlight today.

- Long wick candle indicative of more downside to come.

Recommended by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

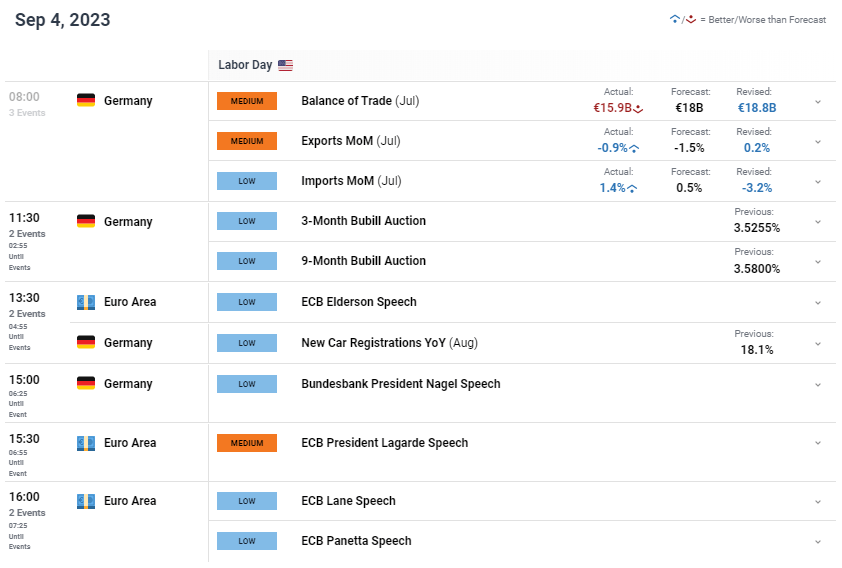

The euro is marginally bid this Monday morning after last week’s Non-Farm Payroll (NFP) report saw markets rally behind the US dollar. Today’s volumes are likely to be relatively tame with the US and Canada celebrating Labor Day. That being said, the euro area has several potentially market moving events scattered throughout the day beginning with German balance of trade which showed exports slowing (see economic calendar below), highlighting economic growth concerns for the Eurozone’s largest economy. The result was a reduction in balance of trade numbers to €15.9B.

Central bank speakers will be the focal point for today with European Central Bank (ECB) Speakers scheduled to speak including President Christine Lagarde. Over the weekend, the ECB’s Wunsch reiterated a hawkish stance and it will be interesting to see whether or not today’s addresses follow a similar viewpoint.

EUR/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

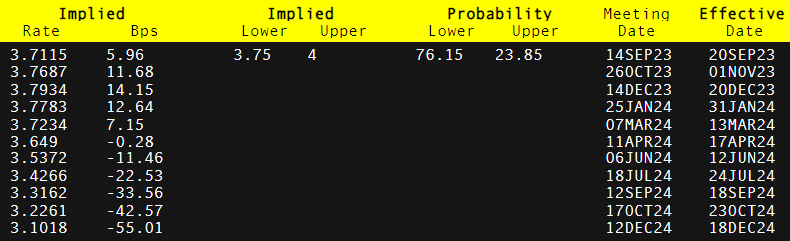

This may be the last chance for the ECB to hike rate in what is a slowing EZ economy in the September meeting but it seems as if market pricing favors a pause (refer to table below) with a +/-76% probability.

