25bps and Done or More Hikes in the Offing?

[ad_1] EUROPEAN CENTRAL BANK (ECB) PREVIEW: Recommended by Zain Vawda Get Your Free EUR Forecast READ MORE: Fed Hikes Rates After Short Pause, Gold and US Dollar Forge Separate Paths Central Banks take center stage this week with the Federal Reserve kicking things off with eyes now turning to the European Central Bank (ECB) and

[ad_1]

EUROPEAN CENTRAL BANK (ECB) PREVIEW:

Recommended by Zain Vawda

Get Your Free EUR Forecast

READ MORE: Fed Hikes Rates After Short Pause, Gold and US Dollar Forge Separate Paths

Central Banks take center stage this week with the Federal Reserve kicking things off with eyes now turning to the European Central Bank (ECB) and President Christine Lagarde. It’s been an interesting ride for the ECB in 2023 with positive signs at the beginning of year now finally starting to wane as the rate hike cycle appears to be bearing fruit.

Over the past week or so we have seen signs that the Euro Area is feeling the effects of the ECB hiking cycle as economic data continues to deteriorate. The poor data off late has reignited a debate about whether the ECB is hiking into a recession with some ECB policymakers for the first time in 2023 adopting a more neutral to dovish stance on the path moving forward. No matter the outcome of this week’s meeting, robust discussions and debates around the policy path moving forward are likely to dominate ECB proceedings for the foreseeable future.

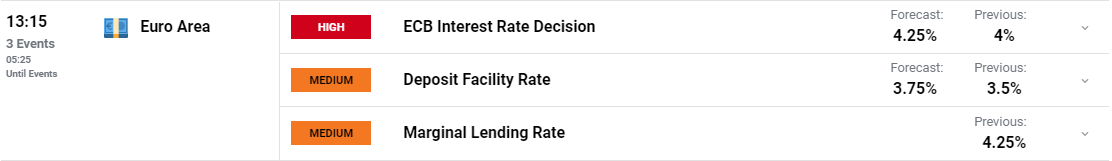

Looking at the rate hike probability distribution for the ECB below and markets are pricing in another 20bps (after the July meeting) of hikes by December 2023 before rate cuts in 2024, something which may factor into ECB President Lagarde’s comments on Thursday. The Euro is overvalued at the moment something which has been weighing on exports from the Euro Area.

