ICT Intraday Trading Model – Trading Systems – 14 November 2022

[ad_1] Hey traders, in this blog, I will explain to you a simplified strategy inspired by ICT – Inner Circle Trader.We will focus on external range liquidity raids manipulations of the previous Day’s Highs/Lows only! I will describe exactly step-by-step what you should do to be profitable. Once you learn to stick to this trading model and

[ad_1]

Hey traders,

in this blog, I will explain to you a simplified strategy inspired by ICT – Inner Circle Trader.

We will focus on external range liquidity raids manipulations of the previous Day’s Highs/Lows only!

I will describe exactly step-by-step what you should do to be profitable. Once you learn to stick to this trading model and risk management. I would say that you can make, a consistent return per month of 20R (10% if you risk 0.5% per trade) under all market conditions. Which is enough to pass the trading challenges and be funded by any prop firm and live just by trading those funds.

I want to have my life easier, and I want to fully focus just to efficient trading without wasting time by drawing the levels and monitoring the charts for the whole day. So, I have created an ICT Template MT4 that automatically updates the levels and sends mobile push notifications, when the liquidity raid occurs, that is the moment I start to monitor for the potential setup. The indicator starts to print necessary price action elements on M1 and if all the conditions and DXY confluence is confirming my thesis. I’m looking only for the entry on a pullback with 3 possible methods. For effective execution, I’m using Flexible Trade Manager which helps me quickly set the trade with correct risk management and manages my partial close and moves stop loss to be.

Strategy Basics

- Trading only specific time: London Kill zone (02:00-05:00 NY time) /New York Kill zone (NYKZ 07:00-10:00 NY time) Setup out of Kill zones = lower probability

- Look for liquidity manipulations resting on the previous Day’s High/Lows (PDL/PDH) (Indicator updates these levels and sends an automatic notification to MT4 mobile app)

- The manipulation of PDL/PDH should enter a higher timeframe level for higher probability, but it’s not always necessary if that happens to multiple pairs at the same time.

- PDL/PDH manipulation and reversal must be followed by Break of structure (BOS) + Displacement/Fair value gap (FVG)(Indicator draws this automatically) Break of structure without FVG = NO ENTRY

- If all the above is valid and USD is on a significant level. We can look for potential entry in the first point of interest level above/below 50% fib. pullback from break of the structure.

- Entry levels – Fair Value Gap (FVG), Order block (OB) or OTE (Optimal Trade Entry) Fib 70,5 – Keyboard F – will plot ICT Fib

- Statistically, we have 10 sessions per week if you follow 3 pairs –> 30 possible setups per week. This doesn’t mean there will be 30 setups per week!! Levels are not hit every day. Be patient

- This strategy is ideal in ranging higher timeframe price action (in trending market conditions this strategy will give you fewer opportunities)

Trading Time

You will find that this strategy works at any time, but the biggest probabilities you will get during the kill zones (indicator highlights them on chart) Here are sessions specifics

London Killzone – LOKZ 02:00-05:00 NY time // 08:00-11:00 EU time

- The highest probability of creating a High of the day when the market is bearish / Low of the day when the market is bullish

- Highest volume and volatile movement – The PA during London Session sees the highest probability of a large directional move in the 24h day

- If you are bullish on the pair there is a high probability of expansion in Mo, Tu, and Wednesday. Same for the bearish case.

- If the price is trending in the London session we might see a quiet NY session – If the price is consolidated in the London session highest probability, is we see a trending move in the NY session

- High probability to see PO3 2 am to 7 am NY time //7 am -1 2 am London time

- If the price doesn’t revert in London, we can expect the big move will be in NY

New York Killzone – NYKZ 07:00-10:00 NY time // 14:00 – 17:00 EU time

- Highest volatility because of the overlap of sessions. The secret is what happened in London.

