Japanese Yen, USD/JPY, US Dollar, BoJ, Intervention, YCC, JGB, Yield Spreads, Daly – Talking Points

- USD/JPY is eyeing new highs after stretching north this week

- The BoJ is on traders’ minds, but intervention may not be seen

- The Fed is forecast to be on hold, but if Treasury yields gain, will it boost USD/JPY?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The Japanese Yen has slid lower going into Friday’s session and with a holiday in Japan today, market conditions could get slippery should USD/JPY pierce above 145.00.

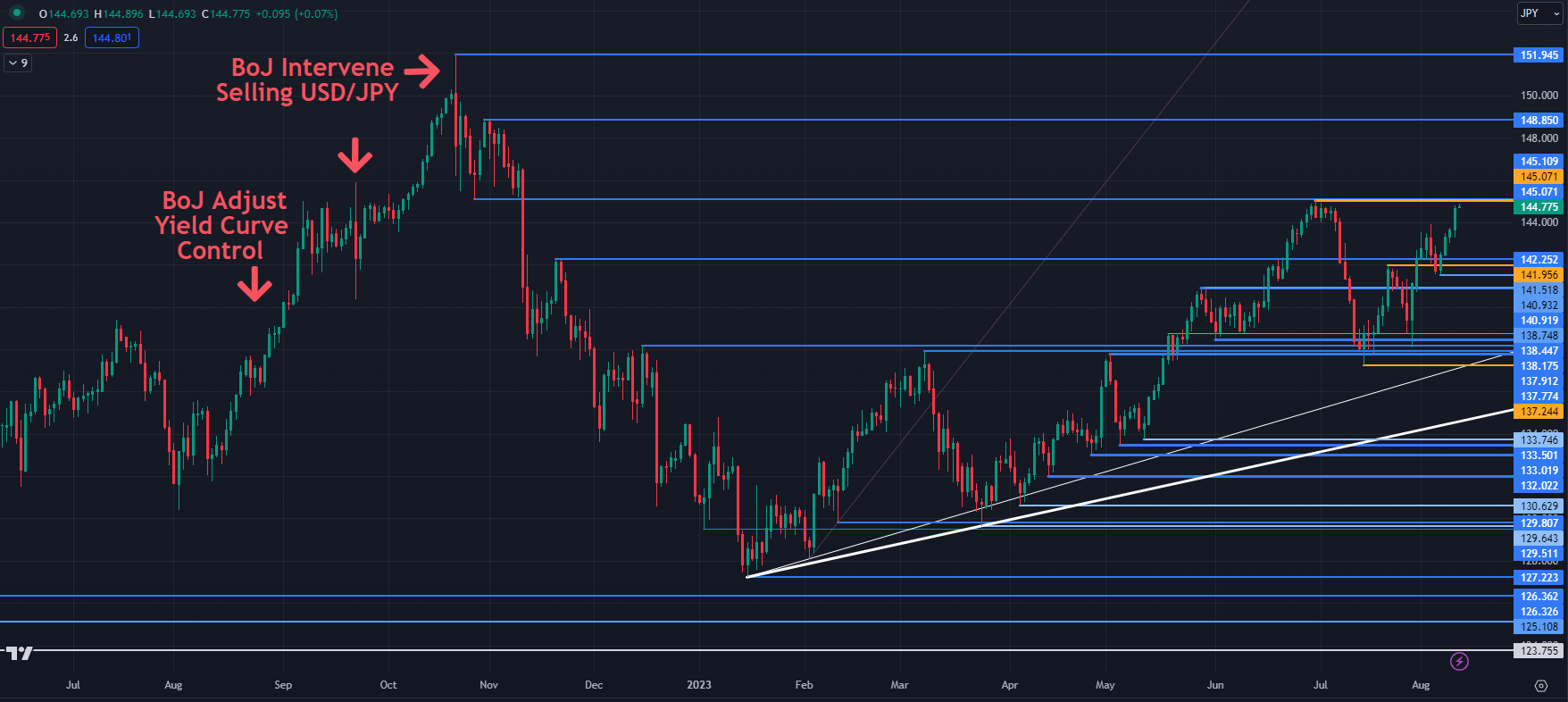

Such a move would mark a new 10-month peak and it was near these levels that the Bank of Japan (BoJ) initially intervened in the FX market, selling USD/JPY in September last year.

Of course, a lot has changed since then and while there has been some light jawboning from Japanese officials recently, the market is generally not anticipating physical intervention until the price moves toward 152.00, if at all. The November 2022 high was 151.95.

