Recovery prods 0.6500 after RBA Minutes, Australia/China statistics

[ad_1] Share: AUD/USD picks up bids to refresh intraday high, reverses from YTD low. Mixed RBA Minutes, softer Aussie wage growth and downbeat China data prod Aussie bulls but US Dollar’s retreat favor recovery. Oversold RSI challenges Aussie bears beyond 0.6460-55 support zone. Multiple hurdles stand tall to test upside; 0.6600 appears the

[ad_1]

- AUD/USD picks up bids to refresh intraday high, reverses from YTD low.

- Mixed RBA Minutes, softer Aussie wage growth and downbeat China data prod Aussie bulls but US Dollar’s retreat favor recovery.

- Oversold RSI challenges Aussie bears beyond 0.6460-55 support zone.

- Multiple hurdles stand tall to test upside; 0.6600 appears the key resistance.

AUD/USD recaptures the 0.6500 round figure while extending the early Asian session rebound from the lowest level since November 2022 amid the Tuesday morning in Europe.

The Aussie pair dropped to the lowest levels in 2023 the previous day after broad risk aversion drowned the risk barometer.

However, the recently mixed headlines from the Reserve Bank of Australia’s (RBA) Minutes of its August monetary policy meeting and the top-tier data from Australia, as well as China, allowed the traders to print a corrective bounce from the 0.6460-55 support zone comprising lows marked in late May and the previous day.

Also read: AUD/USD remains below 0.6500 mark after softer Chinese macro data, seems vulnerable

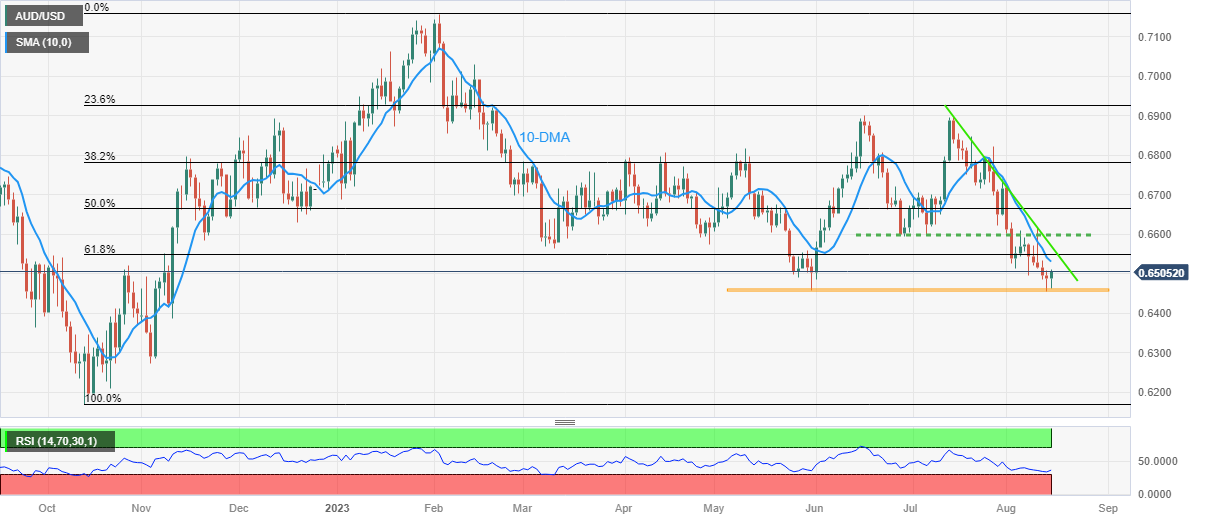

Technically, the failure to provide a daily closing beneath 0.6458 joined the nearly oversold RSI conditions to trigger the AUD/USD pair’s latest rebound.

That said, the 10-DMA level of 0.6530 precedes the 61.8% Fibonacci retracement of October 2022 to February 2023 upside, near 0.6550, to restrict a short-term recovery of the Aussie pair.

Following that, a one-month-old descending resistance line and lows marked in June, as well as early July, respectively near 0.6570 and 0.6600, will be crucial to watch for the AUD/USD buyers to retake control.

On the flip side, a daily closing beneath the 0.6460-55 support area could quickly drag the quote to a September 2022 low of near 0.6365 ahead of highlighting the late 2022 bottom of around 0.6170 for the AUD/USD bears.

AUD/USD: Daily chart

Trend: Limited recovery expected

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :AUDUSD ، AustraliaChina ، China ، macroeconomics ، Minutes ، prods ، RBA ، Recovery ، Statistics ، Technical analysis

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0