- Continuation of London’s Move with a small pullback or a complete reversal on the daily direction mostly on Thursday

- The PA during NY Session sees a consistent round of Economic News Releases – sometimes predictable sometimes not

- If a Low forming in London, we can anticipate a retracement lower in the NY Open and agreement with that daily bias

- When the daily is in a near one-sided momentum ⇒ it is easiest to look for a confirmation of that direction in London PA. If London agrees with the Daily bias

- we can anticipate NY to post a continuation setup. Reversals require more insight

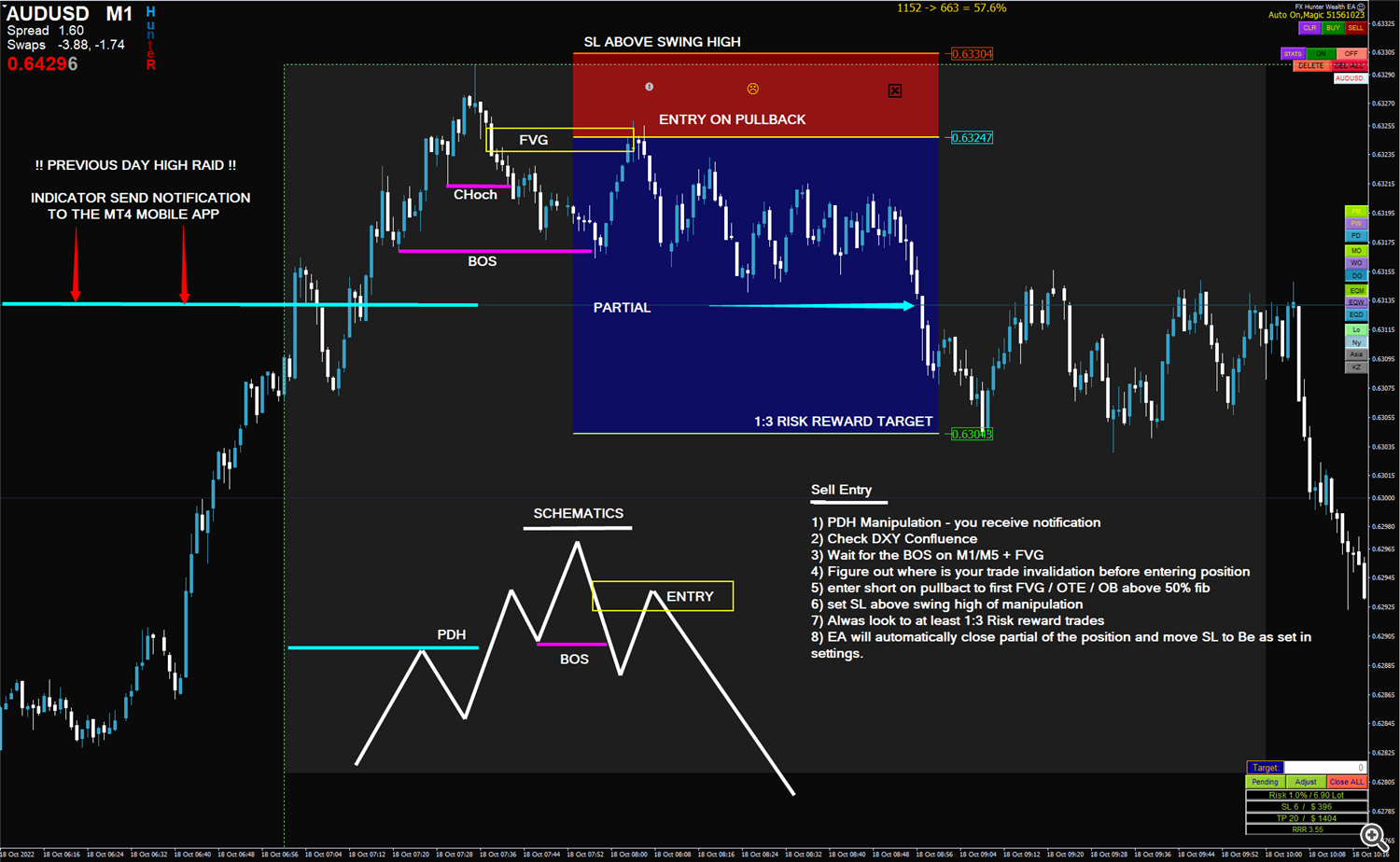

In the picture below you can see AUDUSD. on te average you can get two PDL/PDH raids per week on the symbol.

Trading rules in no order. All of them are important!!

- Trade only in the first 3 hours after London /New York sessions open – Kill zones

- Focus only on 3 pairs max. + DXY for confirmation. I prefer EURUSD and GBPUSD, AUDUSD.

