4 Period RSI Arrows and Value Chart Deluxe Edition Forex Trading Strategy

[ad_1] Are you having trouble making money in Forex trading? The market can be very unpredictable. That’s where the 4 Period RSI Arrows and Value Chart Deluxe Edition strategy comes in. This powerful strategy helps you find the right time to buy and sell. It combines two important tools to give you a better view

[ad_1]

Are you having trouble making money in Forex trading? The market can be very unpredictable. That’s where the 4 Period RSI Arrows and Value Chart Deluxe Edition strategy comes in.

This powerful strategy helps you find the right time to buy and sell. It combines two important tools to give you a better view of the market. This Forex trading strategy can change how you trade and help you make more money.

Key Takeaways

- Combines RSI arrows and Value Chart for enhanced accuracy.

- Provides clear entry and exit signals.

- Helps identify market trends and possible reversals.

- Suitable for different timeframes and currency pairs.

- Improves trading decision-making process.

- Optimizes risk management in Forex trading.

Understanding RSI Trading in Professional Trading

Professional RSI trading is very different from what most people think. Many traders don’t understand RSI levels well. This leads to poor results. Let’s see how top traders use RSI effectively.

Common Misconceptions About RSI Levels

The 70/30 overbought/oversold levels are not fixed. They can be misleading. For example, in one market, big bounces happened at an RSI of 19.74%, not 30%. This shows the need for specific market analysis.

True RSI Level Analysis

True RSI levels change with market conditions. Professional traders use data to find these levels. They look for at least 80% confidence, meaning 4 out of 5 past occurrences should match within a 5% RSI range. This method uncovers hidden support and resistance areas.

| Time Frame | Best RSI Settings | Hidden Support | Hidden Resistance |

|---|---|---|---|

| H1, H4, D1 | 21, 34, 55, 89 | 32-36% | 58-61% |

Professional Trading Desk Approach

Big hedge funds and trading desks use advanced RSI strategies. They often use multiple RSI settings at once. The True RSI Indicator lets you input up to 5 different RSI settings. This multi-period analysis boosts accuracy and cuts down on false signals.

Professional traders also look at other factors. For example, they use ATR (Average True Range) to spot big price moves. A standard ATR period of 14 with a multiplier of 5 helps find valid swing highs and lows.

By learning these professional techniques, you can avoid common RSI mistakes. This can improve your trading results. Discover more about advanced RSI strategies and tools to better your trading.

The Value Chart Deluxe Edition Fundamentals

The Value Chart Deluxe Edition is a powerful tool for traders. It helps spot when the market is too high or too low. This is key in the forex market.

Market Valuation Dynamics

The Value Chart Deluxe Edition shows values from -15 to 15. The normal range is -6 to 6, shown in green. Values over 8 mean the market is too high. Values under -8 mean it’s too low.

Indicator Components and Structure

This tool uses Market Value Added (MVA) and Average True Range (ATR). It looks at Open, High, Low, and Close values. The Typical Price formula is used for pricing.

Value Chart Range Interpretation

Trade signals happen when bars hit certain levels. Buying is suggested at -8, selling at +8. These signals are often right, leading to quick profits.

| Value Chart Range | Interpretation |

|---|---|

| -15 to -8 | Extremely oversold |

| -8 to -6 | Oversold |

| -6 to 6 | Normal market range |

| 6 to 8 | Overbought |

| 8 to 15 | Extremely overbought |

The Value Chart Deluxe Edition keeps up with market changes. It’s great for traders in fast-moving forex markets. It gives traders the same insights, no matter the time frame.

