Payrolls Rise by 187,000, Driving Action in Gold, US Dollar

[ad_1] JULY LABOR MARKET REPORT July U.S. nonfarm payrolls at 187,000 versus 200,000 expected Unemployment rate ticks down to 3.5%, one-tenth of a percent below consensus estimates Gold rises while the U.S. dollar slides following the release of the employment report Recommended by Diego Colman Get Your Free USD Forecast Most Read: Euro Price Outlook

[ad_1]

JULY LABOR MARKET REPORT

- July U.S. nonfarm payrolls at 187,000 versus 200,000 expected

- Unemployment rate ticks down to 3.5%, one-tenth of a percent below consensus estimates

- Gold rises while the U.S. dollar slides following the release of the employment report

Recommended by Diego Colman

Get Your Free USD Forecast

Most Read: Euro Price Outlook – EURUSD on Breakout Watch, EURGBP Range Continues

U.S. employers continued to add to their ranks at a healthy pace at the start of the third quarter for an economy in the advanced stage of the business cycle, but hiring slowed moderately from earlier in the year, a sign that companies are starting to become more cautious about expanding headcount as sticky inflation and the Fed’s aggressive tightening campaign cast a shadow over the economic outlook.

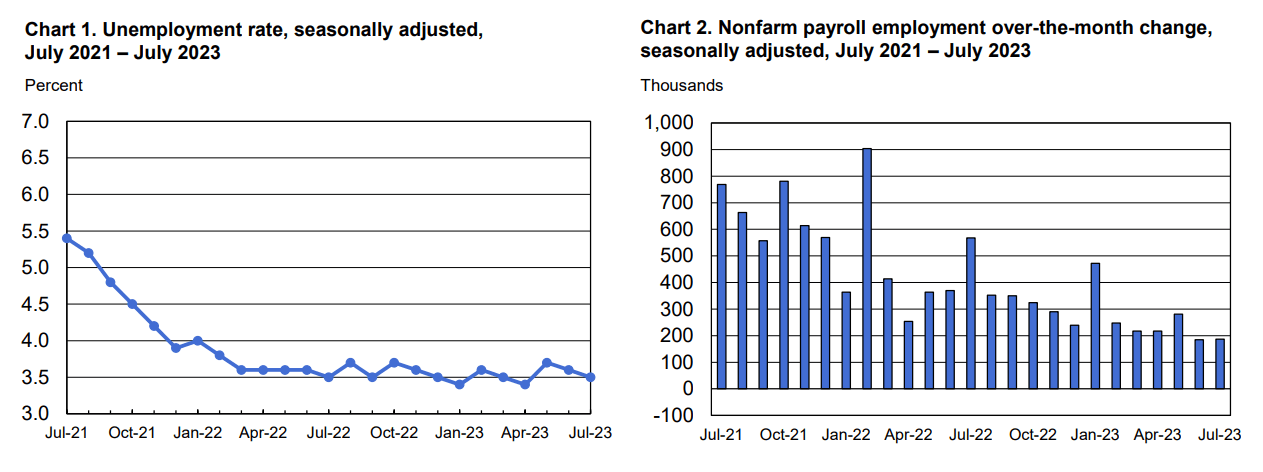

According to the Bureau of Labor Statistics, the U.S. economy added 187,000 jobs in July, below the 200,000 expected, following a downwardly revised 185,000 gain in June. Meanwhile, the jobless rate edged down to 3.5% versus 3.6% expected, indicating extreme labor market tightness, but raising hopes consumer spending will remain stable in the near term.

UNEMPLOYMENT RATE AND NONFARM PAYROLLS

Source: BLS

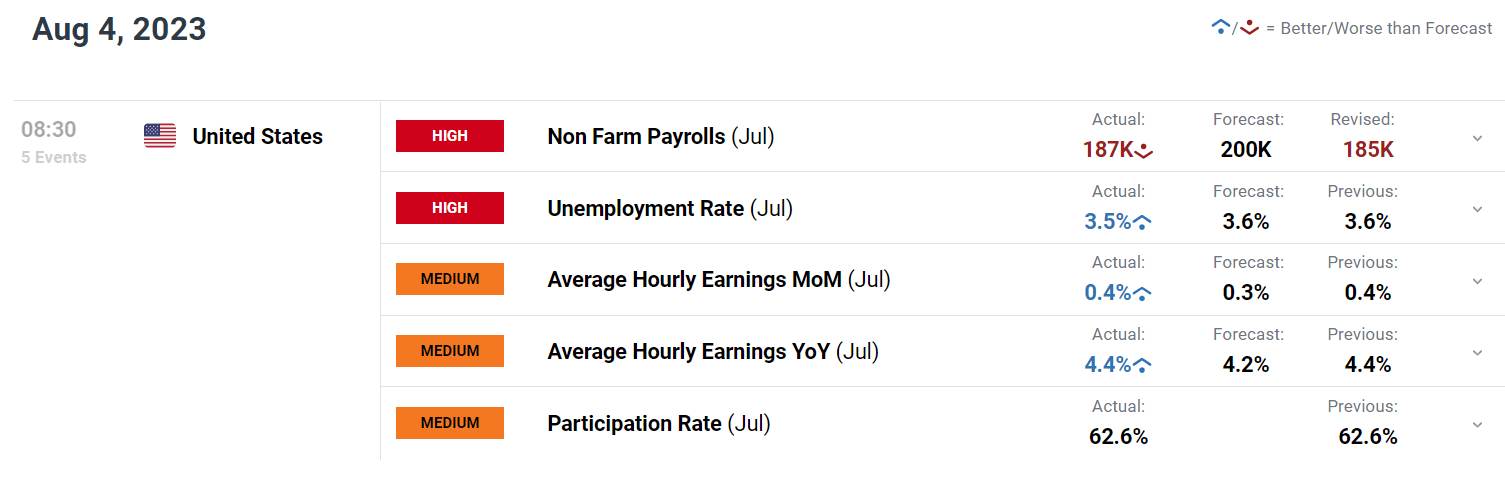

Elsewhere in the nonfarm payrolls survey, average hourly earnings, a powerful inflation gauge closely tracked by the Fed, rose by 0.4% monthly, with the annual rate holding steady at 4.4%. Analysts polled by Bloomberg news were looking for nominal compensation to increase 0.3% on a seasonally adjusted basis and 4.2% in the last twelve months.