ECB INTEREST RATE PROBABILITIES

Source: Refinitiv

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL ANALYSIS

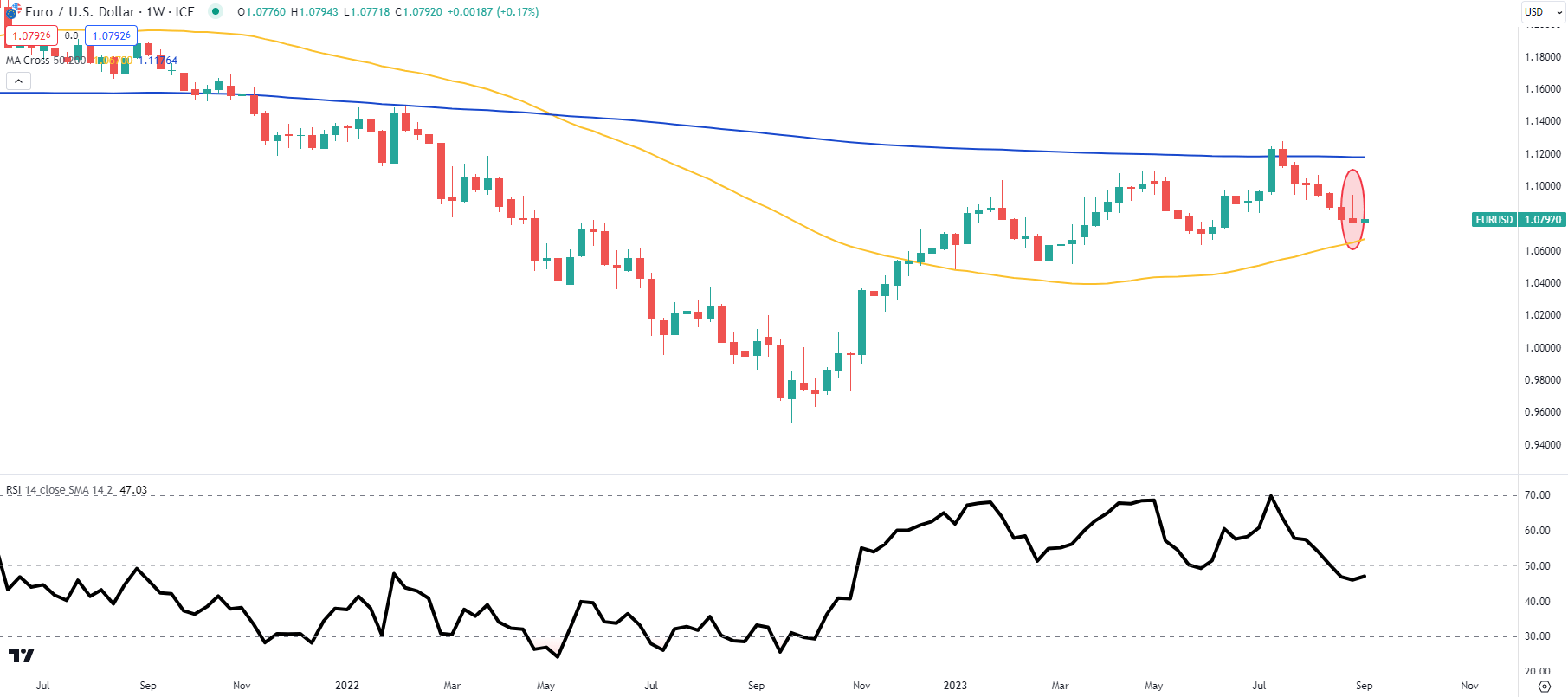

EUR/USD WEEKLY CHART

Chart prepared by Warren Venketas, IG

The weekly EUR/USD above is currently sandwiched between the 50-week moving average (yellow) and 200-week moving average (blue) with the prior week’s candle closing with a long upper wick (red). Traditionally, this would point to subsequent downside to come and could coincide with a weekly close below the 50-week MA.

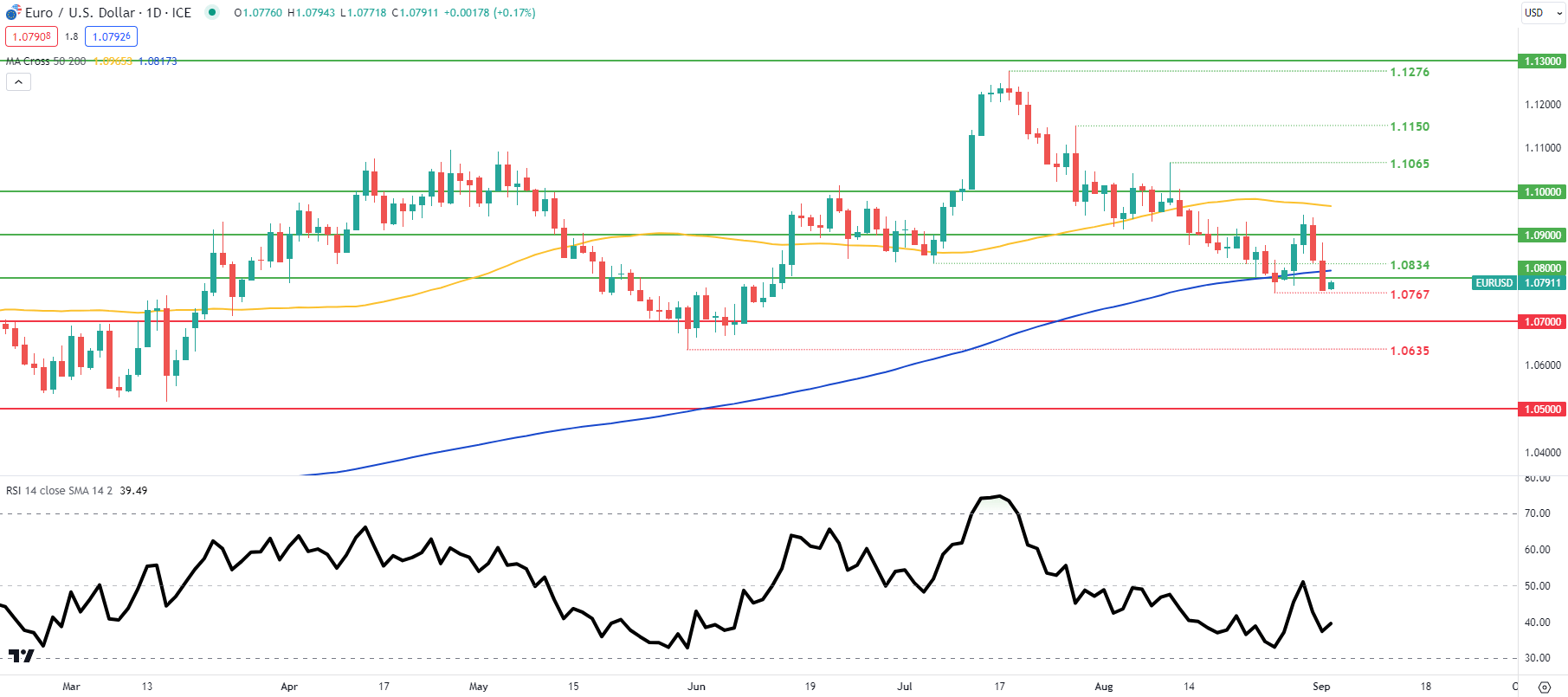

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Shorter-term daily EUR/USD price action remains below the 1.0800 psychological handle with bears eyeing the 1.0767 swing low.

Resistance levels:

- 1.0834

- 200-day moving average (blue)

- 1.0800

Support levels:

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently neither NET LONG on EUR/USD, with 71% of traders currently holding long positions (as of this writing). Download the latest sentiment guide (below) to see how daily and weekly positional changes affect EUR/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0