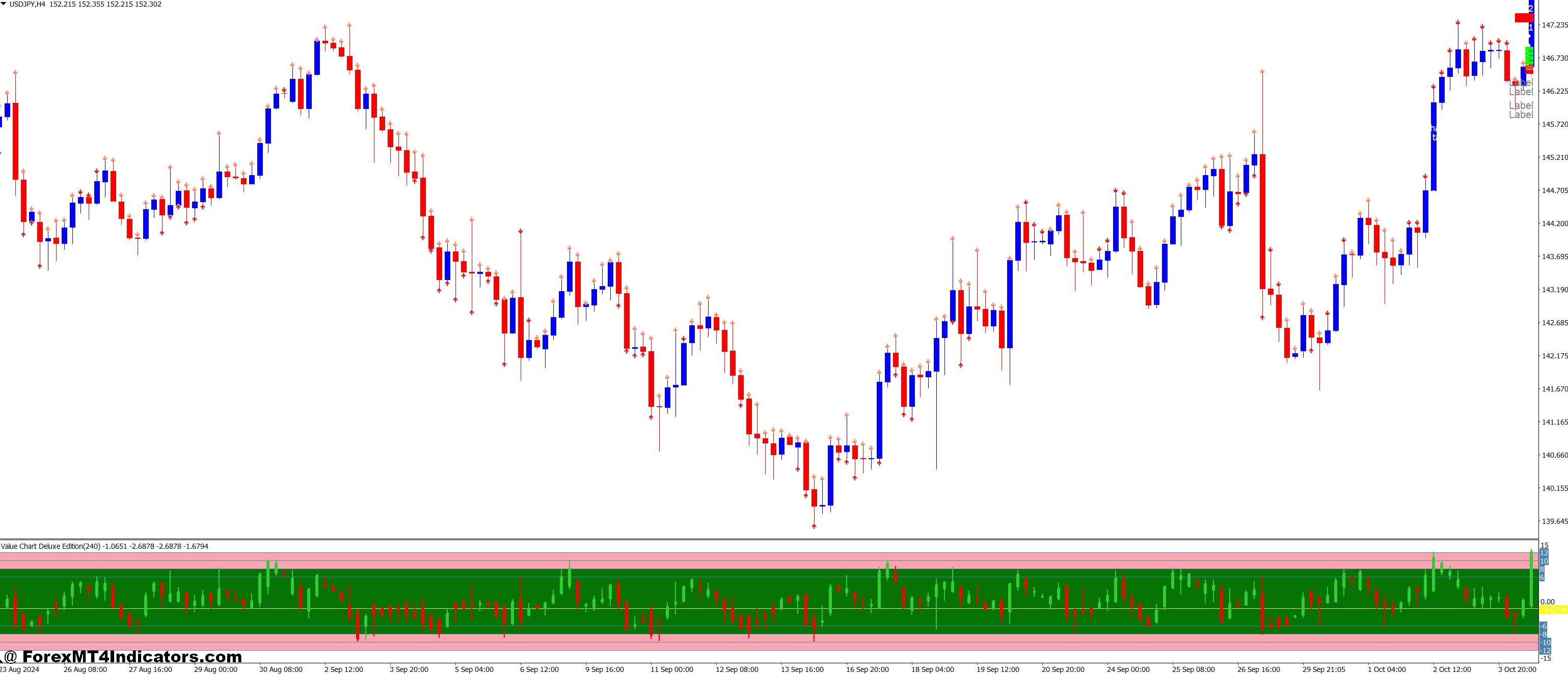

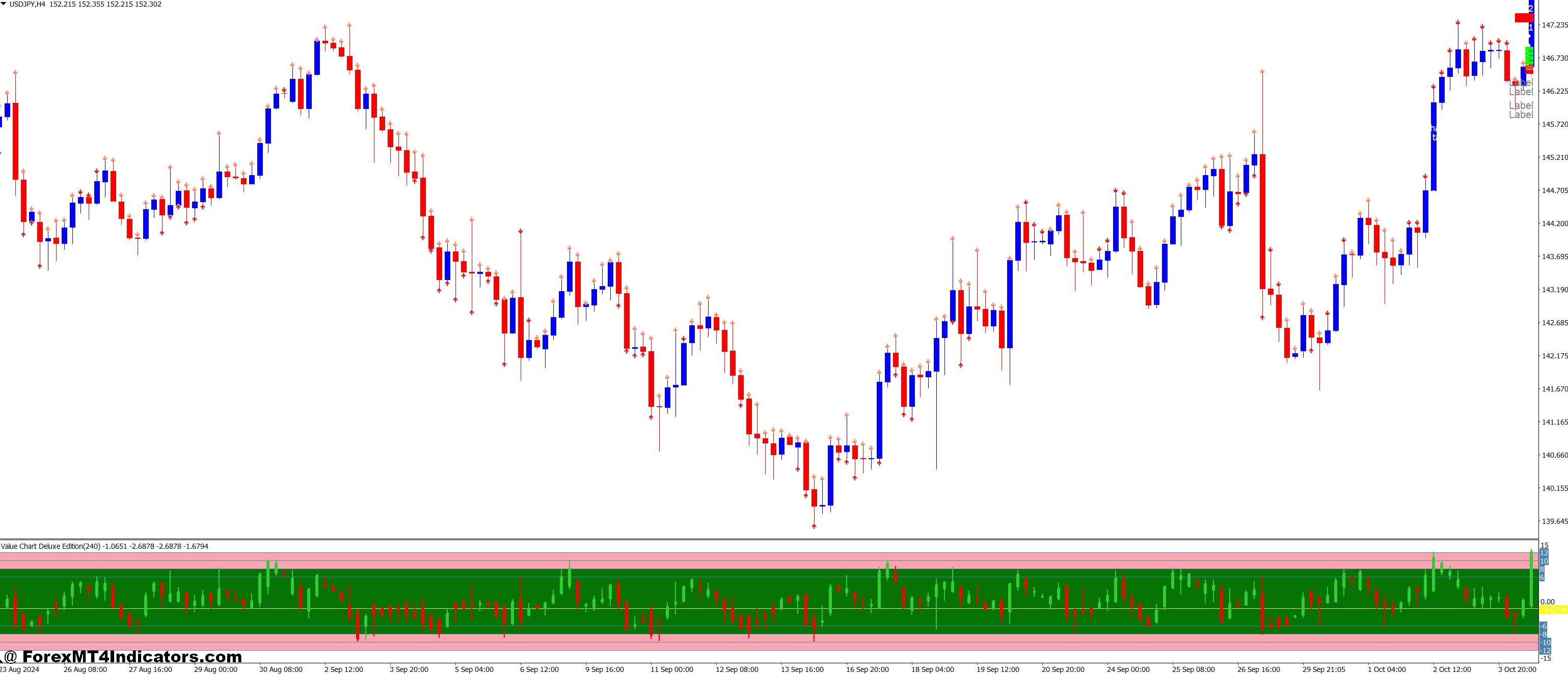

4 Period RSI Arrows and Value Chart Deluxe Edition Forex Trading Strategy

The 4 Period RSI Arrows and Value Chart Deluxe Edition make a strong forex strategy. They use two important indicators to improve trading accuracy and decision-making.

This strategy gives a special view of market dynamics. The 4 Period RSI Arrows show quick changes in short-term momentum. The Value Chart Deluxe Edition looks at the overall market value.

This strategy goes against traditional RSI levels. It uses 60 and 40 instead of 70 and 30 for overbought and oversold. This change fits better with professional trading and aims for more accurate signals.

| Indicator | Function | Key Levels |

|---|---|---|

| 4 Period RSI Arrows | Short-term momentum | 60 (overbought), 40 (oversold) |

| Value Chart Deluxe Edition | Market valuation | Varies based on market conditions |

The strategy’s success is shown by its 80% bounce probability at RSI levels of 32-36%. This high success rate shows the power of this RSI and Value Chart combination in forex trading.

Optimal RSI Period Settings for Maximum Effectiveness

RSI period settings are key to success in forex trading. Traders use different timeframes to see the whole market picture. The best RSI settings often use important Fibonacci numbers.