Source: Refinitiv

THE INFLATION, DISINFLATION STORY

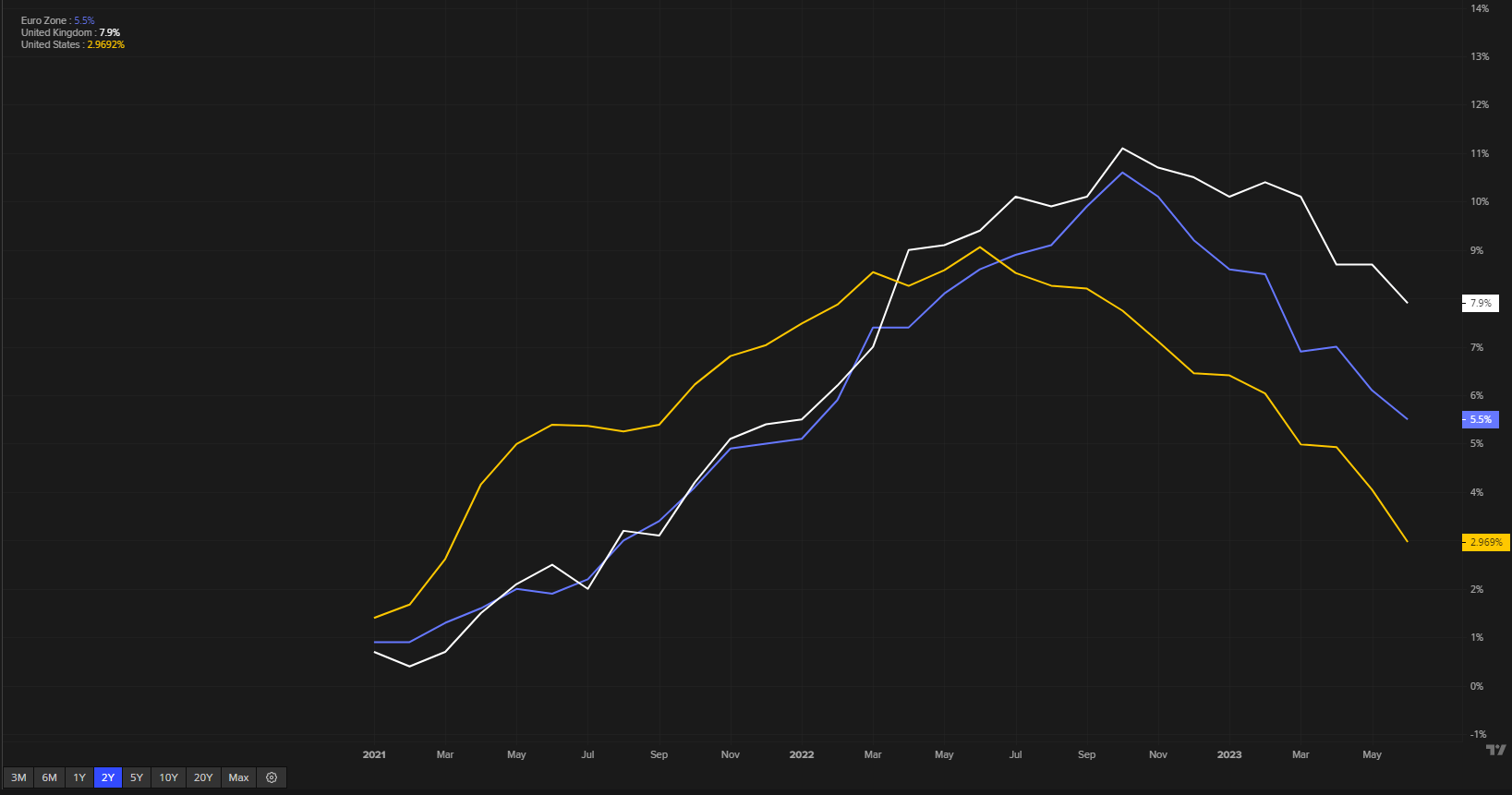

On the inflation front the Euro Area appears to be the front runner in combatting inflation with significant progress of late in comparison to the UK and the US. There is still work to do however with European Central Bank (ECB) President Lagarde leading the charge in getting inflation back under the Central Banks target. There have been signs that inflation could fall quicker than the ECB expect but that would likely occur toward the back end of Q3 heading into Q4 as the Summer season is likely to keep demand elevated for now and thus inflation as well.

Inflation in the UK, US and Euro Area

Source: Refinitiv

The minutes of the previous ECB meeting hinted at robust discussions on the policy path moving forward with such discussion and debates likely to intensify as the ECB approaches its end goal. We are already seeing a change with certain policymakers hinting at a shift to data-dependency rather than any hawkish rhetoric or commitment to further hikes.

Recommended by Zain Vawda

Traits of Successful Traders

EURO AREA GROWTH CONCERNS

Monday this week started on a slightly sour note as Euro PMI data came in worse than expected while Tuesday morning brought another poor print in the form of German Ifo data. This has rekindled fears around a recession in the second half of the year and may give the European Central Bank (ECB) some food for thought as they plan the monetary policy path moving forward.

The IMF released updated forecasts yesterday as well upgrading Global Growth forecasts for 2023 to 3% from a previous 2.8%. However German GDP was revised down to a 0.3% contraction from a previous estimate of 0.1% as the Euro Area begins to feel the full effects of rate hikes over the past 12 months. The opportunity for further hawkish rhetoric does appear to be fading along with the Euro Areas growth prospects for 2023 with recent data around loans also painting a concerning picture. A pause in hikes after the July meeting is likely to depend on the data with a continued fall in inflationary pressures the desired result for the ECB and a sign that a pause may be in order.

POSSIBBLE SCENARIOS AND IMPACT

25bps Rate Hike with Dovish Tilt: a 25bps hike seems a certainty at this stage with the staff projections and overall rhetoric likely to have more sway. Whether the economic projections change following the recent spate of poor data remains to be seen. A dovish message from the ECB would come in the form of no commitment to a rate hike in September with a switch to data dependency, something we have heard from select ECB members of late.

