Rand (ZAR) Firms as BRICS Summit Kicks Off

[ad_1] USD/ZAR OUTLOOK: USD/ZAR Retreats Toward Support at the 18.71 Handle as BRICS Summit Gets Underway, SA Inflation Data Ahead. BRICS Bloc Has a Lot to Overcome Before Any Idea of a Single Currency Becomes Realistic. The South African Rand is in Good Stead for a Continued Recovery as Attention Turns to the Jackson Hole

[ad_1]

USD/ZAR OUTLOOK:

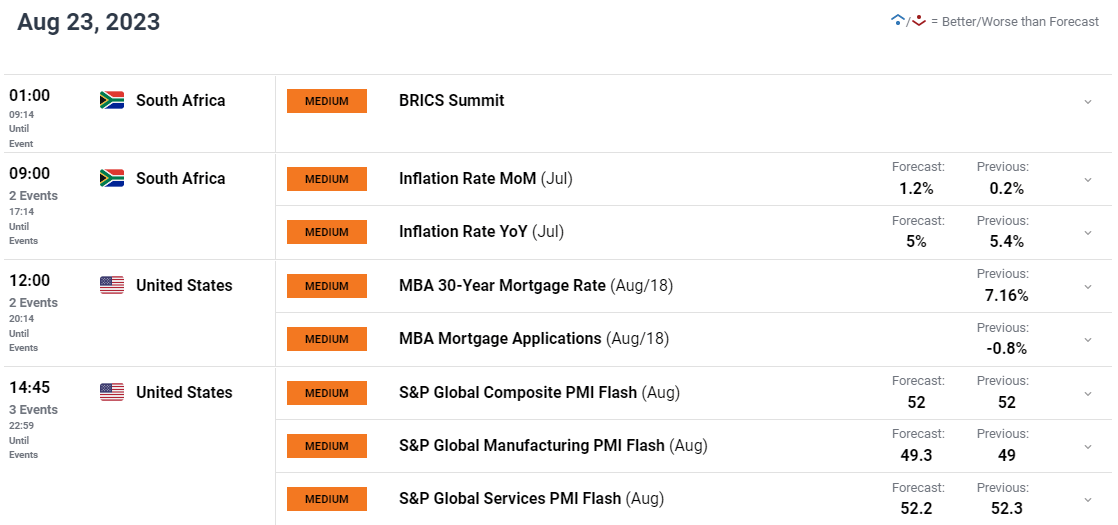

- USD/ZAR Retreats Toward Support at the 18.71 Handle as BRICS Summit Gets Underway, SA Inflation Data Ahead.

- BRICS Bloc Has a Lot to Overcome Before Any Idea of a Single Currency Becomes Realistic.

- The South African Rand is in Good Stead for a Continued Recovery as Attention Turns to the Jackson Hole Symposium.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Get Your Top Trade Opportunities from the DAILYFX Team Free Down Below

Recommended by Zain Vawda

Get Your Free Top Trading Opportunities Forecast

MOST READ: Gold (XAU/USD) Rally Gathers Pace but 200-Day MA Could Cap Gains

The South African Rand (ZAR) has been enjoying an excellent run of late, up around 1.20% against the Greenback at the time of writing. The beginning of the 2023 BRICS summit has coincided with a pause in the US Dollars recent rally have certainly helped the ZAR to arrest its slide which began at the end of July.

BRICS SUMMIT AND IMPROVING ECONOMIC CONDITIONS

The BRICS Summit which became a hot topic a few weeks ago amid rumors that Russian President Vladimir Putin would be attending, given the international arrest warrant against the Russian President. The Bloc which consists of Russia, China, India, Brazil and South Africa are looking to expand their global influence. The countries mentioned do account for around 40% of the global population as well 25% of global GDP.

The lead up to the event has been dominated by chatter around expanding the Bloc as well as a potential currency, a rumor which gained traction following comments by Brazilian leaders. However, the agenda will apparently focus on expanding the Bloc as well as increasing trade in local currency. Market participants and enthusiasts had been discussing the topic of de-dollarisation for some time, with a potential BRICS currency gaining popularity. The truth is another story altogether as there are many obstacles which would need to be overcome for a potential ‘BRICS Currency’, not to mention the time to implement such a widespread and intricate idea. The Challenges for the BRICS Bloc lie internally with China and India, arguably two of the largest players at loggerheads for years over a disputed and shared border. India also has historically had an excellent relationship with Western nations and the US in particular adding further challenges for the Bloc.

