Japanese Yen, USD/JPY, Double Top – Technical Update:

- Japanese Yen making a U-turn against the US Dollar

- Is this the beginning of a broader USD/JPY reversal?

- Double Top chart pattern in focus on the 4-hour

Recommended by Daniel Dubrovsky

Get Your Free JPY Forecast

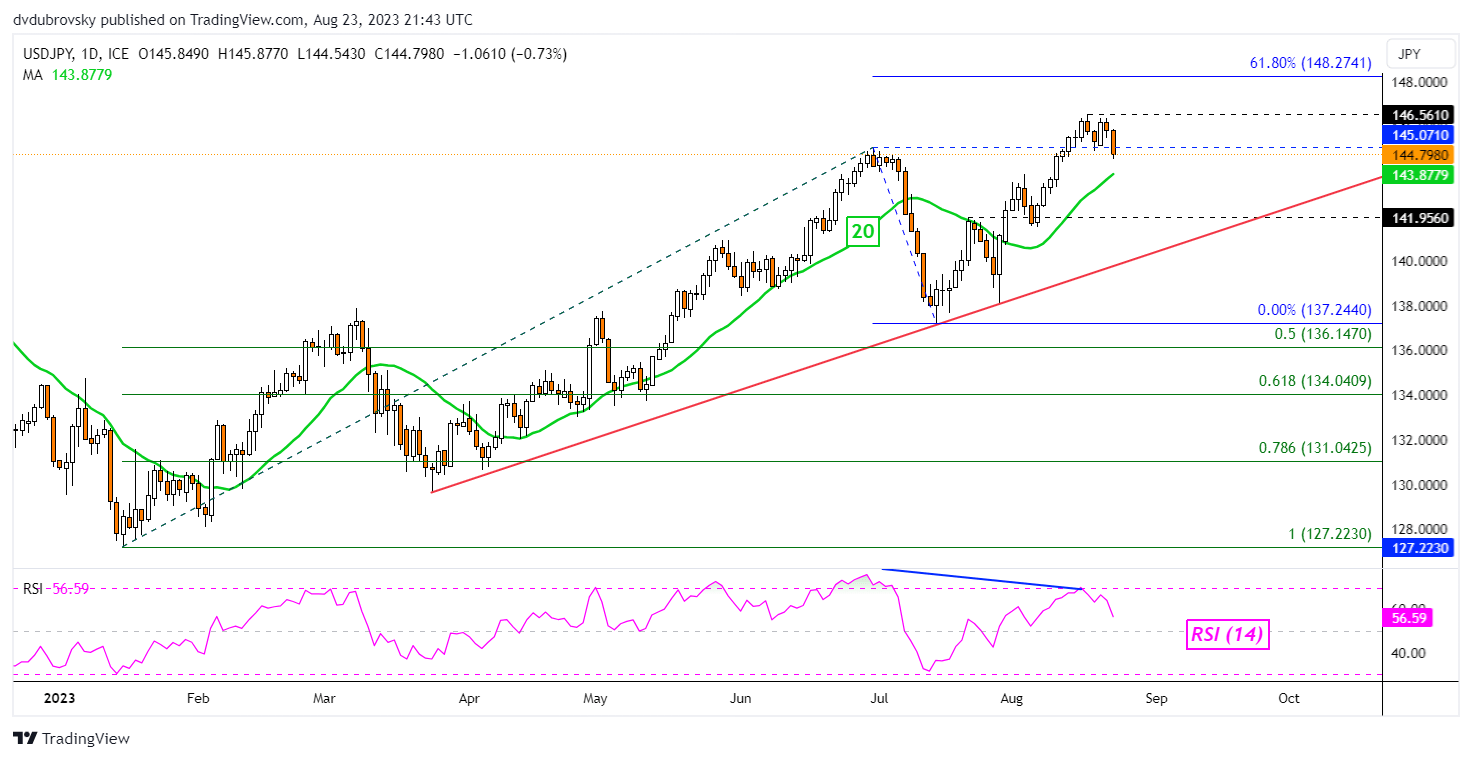

The Japanese Yen might be showing early warning signs that the currency might be getting ready to reverse against the US Dollar. Over the past 24 hours, USD/JPY broke under the 145.07 inflection point that was established in late June. This followed the presence of negative RSI divergence showing fading upside momentum.

That can at times precede a turn lower. Now, recent losses have exposed the 20-day Moving Average (MA) as immediate support. This line may reinstate the near-term upside focus. Otherwise, confirming a breakout below opens the door to extending losses. Still, keep in mind that the rising trendline from March is maintaining the broader bullish technical bias.