- Enter at first level FVG/OB below/above 50% fib retracement or OTE – 70.5 fib

- Never trade a PDL/PDH that has another PDL/PDH resting below/above the market will most run for that liquidity too. Never sell equal highs or buy equal lows

- Only take the clean setups –> you only need 3 winners to reach the weekly goal –> pick the best out of 60 possible trades

- Never enter a trade right before news events.

- Stop trading for the day when >3R is locked

- Stop trading for the week when >6R is locked (go on a demo account, backtest, journal, enjoy free time…)

- Still continue to monitor PA every day to stay in touch with the market

- Stick to your risk management, no matter what

- Don’t be greedy with moving SL to BE too early before taking any profits, you will be kicked from the trade

- Don’t change your plan because of other traders’ opinions/setups. Don’t let them influence your process. Think independently

- Always think in terms of probabilities, does my setup align with HTF context and narrative? is it in sync with multiple timeframes (at least 3)?

- Be aware of your emotions (eg. fear, greed, revenge trading) and stop trading if necessary – Journal your trades and analyze them

AUDUSD M1 Trade example entry from the FVG

- PDH manipulation – Indicators send the notification

- we monitor the market for the BOS with FVG

- we got BOS – is FVG included in the swing that broke the structure? Yes! It means smart money is trading – the reversal has higher probability

- we place the trade by using Trade manager – bring the mouse cursor where you want to place your trade (FVG) – Keyboard S will bring short trader projection

- Adjust the entry to the FVG, SL above the Swing and Target 3R in the left bottom corner you will see your Risk reward, lot size and risk

- Activate the trade by clicking the smiley and entry line will change to purple. It means once the line is hit trade will be open. Or you can click the pending on the right corner, and it will place a pending order

- Once you are in the trade. Trade manager will manage the position for you (you must have a PC on or run it on the VPS)

