🚀 Embark on the 30-Trades Compounding Challenge with TradeWise EA! – My Trading – 16 November 2023

Are you ready for a transformative trading experience? Join us in the ultimate 30-trades compounding challenge powered by TradeWise EA! 📈 I strongly suggested that you subscribe and watch this video before activating the dynamic lot sizing function. This will provide you with vital insights into the workings of the EA’s dynamic lot sizing and

Are you ready for a transformative trading experience? Join us in the ultimate 30-trades compounding challenge powered by TradeWise EA! 📈

I strongly suggested that you subscribe and watch this video before activating the dynamic lot sizing function. This will provide you with vital insights into the workings of the EA’s dynamic lot sizing and how to fully utilize it. The TradeWise EA’s 30 Trades compounding challenge was made and inspired by this.

Key Features:

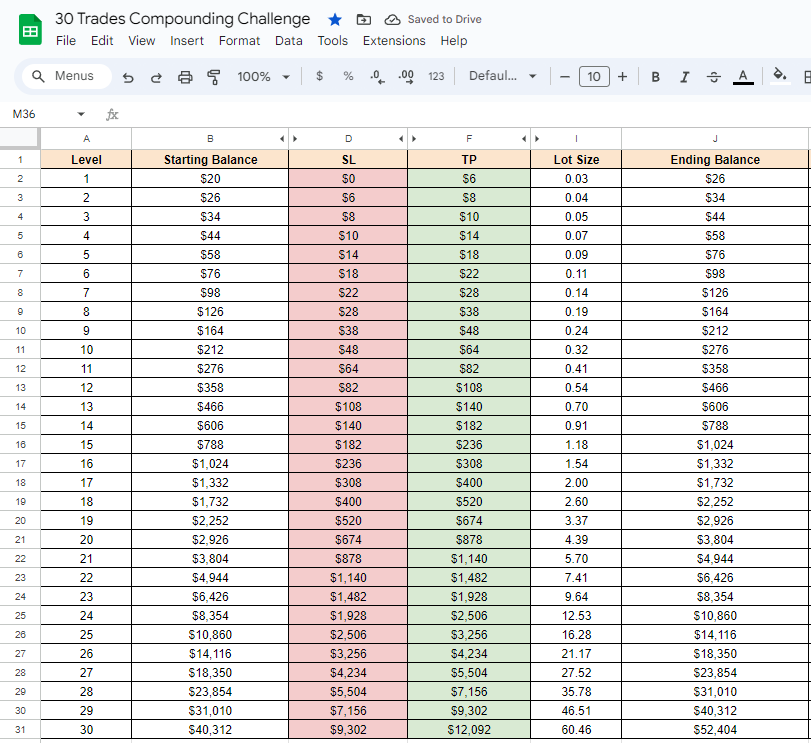

1. Consistent Growth: Witness your initial $20 investment grow exponentially through 30 consecutive successful trades.

2. Intelligent Compounding: Experience the benefits of compounding, amplifying your returns with every successful trade. In the 30 trades compounding challenge, each loss, determined by the lot size and stop-loss pips, seamlessly resets you to the previous level and balance.

3. Risk Management: TradeWise EA guarantees a secure path by dynamically adjusting lot size based on your win/loss in accordance with the compounding strategy’s levels during the 30 trades. It also automatically sets take profit and stop-loss for each trade with optional features such as automatic breakeven line and Label, risk-to-reward ratio, dynamic trailing stop-loss and Symbol’s Spread. Activating these features is a simple one-click process using the dedicated button of A(ATR), P(PIPS), and R(Risk-to-Reward).

4. Visualize Your Success: Keep track of your trading journey with lot size level, win/loss counts, and real-time Profit and Loss (PNL) updates.

5. Lot Sizing: Enabling the 30 Trades Compounding Challenge in the TradeWise EA’s input settings results in dynamic adjustments to lot sizes based on the trading level, as shown in the screenshot below. This offers a smart and customized approach to risk management. Witness automatic increments and decrements in lot sizes as you advance through the compounding challenge. This enhances your trading efficiency, particularly during high volatility, as you no longer need to manually set lot sizes based on levels for each trade.

Note:

1. In this challenge, make sure to set the EA’s Take Profit (TP) input to 20 pips and the Stop-Loss (SL) input to 15.4 pips, reflecting the average SL in pips.

2. Valid only for the following symbols: XAAUSD, EURUSD, GBPUSD, AUDUSD, and NZDUSD.

3. The maximum lot size is based on the symbol and platform you’re using to trade

4. This EA is not automated, meaning the strategy and manual placing of orders will be done by the user.

⚠️ Risk Disclaimer: Trading Involves Risks – Please Read Carefully

“Setting the 30-Trades Compounding Challenge to True” within “TradeWise EA” and participating in this challenge involves inherent financial risks. Before initiating this venture, it is crucial to understand and acknowledge the following:

1. Volatility: Financial markets can be highly volatile, and prices can fluctuate rapidly. This volatility may lead to both substantial profits and significant losses.

2. Past Performance: Historical performance results, such as those presented in the compounding challenge, do not guarantee future outcomes. Market conditions can change, impacting trading results.

3. Market Risks: External factors, economic events, or unforeseen circumstances can influence market behavior. Traders should stay informed about global events that may affect their positions.

4. Educational Purpose: The 30-Trades Compounding Challenge within the TradeWise EA are presented for educational and illustrative purposes. Users are responsible for their own trading decisions and should seek professional financial advice if needed.

5. Risk Management: While TradeWise EA incorporates risk management features, there is no guarantee against losses. Traders should be vigilant in managing their risk exposure and be prepared for potential drawdowns.

6. User Discretion: Participation in the compounding challenge is at the user’s discretion. Users should carefully assess their risk tolerance, financial situation, and investment goals before engaging in trading activities.

Remember, trading involves inherent risks, and past success is not indicative of future performance. It is advisable to seek guidance from financial professionals and thoroughly understand the risks associated with trading before making investment decisions. By participating in the 30-Trades Compounding Challenge, users acknowledge and accept these risks. 💼📉🚨

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