Japanese Yen (JPY) Clobbered To New ’23 Lows; Skirts ‘Intervention Zone’

[ad_1] Japanese Yen (USD/JPY) Analysis and Charts USD/JPY Posts new 2023 high as risk aversion, yield differentials boost the Dollar Key 145 region now in play The Bank of Japan bought Yen above this point in 2022 Learn How to Trade USD/JPY Below Recommended by David Cottle How to Trade USD/JPY The Japanese Yen weakened

[ad_1]

Japanese Yen (USD/JPY) Analysis and Charts

- USD/JPY Posts new 2023 high as risk aversion, yield differentials boost the Dollar

- Key 145 region now in play

- The Bank of Japan bought Yen above this point in 2022

Learn How to Trade USD/JPY Below

Recommended by David Cottle

How to Trade USD/JPY

The Japanese Yen weakened further against the United States Dollar as a new trading week kicked off on Monday, taking USD/JPY into a region that saw ‘intervention’ action from the Bank of Japan to curb Yen weakness back in 2022.

The pair charged back above the psychologically important 145.00 handle, posting a new high for this year of 145.40 in the process. The last time it topped this point was in September 2022, when the Dollar’s rise eventually saw the BoJ stepping in to bring the pair back down, buying Yen directly for the first time since 1998. The market will accordingly be back on intervention watch whenever the pair creeps back above the 145 line, with HSBC reportedly suggesting that BoJ action can be expected in the 145-148 band.

Bank of Japan (BoJ) – Foreign Exchange Market Intervention

The latest move was part of a general bout of Dollar strength, with the greenback supported by rising Treasury yields and some broad risk aversion. Asian stocks were buffeted by new concerns about the ailing Chinese economy. With demand sluggish and deflation taking hold in the world’s second-largest economy, secondary effects are now being felt. Worries about the debt-laden real estate and construction sectors are nothing new, but on Monday came news that property-development giant Country Garden had suspended trade in eleven of its onshore bonds. This in turn prompted speculation that the company will have to restructure its debts, with its shares falling 16% in Hong Kong.

There were also some concerns about Typhoon Lan, which is expected to make landfall in Japan on Tuesday. Air and rail travel is already seeing restrictions.

The Bank of Japan offered unlimited Japanese Government Bonds with residual maturities of between five and ten years on Monday, part of its policy of Yield Curve Control.

Tuesday will see the release of official Gross Domestic Product numbers out of Japan for the second quarter of this year. A modest increase is expected for the annualized growth rate. That’s tipped to come in at 3.1%, above the 2.7% seen in the first three months. The on-quarter rate is expected to have ticked up to 0.8%. As-expected data would suggest that the economy continues to recover from the Covid pandemic, albeit at a quite modest rate.

The BoJ wants to see a durable return of domestic demand before it unwinds its outlying loose monetary policy.

Recommended by David Cottle

Trading Forex News: The Strategy

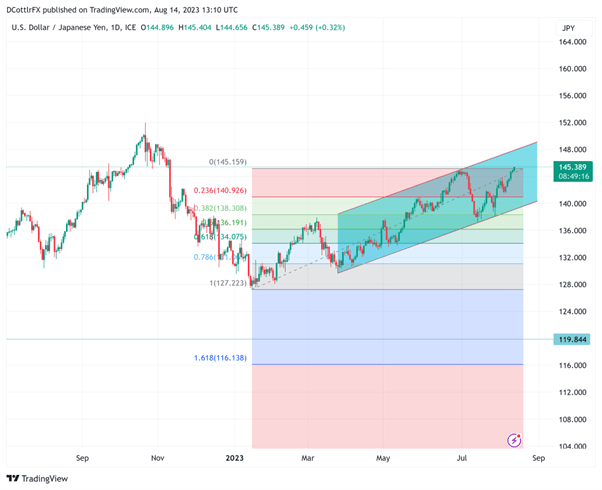

USD/JPY Technical Analysis

USD/JPY Daily Chart Created Using TradingView

USD/JPY has seen a renewed bout of strength since late July but this is merely the latest move in a well-respected broad uptrend channel in place since March.

Monday’s trade has seen initial resistance at 145.258 topped, but it remains to be seen whether Dollar bulls can hold above that on a daily close basis. If they can, they’ll be looking at more resistance points from November 2023, the last time the pair pushed up this high.

The 146.414 region, from which the Dollar slid on November 9 last year now comes in as resistance. There’s likely support at 143.26, Aug 2’s intraday top, and, well below that, there’s initial Fibonacci retracement support at 141, defending channel support at 139. 202. Those last two levels don’t seem in immediate danger but a market wary of central bank intervention will keep them in mind.

As Monday’s European session fades out, the Dollar is hovering around the psychologically important 145.50 level. A close above that will probably embolden bulls to try and push on higher, although the broader market may suspect that the Dollar is becoming a little overstretched, at least in the short term.

Retail trader data shows 19.91% of traders are net-long with the ratio of traders short to long at 4.02 to 1.

See Daily and Weekly IG Client Sentiment Changes in the Report Below

| Change in | Longs | Shorts | OI |

| Daily | 31% | -2% | 4% |

| Weekly | -22% | 30% | 12% |

–By David Cottle for DailyFX

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0