The BoJ adjusted its yield curve control (YCC) program at the end of last month and that saw the 10-year Japanese Government Bond (JGB) trade above 0.65% last week, the highest level since 2014. It has since moved back below 0.60%

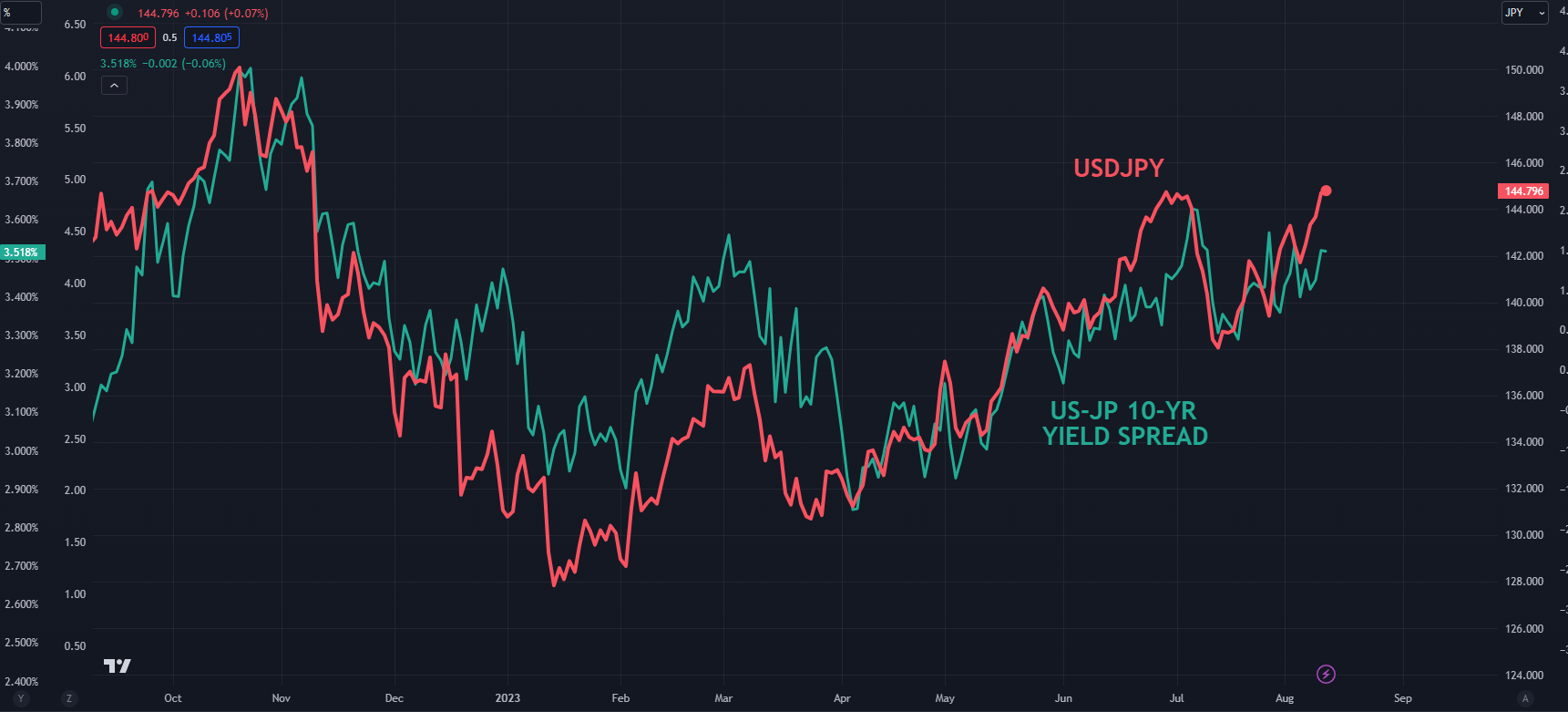

However, the spread between 10-year Treasuries and JGBs continues to move in favour of the US Dollar as illustrated in the chart below.

USD/JPY AND YIELD SPREAD BETWEEN 10-YEAR TREASURIES AND JGBS

Chart created in TradingView

Overnight saw Treasury yields tick higher after US CPI printed slightly below estimates with headline July CPI rising by 3.2% year-on-year to the end of July, rather than the 3.3% forecast.

Additionally, US weekly initial unemployment claims rose 21k to a 5-week peak of 248k, above the 230k anticipated.

This led markets to think that the Fed might turn more dovish than previously thought. These notions evaporated not long after the data when San Francisco Federal Reserve President Mary Daly reiterated her view that monetary policy would need to remain tight for some time.

The interest rate market is ascribing a very low probability of another rate hike by the Fed in this tightening cycle. They anticipate a rate cut by the middle of next year.

Recommended by Daniel McCarthy

How to Trade USD/JPY

USD/JPY TECHNICAL ANALYSIS SNAPSHOT

USD/JPY is bumping up against resistance ahead of 145.10 and a clean break above there could see some clear air for the currency pair. To read more about breakout trading, click on the banner below.

Resistance might be at the prior peaks of 148.85 and 151.95. On the downside, support may lie at the breakpoints of 142.25 and 141.95 ahead of the previous low near 141.50.

Recommended by Daniel McCarthy

The Fundamentals of Breakout Trading

Chart created in TradingView

{{GUIDE|HOW_TO_TRADE_USDJPY}}

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0