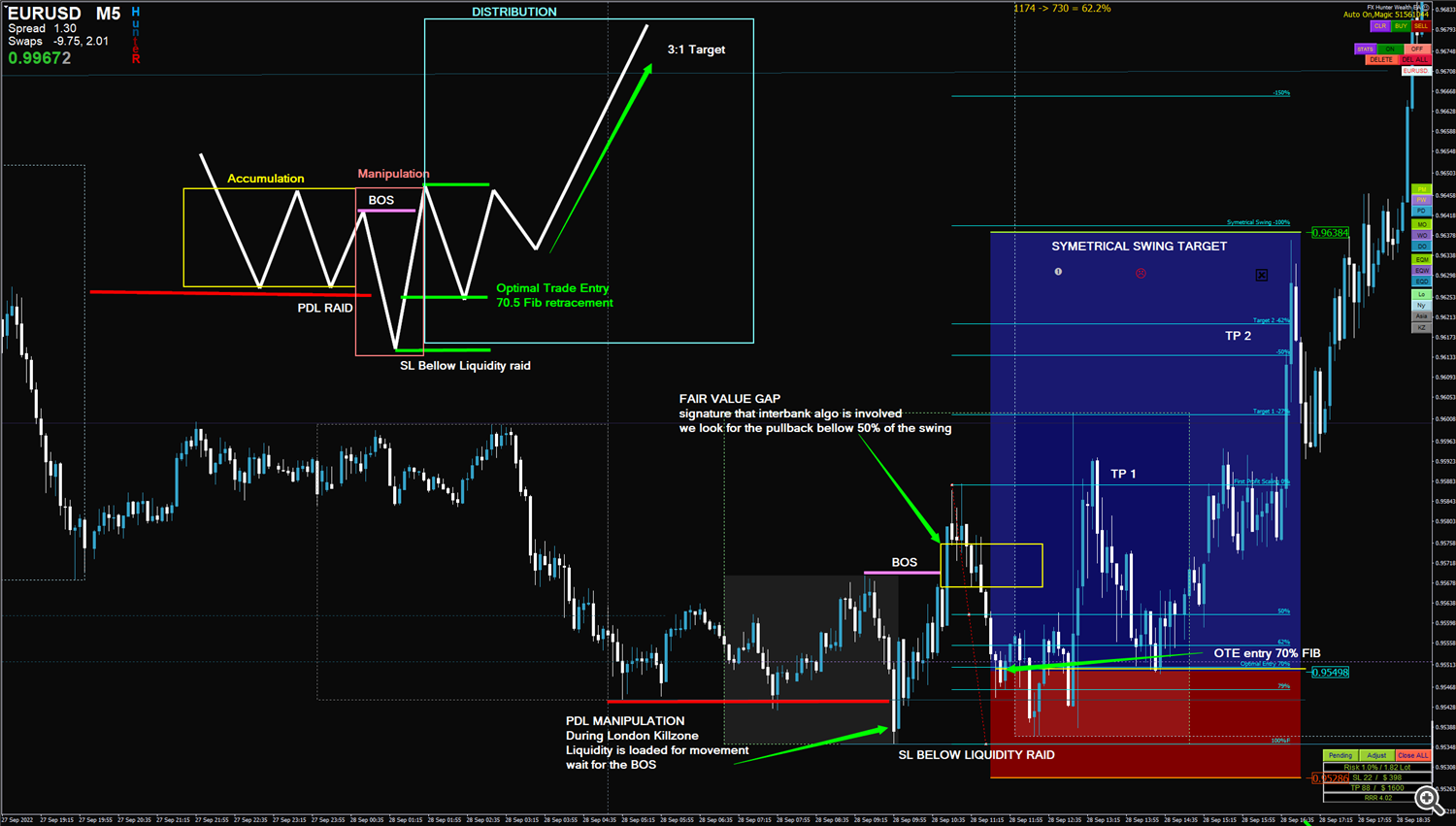

EURUSD M5 Trade example – Optimal trade entry (OTE 70.5 Fib pullback)

- PDL manipulation – The Indicator sends the pus notification

- we are monitoring for the BOS

- we got BOS – is FVG included in the swing that broke the structure? Yes! It means smart money is trading the reversal has a high probability

- we plot the move the mouse to swing low and press keyboard shortcut F. Fib will automatically appear. Adjust to swing high lows

- Keyboard shortcut B will plot long trade projection. Adjust it to 70,5 fib and adjust the SL below the liquidity raid and Target 3R in the left bottom corner you will see your Risk reward, lot size and risk

- Activate the trade by clicking the smiley or click pending button trade manager will place the order for you.

- Once you are in the position, the trade manager will do a partial close and moves SL to BE. (You must have PC on or run it on the VPS)