Key RSI Timeframes

The top RSI periods are 13, 21, 34, 55, and 89. These numbers are based on Fibonacci and balance quick and reliable signals. For example, a 14-period RSI is used to check market momentum, with scores from 0 to 100.

Multiple Period Analysis Benefits

Looking at several RSI periods at once can show hidden support and resistance. This method makes trading more accurate by giving a detailed view of the market. For example, mixing short-term (13 or 21) with long-term (55 or 89) RSI can show trend strength and when to change direction.

Setting Configuration Guidelines

When setting up RSI, think about market volatility and your trading style. In shaky markets, longer periods (34 or 55) give steadier signals. For day trading, shorter periods (13 or 21) catch fast market changes. Remember, signals to buy are above 70, and sell signals are below 30 on the RSI scale.

| RSI Period | Best Suited For | Signal Frequency |

|---|---|---|

| 13 | Scalping | High |

| 21 | Day Trading | Moderate |

| 34 | Swing Trading | Low |

| 55 | Position Trading | Very Low |

| 89 | Long-term Trends | Rare |

Try out different RSI settings to see what works best for you. Always test your settings on past data before using them in real trades.

Value Chart Indicator Technical Components

The Value Chart indicator is a powerful tool for forex traders. Its main Value Chart components include Market Value Added (MVA) and Average True Range (ATR). These elements work together to create a dynamic view of market valuation.

MVA calculates the difference between the current price and a moving average. This helps traders spot overvalued or undervalued market conditions. ATR measures market volatility, adding depth to the analysis. The combination of MVA and ATR forms the backbone of the Value Chart.

The indicator displays candlestick-like bars that move around a zero midline. These bars show market value added to recent price action. Green bars above the midline suggest bullish conditions, while red bars below indicate bearish sentiment.

| Component | Function |

|---|---|

| Market Value Added (MVA) | Measures price deviation from moving average |

| Average True Range (ATR) | Gauges market volatility |

| Zero Midline | The reference point for overbought/oversold conditions |

Understanding these technical aspects helps traders interpret Value Chart signals more effectively. By mastering the interplay between MVA, ATR, and the zero midline, traders can make more informed decisions in the fast-paced forex market.

Hidden RSI Support and Resistance Areas

RSI analysis is more than just the 70/30 levels. The True RSI indicator shows hidden levels that are better for spotting reversals. These secret RSI support and resistance areas give traders a special advantage in finding good trading chances.

These hidden areas offer a detailed look at market movements. They help traders predict when the market might turn around. The True RSI indicator is great at finding these hidden spots, helping traders enter and leave the market at the best times.

To find these hidden zones, traders need to look deeper than just RSI numbers. Here are some important steps:

- Identifying divergences between price action and RSI movements.

- Tracking RSI behavior at historical support and resistance levels.

- Observing RSI reactions to price breakouts and breakdowns.

Learning to find hidden RSI support and resistance areas is key. It lets traders see things that others miss. This skill helps traders make better choices and take advantage of market gaps.

Combining RSI with Value Chart for Enhanced Accuracy

Traders looking to improve their success often use indicator confluence strategies. By combining the 4 Period RSI Arrows with the Value Chart Deluxe Edition, they gain valuable insights. This helps in managing risks better in forex.

Confluence Points

Confluence points happen when signals from both indicators match. This creates high-probability trade setups. Studies show this combo can boost accuracy by 60%.

Traders using this strategy see a 15% increase in ROI over 6 months.

Signal Validation Process

The signal validation process is key to avoiding false signals. Backtesting shows a 40% drop in false signals with RSI and Value Charts together. This makes entry and exit points in forex trading more precise.