In regard to a proposed expansion of the Bloc we have heard different tales regarding the number and composition of countries looking to join BRICS. Among the names mooted are African counterparts Algeria, Morocco as well as more surprising ones such as Saudi Arabia and Iran. The proposed expansion is supported by South Africa, China and Russia with India and Brazil the outliers at present. Brazil is concerned that an expansion may limit its powers within the Bloc while India remains concerned about the growing dominance of China and remain cautious around rushing expansion. India’s Foreign Secretary Vinay Kwatra however did stress that India is positive and open-minded heading into the summit.

This gives a glimpse into the challenges around a potential BRICS currency as Member States have proven that they all have differing goals and expectations which could hinder the progress and power of the BRICS Bloc.

The South African Economy for its part has remained resilient and showed signs of improvement of late. A large part of this has to with a decrease in loadshedding which has had a broader impact on supply chains and helped lower inflation of late. This was a key point to growth as outlined by SA Reserve Bank Governor Lesetja Kganyago when the Central Bank provided its most recent forecasts.

Trading Requires Constant Improvement, See What Traits Successful Traders Share and Download the Guide Below

Recommended by Zain Vawda

Traits of Successful Traders

JACKSON HOLE AND US DOLLAR RISK

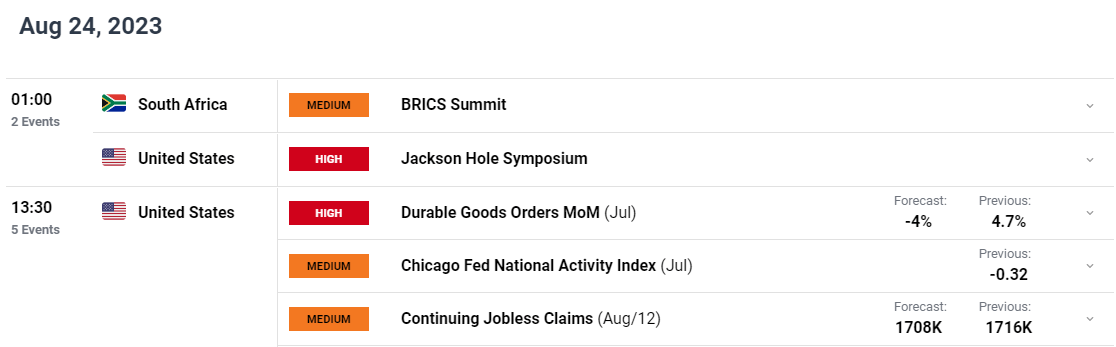

It is interesting that we have the BRICS summit this week which will overlap with the Jackson Hole Symposium which will play host to Central Bankers from the G7. Last year the symposium focused on the growing challenge of inflation and the impact saw volatility and fireworks across markets, something Central Bankers would like to avoid this time around. The reason I say this is given the recent uncertainty around China and further downgrade to US Banks by S&P Global yesterday, we could see a more cautious and pragmatic approach from Central Banks.

The US Dollar continues to surprise at the minute supported by the rise in US yields as well as some safe haven demand. Despite a strong resurgence in the US session today following a bout of weakness in the European and Asian sessions the ZAR has managed to hold onto its gains which is a huge positive. Dollar weakness will come in at some stage with Fed Chair Powell potentially springing a dovish surprise at Jackson Hole which could assist the ZAR and see a return toward the 17.50 mark.