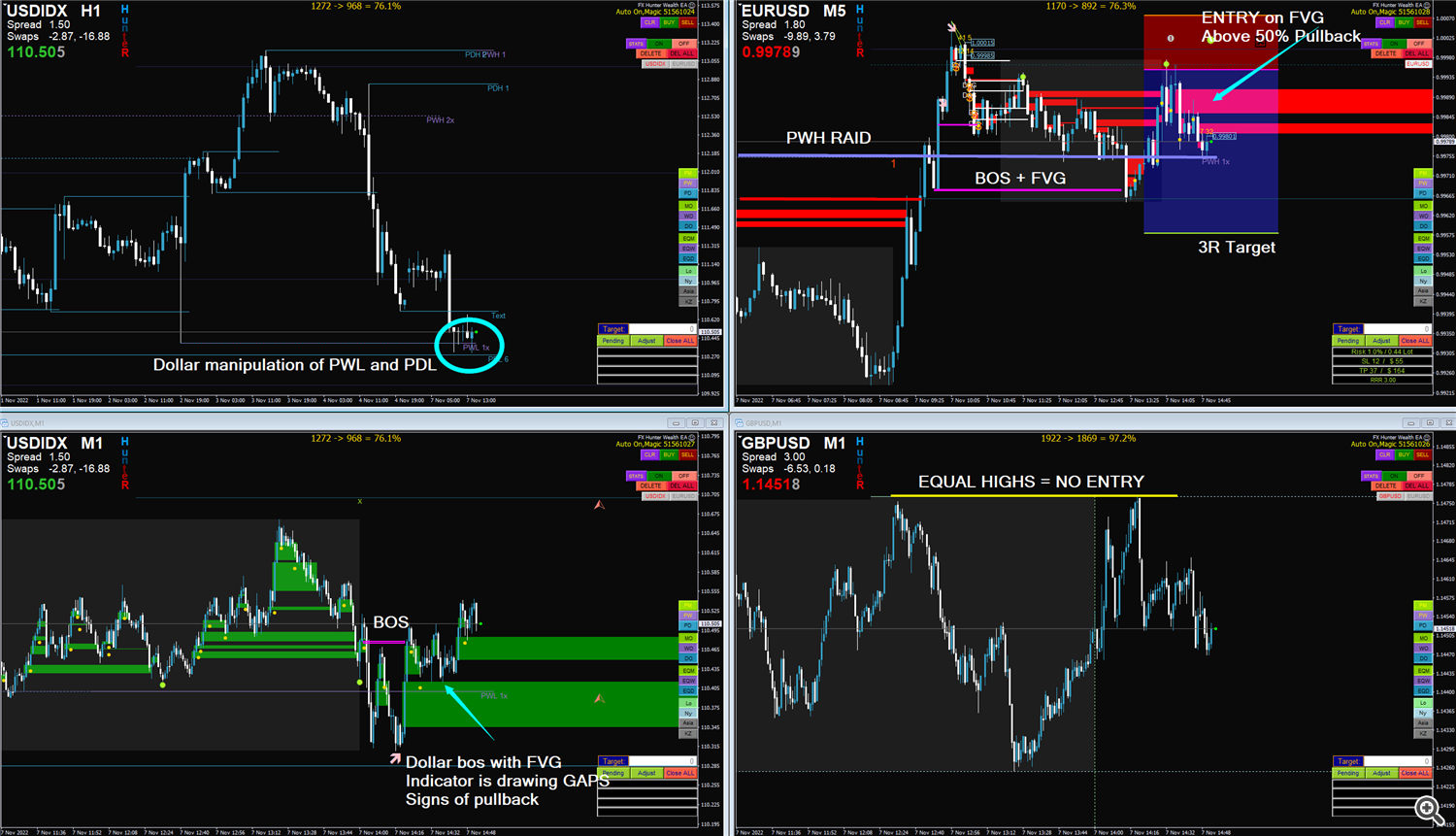

EURUSD M5 Trade example – Order block entry

- PDL manipulation – we receive the notification

- we wait for the BOS break of structure

- we got BOS – is FVG included in swing that broke the structure? Yes! It means smart money are trading the reversal has a high probability

- we identify the Order block (consecutive down candles before the break with displacement) for more accuracy we use last down candle before the explosive move.

- keyboard shortcut B we bring the buy trade visual projection to the upper side of OB and adjust the SL below the liquidity raid and Target 3R in the left bottom corner you will see your Risk reward, lot size and risk

- Activate the trade by clicking the smiley or click pending button trade manager will place the order for you.

- Once you are in the position, trade manager will manage the position for you with partial close and moves SL to BE. (You must have PC on or run it on the VPS)

These were 3 basic examples of entries. We have learned that you need to see PDL/PDH level manipulation, followed by pullback with the Break of the structure which must include displacement (candle with fair value gap – FVG). Then we look for a pullback at least 50% for the entry Below/above 50% pullback we want to enter in the Order block – OB, FVG – Fair value gap or OTE – Optimal trade entry – 70.5% fib – which is the way I recommend to the beginners.