Chart Created in TradingView

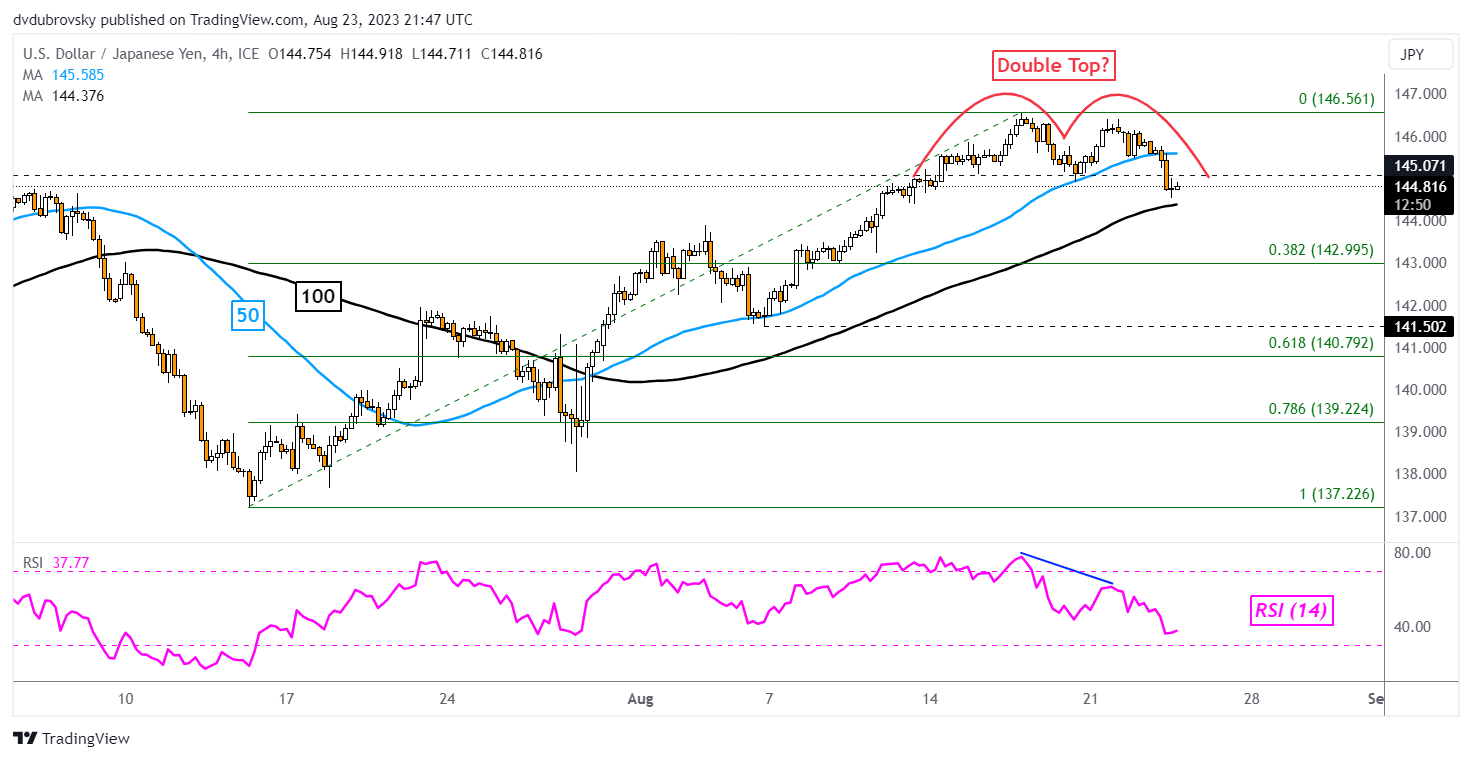

Zooming in on the 4-hour chart reveals that a Double Top chart pattern appears to be in play. Prices have closed under the neckline of around 145.07, and this also followed the emergence of negative RSI divergence. Confirmation is lacking at the time of publishing, but immediate support is the 100-period Moving Average on this timeframe.

Breaking under the line may open the door to extending losses that the Double Top could be insinuating. That places the focus on the 38.2% Fibonacci retracement level of 142.99 before the current August low of 141.50 comes into focus. Otherwise, closing above 146.56 opens the door to extending gains towards the 61.8% Fibonacci extension level of 148.27 seen on the daily chart above.

Recommended by Daniel Dubrovsky

How to Trade USD/JPY

Chart Created in TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0