Stock Indices Continue to Slide on China Growth Worries and Bank Downgrades

[ad_1] FTSE, DAX and S&P 500 News and Analysis FTSE 100 slips despite UK inflation diminishing DAX 40 remains under pressure S&P 500 drops to new one-month low as Fitch joins Moody’s with warning to banks Written by IG Senior Analyst Axel Rudolph Recommended by IG Get Your Free Equities Forecast FTSE 100 slips despite

[ad_1]

FTSE, DAX and S&P 500 News and Analysis

- FTSE 100 slips despite UK inflation diminishing

- DAX 40 remains under pressure

- S&P 500 drops to new one-month low as Fitch joins Moody’s with warning to banks

Written by IG Senior Analyst Axel Rudolph

Recommended by IG

Get Your Free Equities Forecast

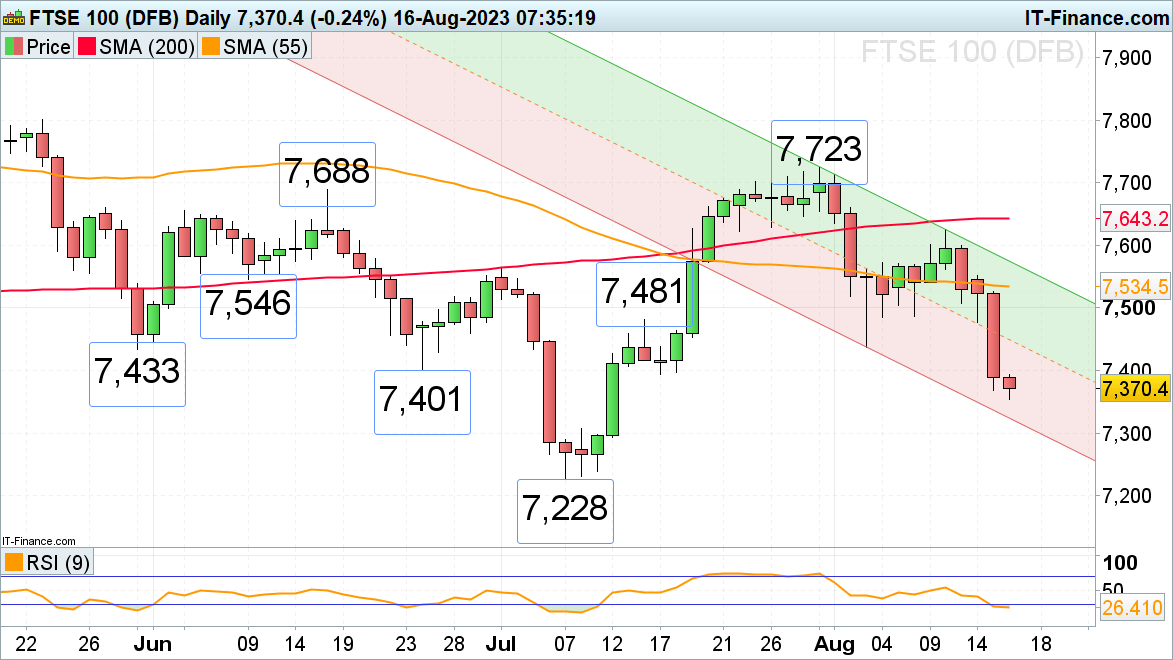

FTSE 100 slips despite UK inflation diminishing

Following on from Tuesday’s sharp falls, the FTSE 100 continues to slide despite UK inflation dropping to levels last seen in February 2022 and matching market consensus at 6.8% in July, driven by falling gas and electricity prices.

The UK blue-chip index is now trading in one-month lows and is fast approaching its 7,228 July trough. En route minor support may be found around the 10 July high at 7,307.

Immediate resistance can be spotted at the 7,394 mid-July low and more significant resistance between the May and early August lows at 7,433 to 7,437.