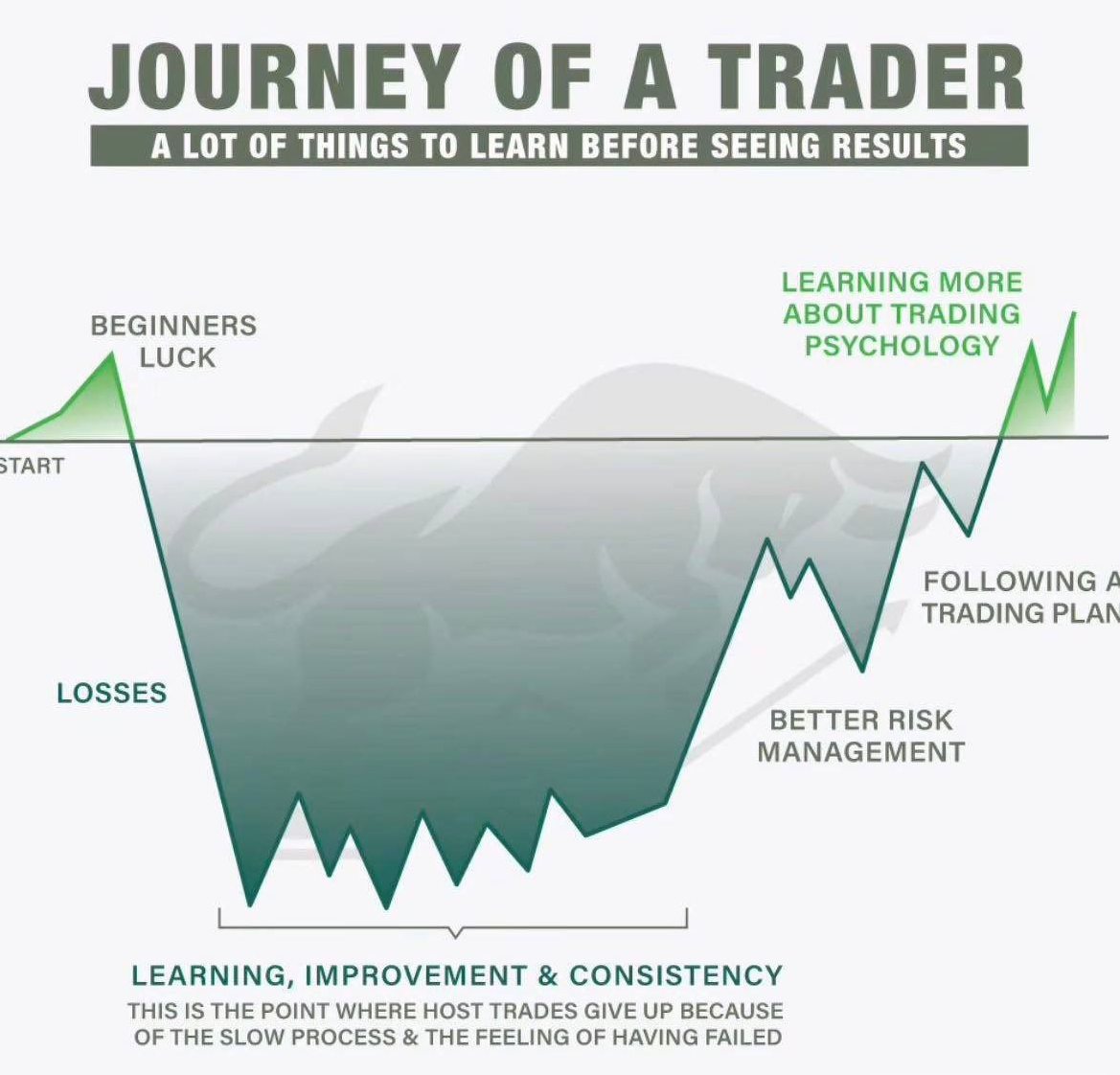

The most important thing is to calm down and don’t hurry into position. Wait for all conditions to be meet. Per my experiences, I made most of the mistakes by just not being patient. You will make a lot of mistakes too. So, please don’t expect to be profitable in one week. It’s not possible. You will need to give it consistent daily efforts for a few weeks most likely months, to get your eyes used to see things that you didn’t see until now. Following daily routine, observing the charts, and making notes is what will make you a master.

Daily Routine

- Don’t open any social media, and turn off everything could distract your focus

- Check the MT4 – 30 minutes before the London Kill zone

- Go thru your pairs and look where are PDL/PDH, and identify HTF order flow (PWL, PWH on Mondays)

- Mark out valid higher time frame Order blocks and Fair value gaps around PDL /PDH

- If the Asia session was trending. Skipp London session, the probability of reversal is low, wait for New York

- Wait for the PDL / PDH manipulations (Notification will come to the MT4 Phone)

- Received notification? Look for trade as per the trading model

- If successful in the London session, you are done for the day.

- if you didn’t have setup wait for NYKZ and repeat all steps (+ mark out LOKZ H/L)

- If PA is not clear don’t force a trade, skipping a trading session without hesitation is a level of maturity

No Hard work can beat long-term consistency and following the process. Just do this every day, it will come!!

You need to feel the correlation and importance of the Dollar. For example, if the PDL is hit on EURUSD and DXY still has some PDH/PWH which was not reached do not enter EURUSD long yet. You must wait until the DXY hit the level and starts to do a pullback. When you got BOS + FVG on EURUSD and DXY starts to do the same you are good to go. Later when you do your observation you will find out that if the Dollar hits the level and reverse it takes with it all other majors no matter where they are. So, always watch Dollar for the confirmations.