Recommended by Diego Colman

Get Your Free Gold Forecast

LABOR MARKET DATA AT A GLANCE

Source: DailyFX Economic Calendar

Slower hiring brings positive news for the Fed, as it signals that price stability may be restored without sacrificing the economy to the altar of a 2% inflation target. However, traders should keep an eye on wages as elevated pay growth poses upside inflation risks. In any case, the Goldilocks report presents policymakers with the opportunity to engineer a soft landing, something that has historically been challenging to achieve when aggressive tightening measures were necessary.

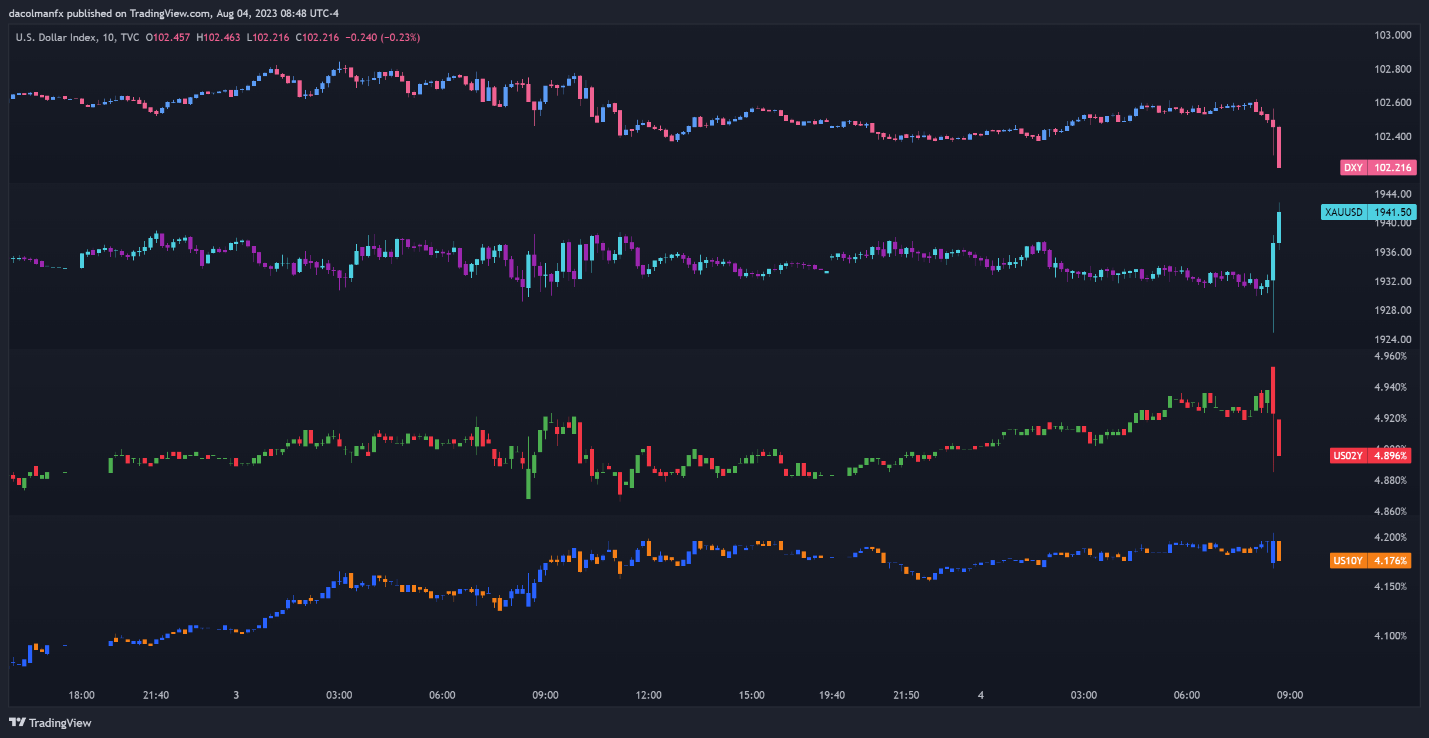

Immediately following the release of the employment survey, the U.S. dollar, as measured by the DXY index, took a turn to the downside, sliding into negative territory, weighed by retreating Treasury yields. Meanwhile, gold prices perked up, rising to $1,940, boosted by the moves in the fixed-income space.

Recommended by Diego Colman

Get Your Free Top Trading Opportunities Forecast

US DOLLAR, GOLD, US YIELDS CHART

Source: TradingView

With the U.S. economy holding up well but cooling, interest rate expectations could soon head in a more dovish direction, pushing traders to price out further tightening entirely for 2023. Against this backdrop, the U.S. dollar could struggle to extend its recovery, creating a positive environment for gold prices.

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0