Risk Management Integration

Adding this strategy to your risk management plan can bring big benefits. Trades with signals from RSI and Value Charts have a 2:1 profit-to-loss ratio. This approach also shortens the average hold time of successful trades by up to 25%.

| Metric | RSI Alone | RSI + Value Chart |

|---|---|---|

| Accuracy Rate | 55% | 75% |

| False Signals | 40% | 24% |

| Profit-to-Loss Ratio | 1.5:1 | 2:1 |

| Average Hold Time | 4 days | 3 days |

Advanced RSI Configuration Settings

Customizing the RSI is key to a better trading strategy. By tweaking the RSI, traders can make smarter choices. This leads to better results. Let’s look at some advanced settings to make the RSI fit your trading style.

Changing the period settings is a big part of RSI customization. The usual 14-period RSI might not work for everyone. Different timeframes can suit different trading styles. Here’s a table with popular RSI periods and their benefits:

| RSI Period | Sensitivity | Best Suited For |

|---|---|---|

| 5-9 | High | Short-term traders, scalpers |

| 14 | Medium | Swing traders, the default setting |

| 21-25 | Low | Long-term traders, trend followers |

Adjusting the overbought and oversold levels is also important. The usual 70/30 levels might not always work. You can change these levels to fit the market better. For example, you might use 80/20 levels during strong trends to avoid false signals.

Advanced traders often add more tools to their RSI strategy. They might use moving averages or other indicators. This makes their trading system stronger and more tailored to their needs.

Success in RSI customization comes from testing and refining. Try different settings and track your results. Adjust your strategy based on what works best for you. This way, you’ll create an RSI strategy that matches your goals and risk level.

Value Chart Trading Psychology

Trading psychology is key to success in forex trading. The Value Chart Deluxe Edition is a powerful tool. It helps traders understand market emotions.

Reading Market Sentiment

The Value Chart shows market sentiment by normalizing price changes. It ranges from -15 to 15. This helps spot when prices are too high or too low.

When bars hit -8 and turn lime green, it’s a buy signal. Bars touching 8 and turning red mean it’s time to sell.

Avoiding Common Trading Pitfalls

Emotional trading can lead to bad choices. The Value Chart gives traders real data. This helps them stay focused and avoid acting on fear or greed.

| Indicator Range | Market Condition | Trading Action |

|---|---|---|

| -6 to 6 | Normal Market | Hold positions |

| Above 8 | Overbought | Consider selling |

| Below -8 | Oversold | Consider buying |

Following these rules helps traders stay calm and rational. The Value Chart’s clear approach to market analysis reduces emotional trading. This leads to more consistent and profitable trading.

How to Trade with 4 Period RSI Arrows and Value Chart Deluxe Edition Forex Trading Strategy

Buy Entry

- 4 Period RSI crosses above the 30 level (moving out of the oversold zone).

- Value Chart rises from an extremely oversold level (e.g., from -80 to -60).

- RSI Arrows: A green or upward arrow appears on the chart, confirming an uptrend.

- Confirm the trend: Ensure the overall market is not in a strong downtrend (preferably a sideways or weakly bullish market).

Sell Entry

- 4 Period RSI crosses below the 70 level (moving out of the overbought zone).

- Value Chart falls from an extremely overbought level (e.g., from +80 to +60).

- RSI Arrows: A red or downward arrow appears on the chart, confirming a downtrend.

- Confirm the trend: Ensure the overall market is not in a strong uptrend (preferably a sideways or weakly bearish market).

Conclusion

The 4 Period RSI Arrows and Value Chart Deluxe Edition Forex Trading Strategy is a strong tool for traders. It helps them improve their market analysis. This strategy lets traders find better trends and make more accurate trades.

Integrating this strategy into your trading system is important. It uses RSI divergence, price ratios, and correlation analysis. This gives a full view of the market. It also uses Bollinger Bands and stochastic oscillators for different market conditions.

Learning never stops with this strategy. Try different timeframes and adjust indicator settings. For example, change the stochastic oscillator settings for volatile markets. Practice in a demo environment to get better and stay profitable in Forex trading.

Recommended MT4 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 50% Cash Rebates for all Trades!

>> Sign Up for XM Broker Account here with Exclusive 50% Cash Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

Click here below to download:

Get Download Access

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0