MT4 Workflow Tip

- We Always need to know the the USD is doing. None of the pairs will move until the USD does.

- Watch DXY H1 to monitor the levels and price action around them

- Watch DXY M1 to monitor reaction on the levels in the details, you need to see BOS with gaps

- Watch other pairs M5/M1. Once you get the notification indicator will be printing the gaps if they occur

- if you get BOS then you can look for the pullback and entry

Risk Management

There is no strategy in the world that wins every trade. Accepting the fact that the outcome of every trade is uncertain and acting like risk management is all that you have is only the way to be successful in the long-term run.

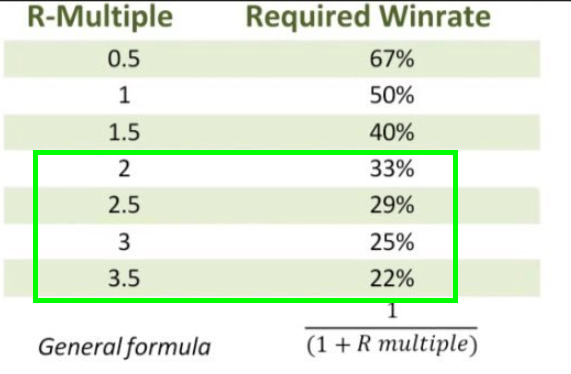

Refer to the tab as a guide for your risk management. Let’s assume you just 4 of 10 trades, with 2:1 RRR. Congrats you are profitable!

- Your positions size should be such that few losing trades will not scare you to open another trade

- 0.25% per trade on the beginnings

- Up to 1% per trade when you got this under your skin, I personally still prefer 0.5%

- Max. 20 pip SL

Targets

Less is more especially in trading. Knowing when to close your platform and live life is one of the most important things in trading. Never try to make more. Overtrading leads only to give the money back to the markets.

- Daily Target – 3R – 0.5% risk per trade = 1.5%

- Weekly Target – 6R – 0.5% risk per trade = 3%

- Monthly Target – 20R** – 0.5% risk per trade = 10%

- Always look for setups that offer at least 3R – you need win only 3 out of 10 to be profitable!!

- Set up partial close in the trade manager to XX. Yes, TP will not be hit with full positions, but its better earn small than full stop loss.

- It’s better to a get partial close and break even that a full stop loss

- 2.5 R per trade requires only a 33%-win rate to be profitable

- Stop trading if you reach your daily target >3R

- Stop trading for the week when >6R is locked don’t stop analyzing, but go to the demo account, do backtesting, and journal.

Trading is business, I think you would never do any business without knowing the possible outcomes. So, before you even consider risking your own money on this strategy, you should do visual Backtests and create your own trade journal. This will help you train your eye in the visualization of the pattern we are looking for and mainly you will get your statistical probability data. I suggest you backtests at least 200 trades on each pair.

Back-testing

For effective backtesting I have implemented the mode which hides 30% of your chart on the right side. In order bring this mode press 4 times – 0 (zero)

Scroll your charts as far to the history you want to back test and by moving the chart manually to the right explore the price development, once our PDL/PDH is hit, place your trade projection from Trade manager by pressing B – BUY and S – Sell. adjust the trade and continue with moving the chart you will see how the trade ended up. Continue with all until you end your back testing session and press 1 on the keyboard. The trade manager will automatically calculate your results. Of course, visual back testing is not like live trading, but it’s necessary for you to do it before you start trading, so you have an idea what typ of trades you looking for.