Source: IG

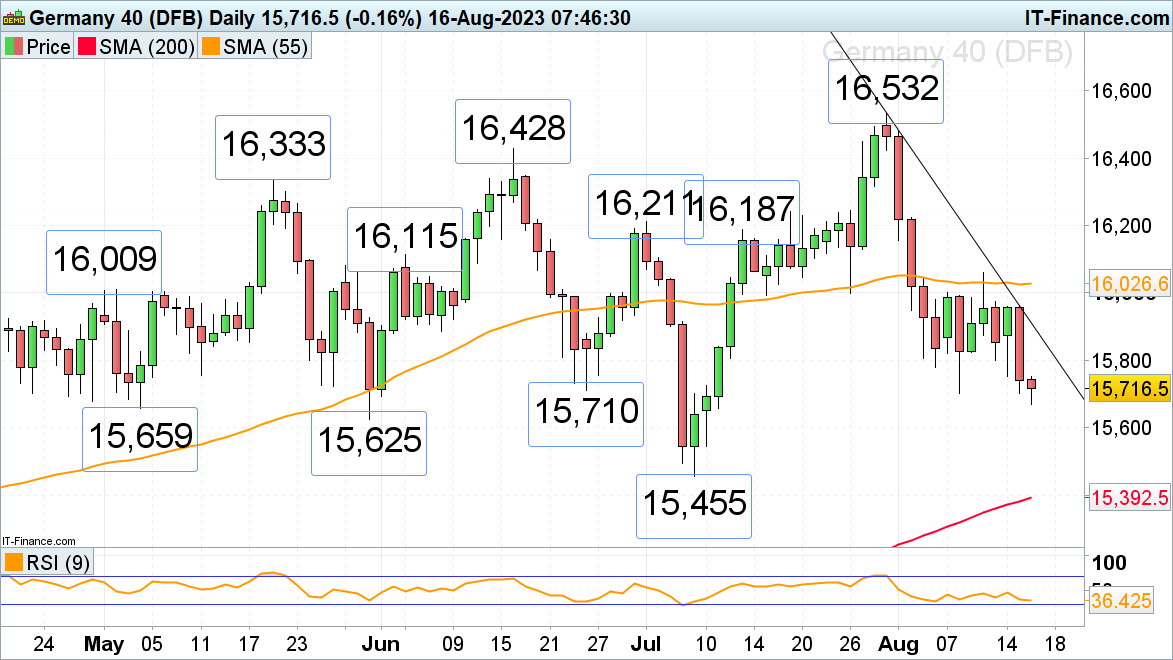

DAX 40 remains under pressure

The DAX 40’s slide on China growth worries and possible downgrades of major banks by the ratings agency Fitch is ongoing with the index trading in one-month lows and flirting with the June trough at 15,710.

The next lower early and late May lows at 15,659 to 15,625 may soon be reached but could offer support. If not, the July trough at 15,455 would be back in the frame.

Minor resistance can be found around the 4 August low at 15,780 and more important resistance along the July-to-August downtrend line at 15,912. While the index remains below the next higher 16,062 high seen last week, overall downside pressure should dominate.

Source: IG

Learn how to approach trending markets in our dedicated guide below:

Recommended by IG

The Fundamentals of Trend Trading

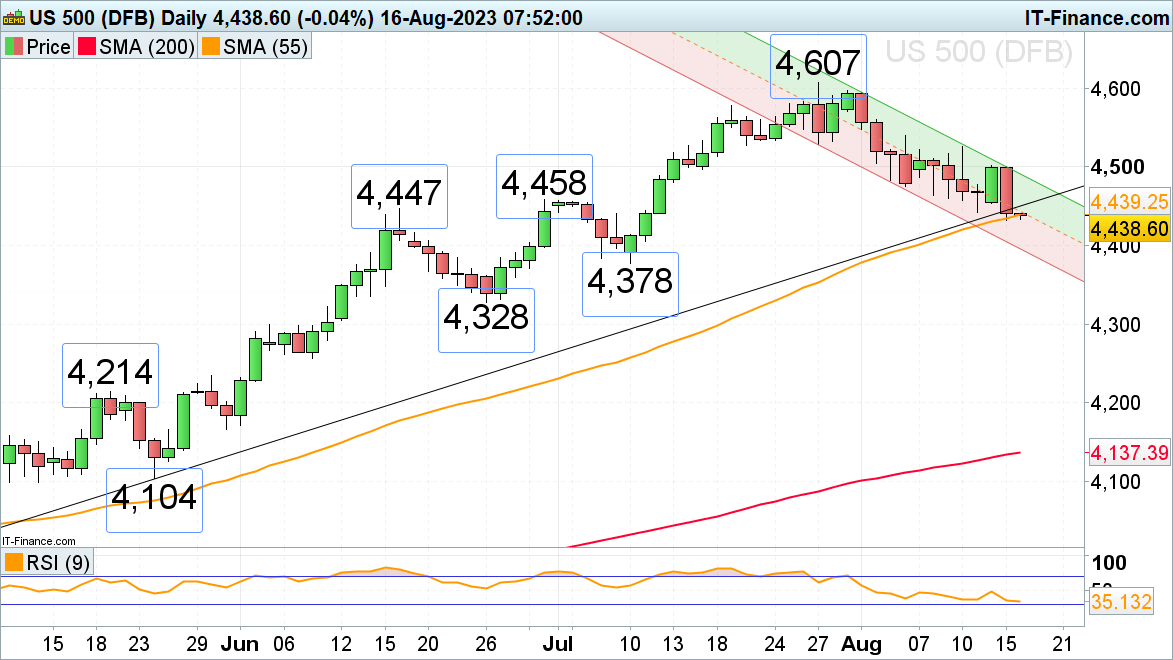

S&P 500 drops to new one-month low

Worries about lacklustre China growth and major US investment banks such as JPMorgan possibly being downgraded by Fitch have pushed the S&P 500 to a new one-month low.

The index also slipped through and closed below its March-to-August uptrend line at 4,450 and reached the 55-day simple moving average (SMA) at 4,439 which may offer short-term support.

If slipped through on a daily chart closing basis, however, the July low at 4,378 should be next in line.

Resistance above the breached six-month uptrend line, now because of inverse polarity a resistance line, can be spotted between the June to July highs at 4,447 to 4,458. While no rise above the next higher 4,526 high – seen last week – occurs, the S&P 500 should retain its short-term bearish bias.

Source: IG

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0