25bps Rate Hike with Hawkish Tilt: a 25bps hike followed by continued concerns around core and service inflation prices with no real mention of data dependency as a guide moving forward could be viewed as hawkish on the part of the ECB. Such a move could provide the Euro with another jolt in the arm which should result in gains against major counterparts.

For all market-moving economic releases and events, see the DailyFX Calendar.

TECHNICAL OUTLOOK

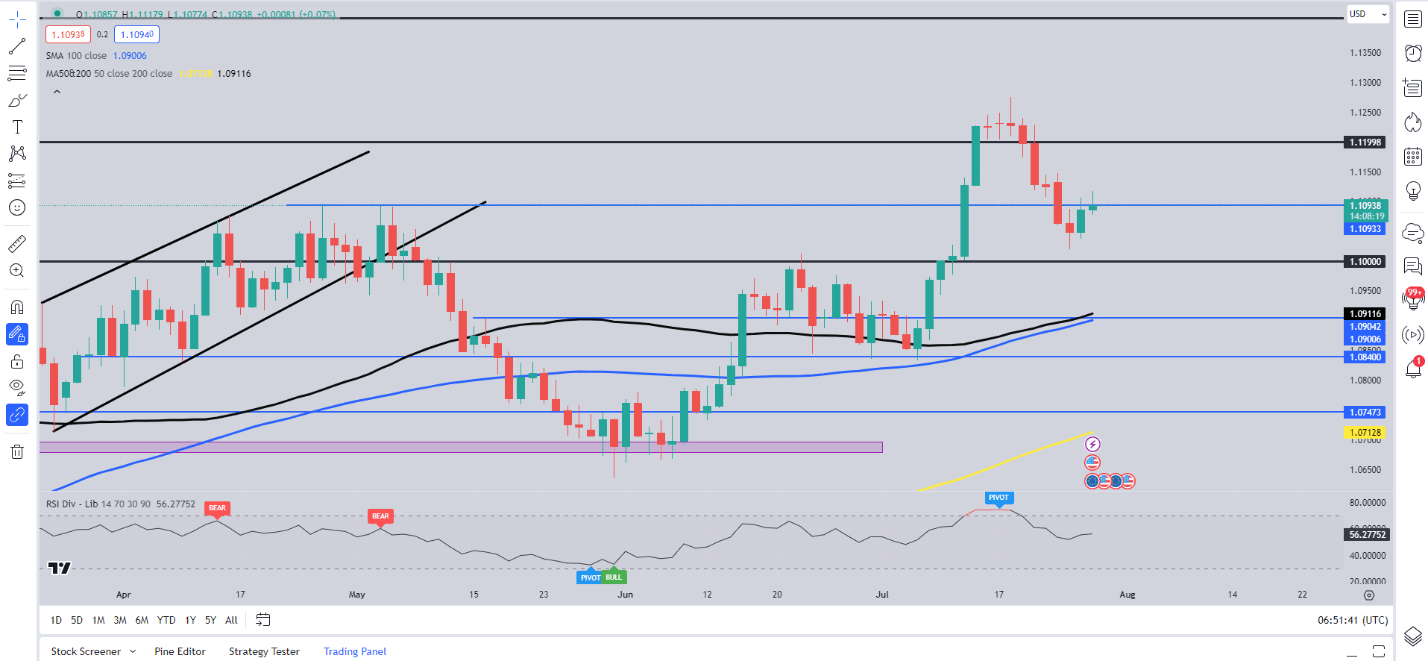

EURUSD from a technical perspective remain caught within a 250-pip range between the 1.1250 and 1.1000 handles at the moment with a bullish engulfing candle close yesterday hinting at the potential for a deeper retracement. Looking at the MAs and it may be something to keep an eye on as the 100-day MA looks ready to cross above the 200-day MA in what would be a golden cross pattern, further evidence that the overall bullish momentum remains in play.

A break below the 1.1000 mark could see the 100 and 200-day MAs tested serving as support and could cap further downside. The 1.0840 handle will remain key if we are to see some form of bullish continuation.

Support Areas

- 1.1000 (Psychological Level)

- 1.0900 (100-200-day MAs)

- 1.0840 (July Swing Low)

Resistance Areas

- 1.1150

- 1.1250 (YTD Highs)

- 1.1400

EUR/USD Daily Chart

Source: Tradingview, Prepared by Zain Vawda

Recommended by Zain Vawda

Improve your trading with IG Client Sentiment Data

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0