Possible Outcome

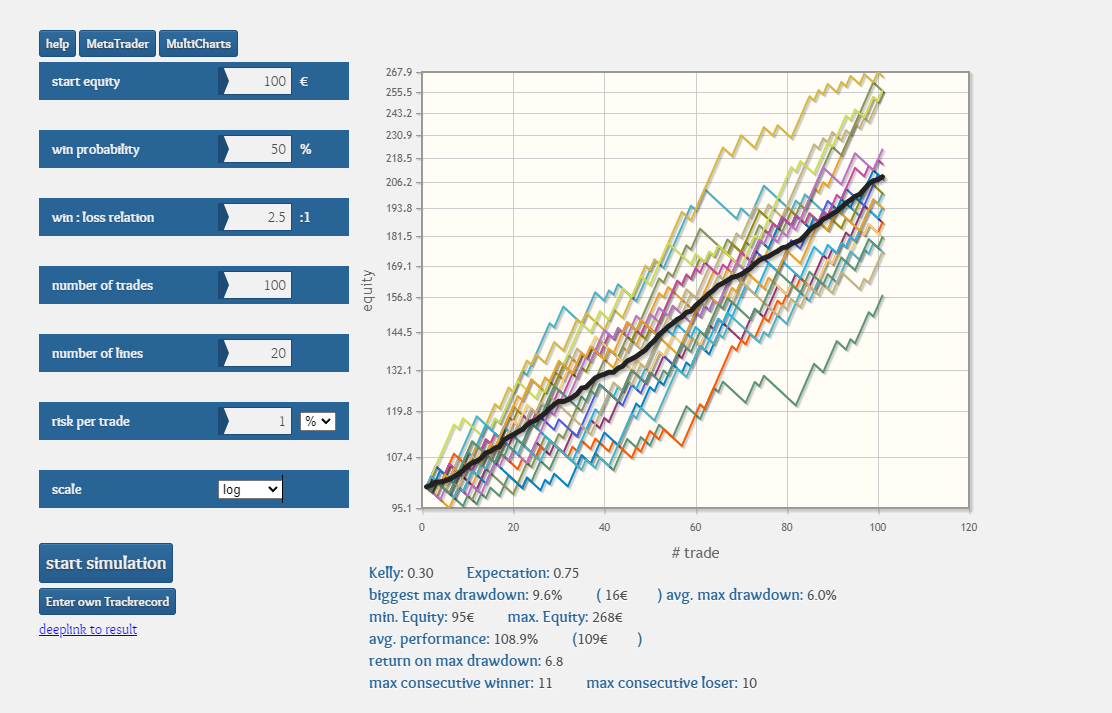

After you make your own back-testing and forward testing, I suggest you do an equity curve simulation. It can calculate possible scenarios of your equity curve with probabilities.

Check Equity Simulator here – http://equitycurvesimulator.com/

Trading Psychology

Trading psychology is so important that this should be on the beginning of the blog. Strategy is 10% Strategy, 30% Risk management and 60% psychology. Yes, that’s how it is, trust me. Positive RR strategy has mostly less winners than losers, but winners pay 3 times more. However, not everyone is able to handle it this way. That´s why not everyone will succeed in the manual trading. That´s the fact. Stop focusing on results and focus mainly on following your process consistently. Put in hard consistent work. Results will come.

- Leave your ego at the door, markets will humble you otherwise

- Trading is not difficult, but rather the discipline

- Don’t try to catch a home run trade. You will get such trades, but real wealth is built with consistent small amounts of returns.

- Lower your expectations, increase your time horizon

- Your greatest lessons are going to come with pain

- Submit to the pain, submit to adversity, and above all submit to time

- You are neither a bull nor a bear, you are a trader

- Treat demo accounts like real money accounts. Do not underestimate the power of bad habits in forming

- Don’t try to flip a small account into a huge one, rather work on your skills and apply as a funded trader

- Be comfortable with the grey area in trading, you don’t know what’s going to happen next

- Don’t chase price, let the price come to you. Its ok to miss a trade.

- You don’t have to make a trade every day. PATIENCE, no trade is better than a losing trade

- Avoid big losses at all costs, minimize small losses, and compound small winners

- You are responsible for every buy/sell, you are responsible for your wins, you are responsible for your losses.

- Never make anyone else responsible for your actions, besides yourself

- Never assume you know everything, there is always room for optimization

- If you are a new trader, try to understand Price Action on the left side of the chart (backtesting), and how to execute from the right side (front testing)

I recommend you listen to this audiobook – TRADING IN THE ZONE by MARK DOUGLAS

This is the basics of the strategy. Join my Discord Community for the support and meet other traders who trade this strategy too.

Concept is inspired by Inner Circle Trader – Michael J Huddleston.

Thank you for reading and wish you all good on your journey to freedom!!

Dave FX Hunter

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0