For all market-moving economic releases and events, see the DailyFX Calendar

FINAL THOUGHTS AND TECHNICAL OUTLOOK

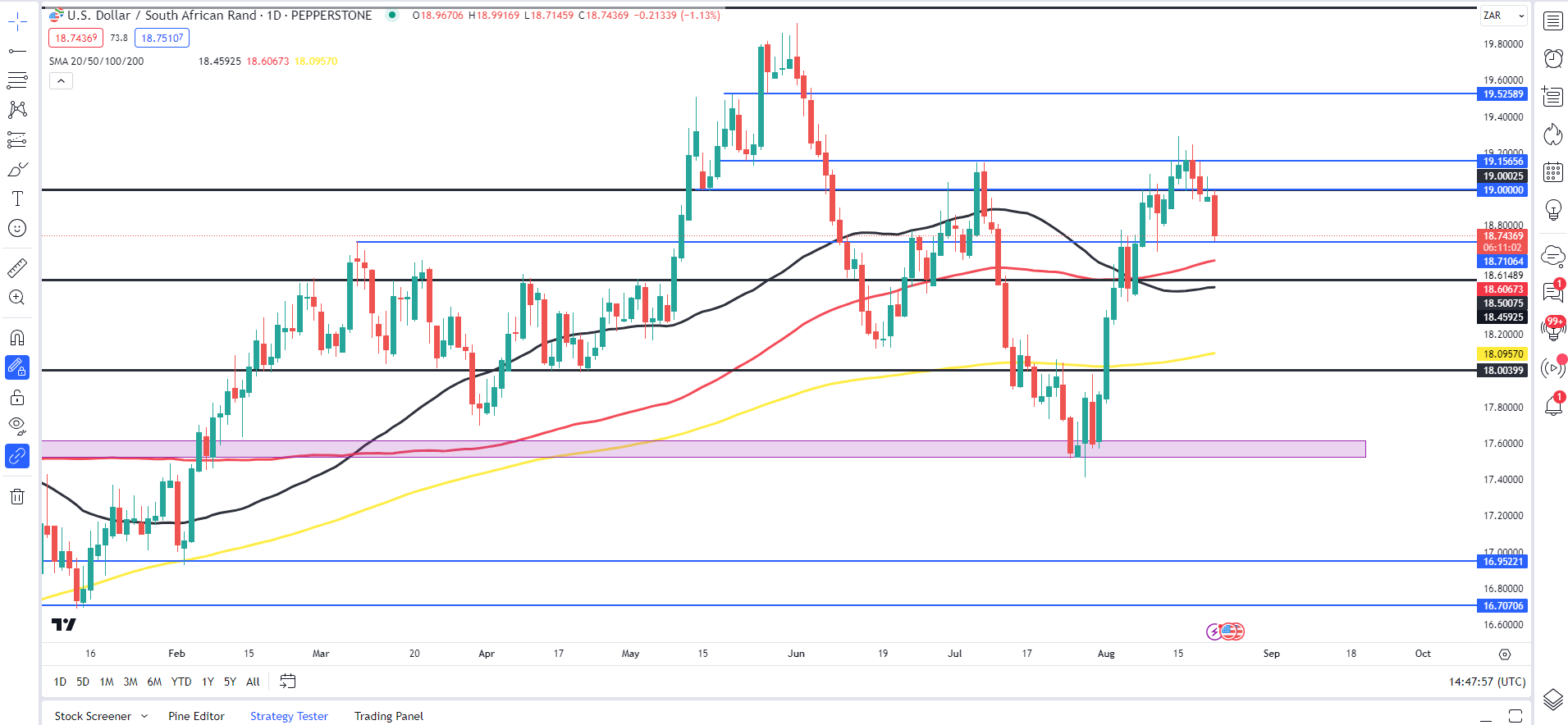

USDZAR from a technical standpoint has always fascinated me as we tend to trend for a sustained period of time. Looking back historically and trends seem to run for 3-4 months at a time before we see a significant change in the overall trend of the pair. This is something which has continued this year with the upside rally beginning on February 2 from the lows around the 16.9200 mark all the way to the 19.9200 mark on June 1.

USDZAR had been on extended upside rally since the end of July helped in large part by a resurgent US Dollar and a weakening economic outlook from China. The last 5 days or so has seen a noticeable shift as despite the Dollar remaining firm and US Yields rising the ZAR has put in impressive gains.

Looking ahead and support to the downside is provided by the 50 and 100-day MA resting around the 18.60 and 18.45 handles respectively with a candle close below opening up a retest of the psychological 18.00 mark. This area also lines up with the 200-day MA and could prove a tough nut to crack for ZAR bulls.

Alternatively, a move higher here will need to close convincingly above the 19.15-19.20 resistance area before any potential of making a run for the 20.00 mark. All in all, as things stand the downside appears more realistic but a surprise by Fed Chair Powell could see USDZAR rekindle its upside momentum and make a run for the coveted 20.00 mark.

USD/ZAR Daily Chart, August 22, 2023

Source: TradingView, Prepared by Zain Vawda

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0